- Norway

- /

- Renewable Energy

- /

- OB:MGN

Magnora (OB:MGN): Profit Growth Forecasts Fuel Optimism as Dividend Risk Challenges Bull Case

Reviewed by Simply Wall St

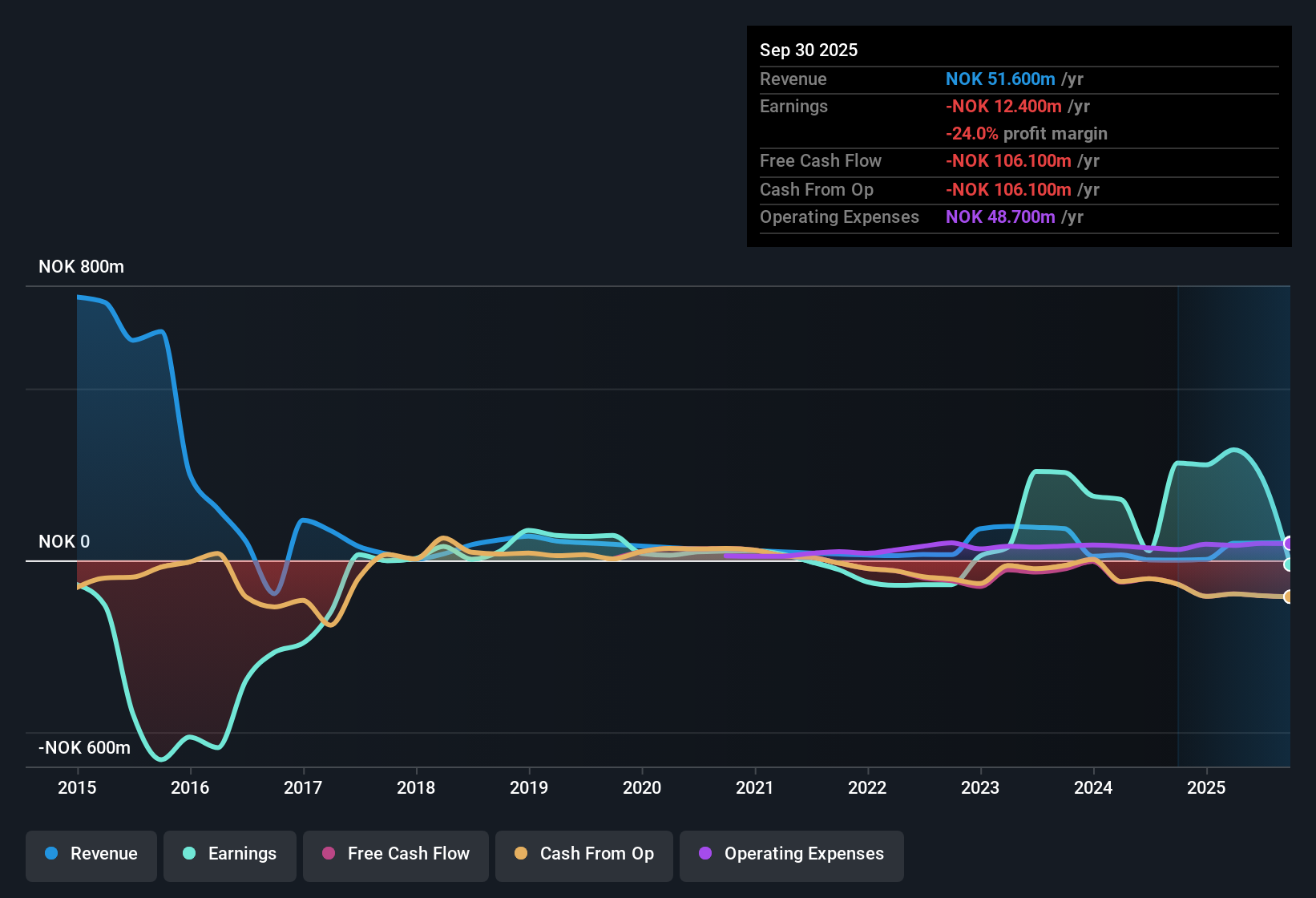

Magnora (OB:MGN) remains in the red, but has managed to shrink its losses by an impressive 48.1% per year over the past five years. Looking ahead, analysts expect the company to become profitable within the next three years, with forecasts pointing to explosive earnings growth of 58.93% per year and revenue climbing 42.1% annually. This rate far outpaces the Norwegian market's 2.4% average. For investors, this puts the spotlight on Magnora’s rapid transformation, with robust growth prospects on the horizon even as the share price (NOK 19.8) currently sits below its estimated fair value (NOK 33.92).

See our full analysis for Magnora.With the numbers now on the table, it is time to see how Magnora’s earnings performance aligns with the key narratives shaping expectations in the market.

See what the community is saying about Magnora

Profit Margins Set to Tighten

- Analysts project Magnora’s profit margins will shrink from 648.6% today to just 53.3% within the next three years, indicating a significant narrowing as the company chases higher revenue.

- According to analysts' consensus view, such a sharp drop in margins might seem concerning from a headline perspective. However, the narrative argues the company’s strategy of selling projects during high-demand periods could offset this margin compression:

- Consensus notes Magnora’s strong cash position will give it freedom to exit projects when pricing is most attractive, potentially supporting earnings even as margins fall.

- With expansion in South Africa and Germany and a focus on high-value opportunities, consensus suggests operational flexibility could help protect net income as market conditions shift.

- The sharp margin compressions are at the heart of the analyst debate, but the consensus claims Magnora’s tactical approach could help the company outperform expectations.

See how analysts weigh these shifts and what it means for the next leg of Magnora’s growth story. 📊 Read the full Magnora Consensus Narrative.

Dividend Sustainability Remains Fragile

- The key risk flagged is around dividend sustainability, with explicit concerns about Magnora’s capacity to maintain its dividend amid ongoing losses and large investments.

- Analysts' consensus view emphasizes that while projected profit growth is robust, dividend outflows might be pressured if geopolitical risks or project delays dent earnings:

- A rapid expansion strategy across multiple markets could weigh on short-term cash flow.

- Exposure to market and currency risks means even with profit gains, dividends might not stay stable unless profitability is entrenched.

Valuation Hinges on Future Growth

- Despite trading at a price-to-sales ratio of 24.5x, well above peers and the European Renewable Energy industry, Magnora is changing hands at NOK 19.8, below both its analyst target (NOK 34.45) and DCF fair value (NOK 33.92).

- Analysts' consensus narrative puts the spotlight on this valuation tension, highlighting the bet investors are making:

- Consensus points out that for Magnora to hit the price target, the company must reach earnings of NOK 240.3 million by 2028 and trade on a PE of 11.2x, above today’s multiple.

- The combination of rapid revenue growth and a discounted price is attractive, but analysts are clear that execution risks, especially in project timing and margin control, will be decisive for upside.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Magnora on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the data tells a different story? It only takes a few minutes to shape your own perspective and add your voice. Do it your way.

A great starting point for your Magnora research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Magnora’s rapid revenue growth stands out, concerns remain about shrinking profit margins and the fragility of its dividend as expansion and investment put pressure on cash flow.

If reliable income matters to you, discover companies with consistent and robust payouts by checking out these 2003 dividend stocks with yields > 3%, which offer greater dividend security even during volatile periods.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:MGN

Magnora

Operates as a renewable energy development company in Norway, Sweden, South Africa and the United Kingdom.

Exceptional growth potential with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)