- Norway

- /

- Marine and Shipping

- /

- OB:WEST

Here's Why We Think Western Bulk Chartering (OB:WEST) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Western Bulk Chartering (OB:WEST). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Western Bulk Chartering

Western Bulk Chartering's Improving Profits

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. So for many budding investors, improving EPS is considered a good sign. It's an outstanding feat for Western Bulk Chartering to have grown EPS from US$0.11 to US$2.41 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement. This could point to the business hitting a point of inflection.

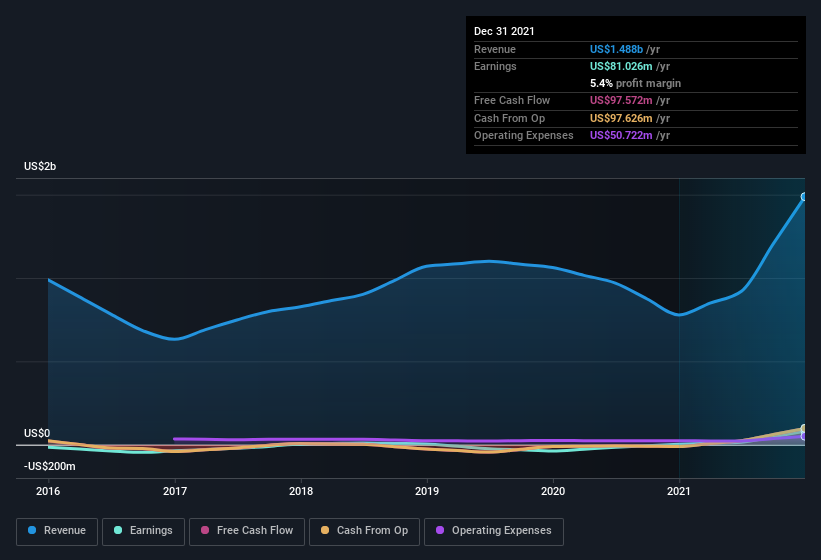

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Western Bulk Chartering shareholders can take confidence from the fact that EBIT margins are up from 0.5% to 4.2%, and revenue is growing. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Western Bulk Chartering isn't a huge company, given its market capitalisation of kr1.5b. That makes it extra important to check on its balance sheet strength.

Are Western Bulk Chartering Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Any way you look at it Western Bulk Chartering shareholders can gain quiet confidence from the fact that insiders shelled out US$4.5m to buy stock, over the last year. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. We also note that it was the Chairman of the Board, Bengt Rem, who made the biggest single acquisition, paying kr2.0m for shares at about kr30.00 each.

Does Western Bulk Chartering Deserve A Spot On Your Watchlist?

Western Bulk Chartering's earnings have taken off in quite an impressive fashion. Most growth-seeking investors will find it hard to ignore that sort of explosive EPS growth. And may very well signal a significant inflection point for the business. If that's the case, you may regret neglecting to put Western Bulk Chartering on your watchlist. However, before you get too excited we've discovered 3 warning signs for Western Bulk Chartering (1 can't be ignored!) that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Western Bulk Chartering, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Western Bulk Chartering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:WEST

Flawless balance sheet and good value.

Market Insights

Community Narratives