The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Odfjell (OB:ODF). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Odfjell with the means to add long-term value to shareholders.

See our latest analysis for Odfjell

Odfjell's Improving Profits

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. So for many budding investors, improving EPS is considered a good sign. It's an outstanding feat for Odfjell to have grown EPS from US$0.40 to US$2.53 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company.

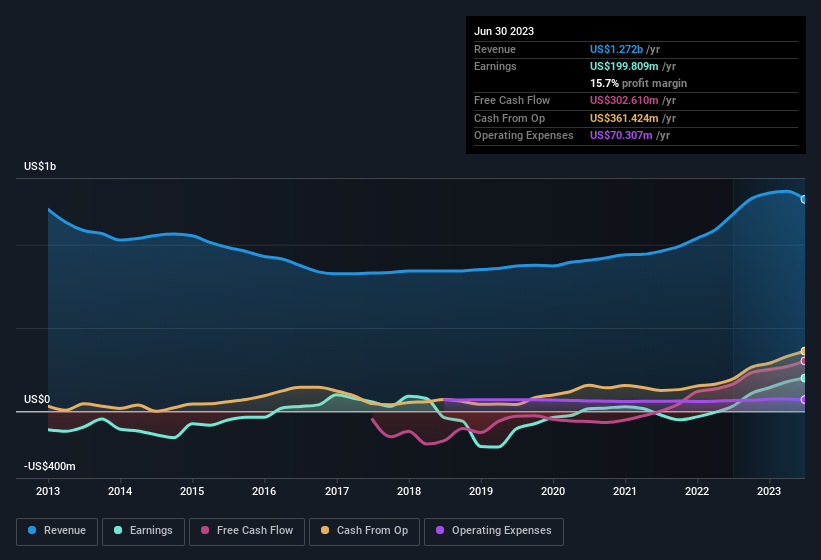

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Odfjell shareholders is that EBIT margins have grown from 9.6% to 22% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Odfjell's future EPS 100% free.

Are Odfjell Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

A great takeaway for shareholders is that company insiders within Odfjell have collectively spent US$469k acquiring shares in the company. While this investment may be modest, it is great considering the lack of insider selling.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Odfjell insiders own more than a third of the company. Owning 45% of the company, insiders have plenty riding on the performance of the the share price. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. US$3.6b This is an incredible endorsement from them.

Does Odfjell Deserve A Spot On Your Watchlist?

Odfjell's earnings per share growth have been climbing higher at an appreciable rate. Just as heartening; insiders both own and are buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Odfjell belongs near the top of your watchlist. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Odfjell (1 can't be ignored) you should be aware of.

The good news is that Odfjell is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:ODF

Odfjell

Provides services for the transportation and storage of bulk liquid chemicals, acids, edible oils, and other specialty products in North America, South America, Norway, the Netherlands, rest of Europe, the Middle East, Asia, Africa, and Australasia.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026