Is Norwegian Ready for Takeoff After Its 35% Share Price Surge in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do next with Norwegian Air Shuttle stock? You are not alone. It has been grabbing attention among both value seekers and those chasing momentum. This past year, shares surged 49.3%, capping off a dramatic three-year gain of 133.5%. Even after a recent dip, with shares down 2.1% in the last week and 6.2% across the last month, the stock remains up an impressive 35.2% year to date. Those numbers have created a real sense of optimism about Norwegian's position in the European airline industry, especially as travel demand continues to recover. Of course, the longer-term pain cannot be ignored, with shares still down 50.0% from five years ago, reflecting the company’s turbulent history and shifting expectations around risk.

When it comes to whether this stock is truly undervalued, Norwegian Air Shuttle scores a 3 out of 6 based on our standard valuation checks. That means it passes half of the traditional criteria that value investors favor. But what do those numbers really mean for future returns? To answer that, we will break down the valuation approaches in detail and reveal an even more insightful way of thinking about where Norwegian Air Shuttle stands today.

Why Norwegian Air Shuttle is lagging behind its peers

Approach 1: Norwegian Air Shuttle Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its future cash flows and discounting them back to their present value. This method helps investors understand whether a stock is trading below or above its intrinsic value, using solid financial forecasts rather than market sentiment alone.

Norwegian Air Shuttle currently generates Free Cash Flow (FCF) of around NOK 4.84 billion. Analysts provide forecasts up to 2027, estimating FCF will reach NOK 5.21 billion that year. For the following years, projections are extrapolated, showing a gradual increase and expected to reach about NOK 5.19 billion by 2035. All figures are reported in Norwegian kroner (NOK).

Based on this cash flow analysis, the estimated intrinsic value of Norwegian Air Shuttle comes in at NOK 56.03 per share. Compared to the current market price, this suggests the stock is trading at a remarkable 72.5% discount, pointing toward significant undervaluation on a fundamental basis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Norwegian Air Shuttle is undervalued by 72.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Norwegian Air Shuttle Price vs Earnings

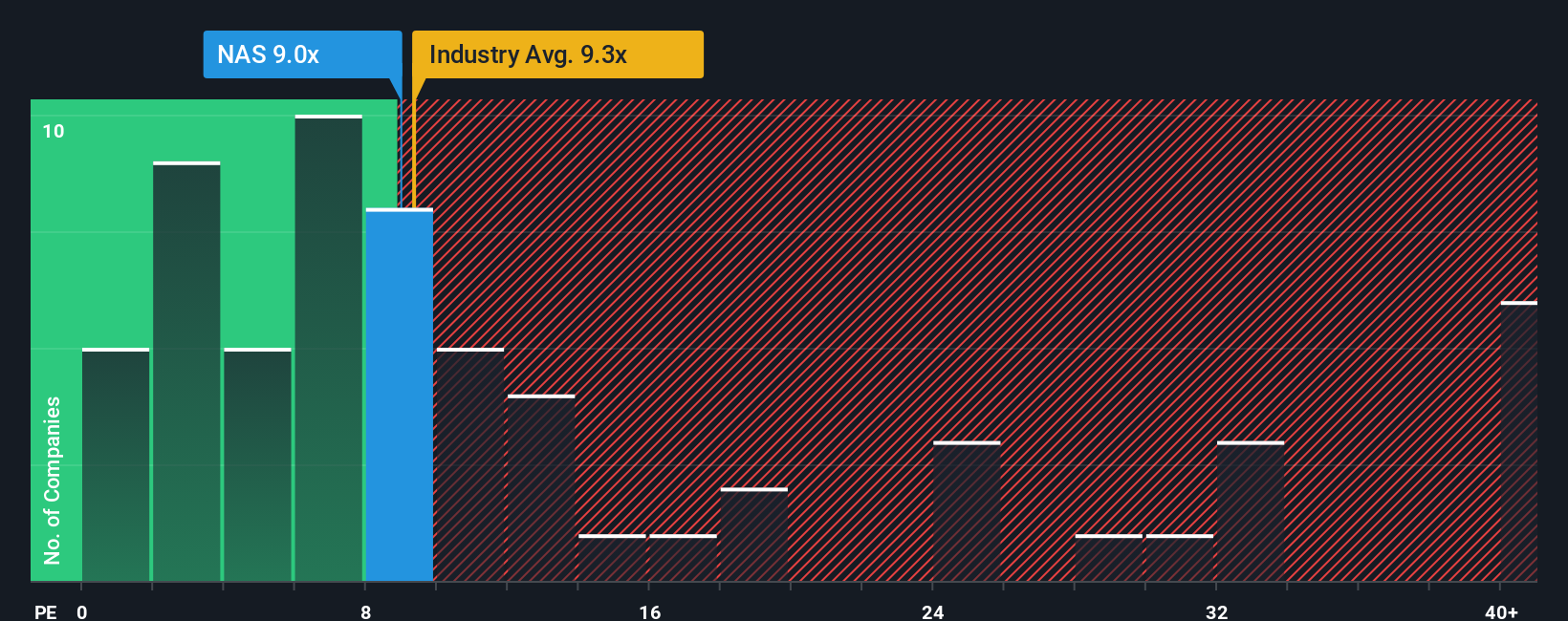

For profitable companies like Norwegian Air Shuttle, the Price-to-Earnings (PE) ratio is a practical and widely used way to assess whether a stock is fairly valued. This metric relates a company’s share price to its earnings, helping investors gauge how much they are paying for each unit of profit. Generally, higher expected growth or lower perceived risk can justify a higher "normal" PE, while slower growth or higher risk should lower the multiple.

Norwegian Air Shuttle is currently trading at a PE ratio of 9.0x. To put this in context, this sits just below the airlines industry average of 9.3x and well above the average for its listed peers at 4.3x. At first glance, this might imply Norwegian is priced reasonably or even a bit expensively compared to its direct competitors, but that does not tell the whole story.

This is where Simply Wall St's proprietary "Fair Ratio" becomes invaluable. The Fair Ratio, set at 7.8x for Norwegian Air Shuttle, reflects what would be justified based on the company’s earnings growth, profit margins, industry norms, market capitalization, and risk profile. Unlike basic peer or industry averages, the Fair Ratio is tailored to Norwegian’s unique circumstances, giving investors a more nuanced view.

Comparing Norwegian’s actual PE of 9.0x to its Fair Ratio of 7.8x, the difference is not dramatic, but it leans toward being a bit overvalued on earnings alone. Investors should note the market is asking for a slight premium over what the company’s fundamental profile supports.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Norwegian Air Shuttle Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is an investor’s own story about a company, combining assumptions about its future revenue, earnings, and margins into a structured financial forecast and a fair value estimate. Instead of relying only on ratios and past performance, Narratives let you clearly link your outlook for Norwegian Air Shuttle to tangible numbers, bringing together the company's unique business story and its financial future.

Narratives are easy to use, even for beginners, and are available directly on Simply Wall St’s Community page, where millions of investors regularly share and compare perspectives. By building and sharing your Narrative, you can decide whether Norwegian’s current Price is above or below what you think is a reasonable Fair Value, helping you make informed buy or sell decisions with confidence. Narratives are always up to date and dynamically adjust as new news, financials, or earnings come in, so your investment thesis always reflects the latest information.

For Norwegian Air Shuttle, you will find the most optimistic investors forecasting a fair value as high as NOK19.0 per share, while the most cautious believe it is worth just NOK13.0, proving your view truly matters.

Do you think there's more to the story for Norwegian Air Shuttle? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Norwegian Air Shuttle might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NAS

Norwegian Air Shuttle

Provides air travel services in Norway and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)