- Norway

- /

- Marine and Shipping

- /

- OB:KCC

Things Look Grim For Klaveness Combination Carriers ASA (OB:KCC) After Today's Downgrade

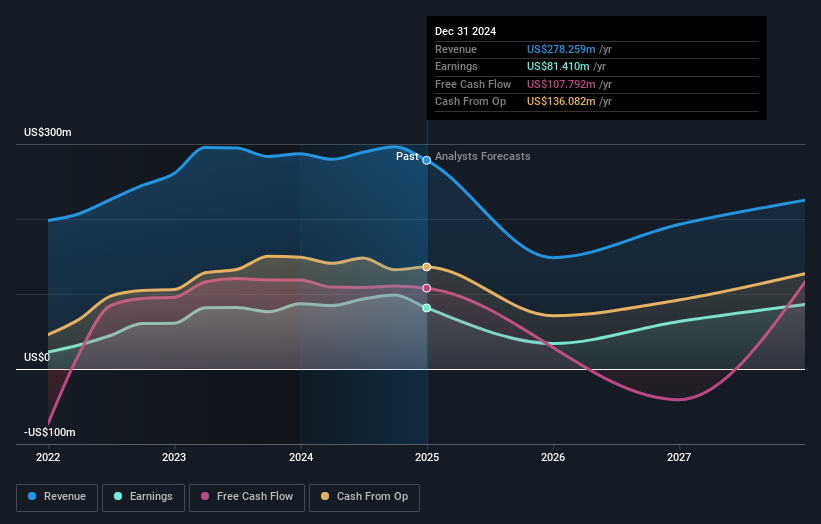

Today is shaping up negative for Klaveness Combination Carriers ASA (OB:KCC) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. Revenue and earnings per share (EPS) forecasts were both revised downwards, with the analysts seeing grey clouds on the horizon.

Following the latest downgrade, the current consensus, from the three analysts covering Klaveness Combination Carriers, is for revenues of US$149m in 2025, which would reflect a sizeable 47% reduction in Klaveness Combination Carriers' sales over the past 12 months. Statutory earnings per share are anticipated to plummet 58% to US$0.57 in the same period. Previously, the analysts had been modelling revenues of US$175m and earnings per share (EPS) of US$0.97 in 2025. It looks like analyst sentiment has declined substantially, with a substantial drop in revenue estimates and a pretty serious decline to earnings per share numbers as well.

View our latest analysis for Klaveness Combination Carriers

It'll come as no surprise then, to learn that the analysts have cut their price target 6.5% to US$9.54. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on Klaveness Combination Carriers, with the most bullish analyst valuing it at US$11.26 and the most bearish at US$7.38 per share. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await Klaveness Combination Carriers shareholders.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 47% by the end of 2025. This indicates a significant reduction from annual growth of 16% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue decline 0.7% annually for the foreseeable future. The forecasts do look bearish for Klaveness Combination Carriers, since they're expecting it to shrink faster than the industry.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for Klaveness Combination Carriers. Unfortunately they also cut their revenue estimates for this year, and they expect sales to lag the wider market. That said, earnings per share are more important for creating value for shareholders. After such a stark change in sentiment from analysts, we'd understand if readers now felt a bit wary of Klaveness Combination Carriers.

After a downgrade like this, it's pretty clear that previous forecasts were too optimistic. What's more, we've spotted several possible issues with Klaveness Combination Carriers' business, like a weak balance sheet. For more information, you can click here to discover this and the 2 other flags we've identified.

We also provide an overview of the Klaveness Combination Carriers Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Klaveness Combination Carriers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:KCC

Klaveness Combination Carriers

Owns and operates combination carriers for the dry bulk shipping and product tanker industries in the Middle East, Australia, Oceania, North East Asia, South America, North America, Europe, Africa, Southeast Asia, and South Asia.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)