Results: Xplora Technologies AS Delivered A Surprise Loss And Now Analysts Have New Forecasts

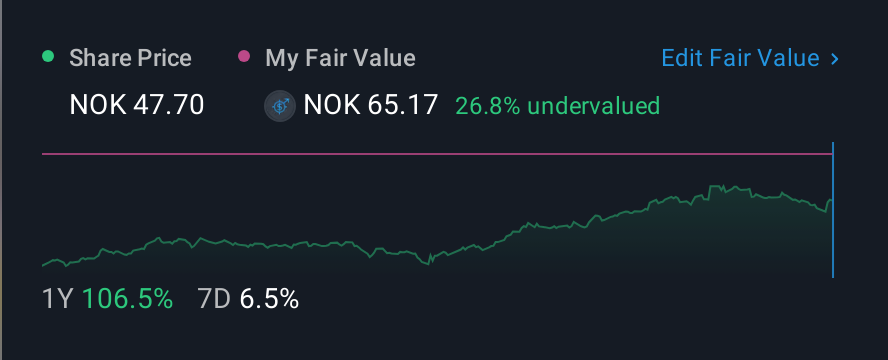

Shareholders of Xplora Technologies AS (OB:XPLRA) will be pleased this week, given that the stock price is up 10% to kr53.00 following its latest quarterly results. Revenues came in at kr463m, in line with estimates, while Xplora Technologies reported a statutory loss of kr0.62 per share, well short of prior analyst forecasts for a profit. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

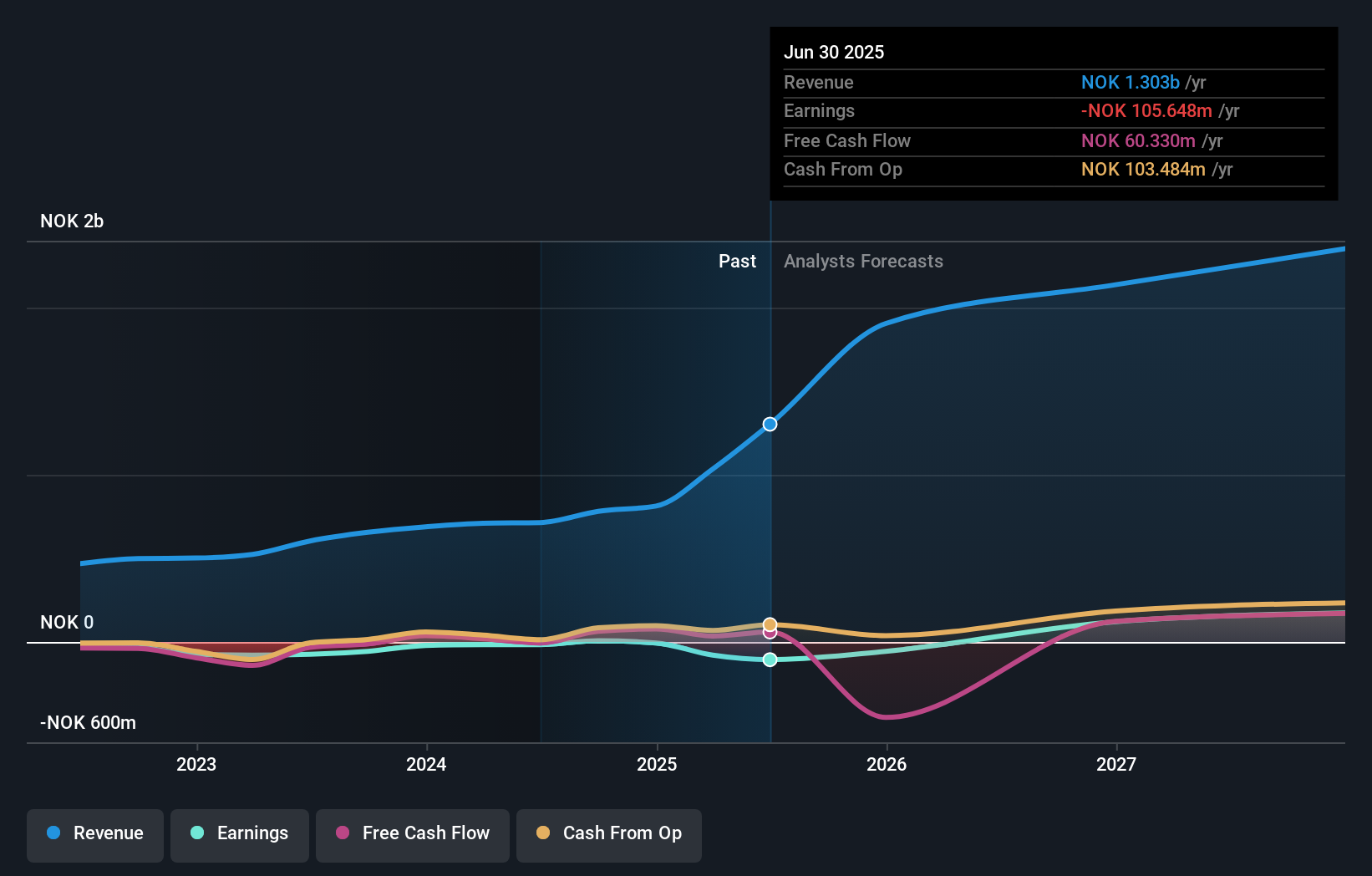

Taking into account the latest results, the consensus forecast from Xplora Technologies' twin analysts is for revenues of kr1.91b in 2025. This reflects a huge 46% improvement in revenue compared to the last 12 months. Statutory losses are forecast to balloon 48% to kr1.24 per share. Yet prior to the latest earnings, the analysts had been anticipated revenues of kr1.91b and earnings per share (EPS) of kr2.21 in 2025. So despite reconfirming their revenue estimates, the analysts are now forecasting a loss instead of a profit, which looks like a definite drop in sentiment following the latest results.

Check out our latest analysis for Xplora Technologies

Although the analysts are now forecasting higher losses, the average price target rose 6.8% to 58.75, which could indicate that these losses are expected to be "one-off", or are not anticipated to have a longer-term impact on the business.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. The analysts are definitely expecting Xplora Technologies' growth to accelerate, with the forecast 114% annualised growth to the end of 2025 ranking favourably alongside historical growth of 34% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 15% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that Xplora Technologies is expected to grow much faster than its industry.

The Bottom Line

The biggest low-light for us was that the forecasts for Xplora Technologies dropped from profits to a loss next year. Fortunately, they also reconfirmed their revenue numbers, suggesting that it's tracking in line with expectations. Additionally, our data suggests that revenue is expected to grow faster than the wider industry. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have analyst estimates for Xplora Technologies going out as far as 2027, and you can see them free on our platform here.

You can also view our analysis of Xplora Technologies' balance sheet, and whether we think Xplora Technologies is carrying too much debt, for free on our platform here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:XPLRA

Xplora Technologies

An information technology company, develops wearable smart devices and connectivity services for kids and families in Germany, Sweden, Norway, the United Kingdom, Finland, Denmark, Spain, the United States, and France.

High growth potential and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026