In recent weeks, global markets have experienced varied movements with the S&P 500 Index advancing and small-cap indices like the Russell 2000 outperforming, while European markets responded positively to interest rate cuts by the ECB. Amidst these developments, investor interest in growth companies with high insider ownership remains strong as such stocks often indicate confidence from those closest to the business. When evaluating potential investments in this context, a combination of robust growth prospects and significant insider ownership can suggest alignment between company leadership and shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

Let's dive into some prime choices out of the screener.

Norbit (OB:NORBT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Norbit ASA is a technology company that offers various products and solutions, with a market capitalization of NOK 6.12 billion.

Operations: The company's revenue is derived from three main segments: Oceans at NOK 627.80 million, Connectivity at NOK 484.20 million, and Product Innovation and Realization (PIR) at NOK 477.50 million.

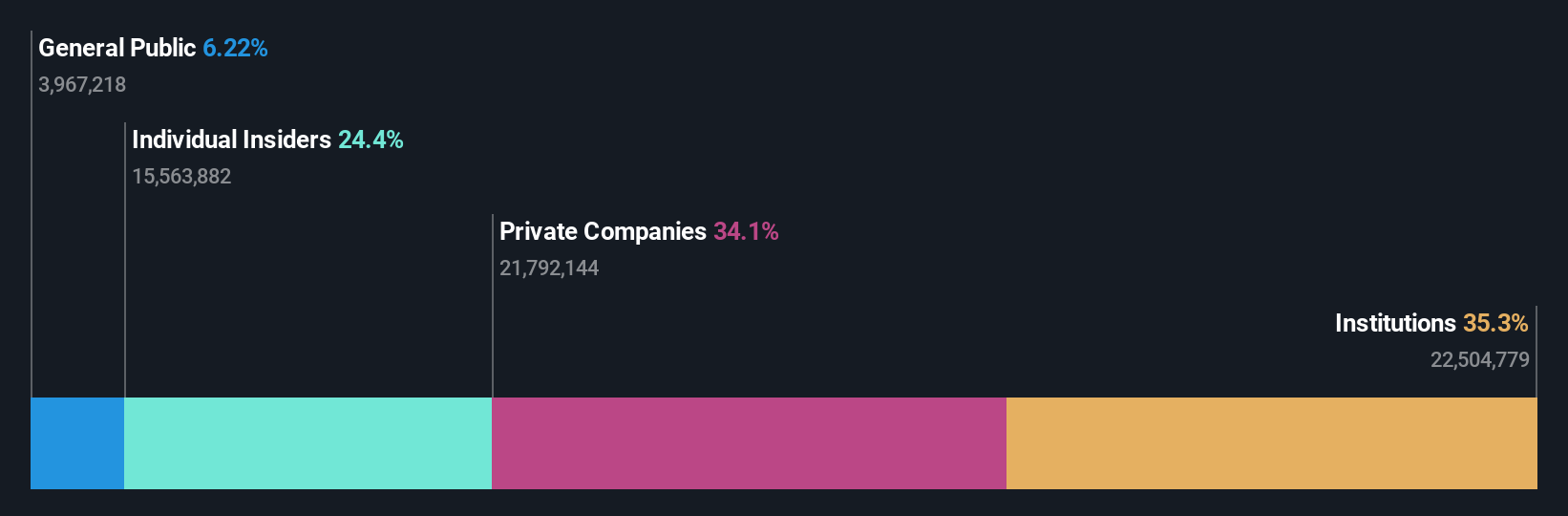

Insider Ownership: 14.6%

Norbit's earnings are forecast to grow significantly at 47.9% annually, outpacing the Norwegian market. Despite recent shareholder dilution, its revenue growth of 18.1% per year surpasses the local market average. The company was recently added to the S&P Global BMI Index and is engaged in strategic acquisitions to enhance its market position. Recent contracts include a NOK 75 million order for surveillance sonar systems and an advanced negotiation for a NOK 50 million contract manufacturing deal.

- Get an in-depth perspective on Norbit's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Norbit implies its share price may be too high.

Beijing InHand Networks Technology (SHSE:688080)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing InHand Networks Technology Co., Ltd. operates in the technology sector, focusing on providing industrial IoT solutions, with a market cap of approximately CN¥2.40 billion.

Operations: The company's revenue from its computer networks segment is CN¥517.66 million.

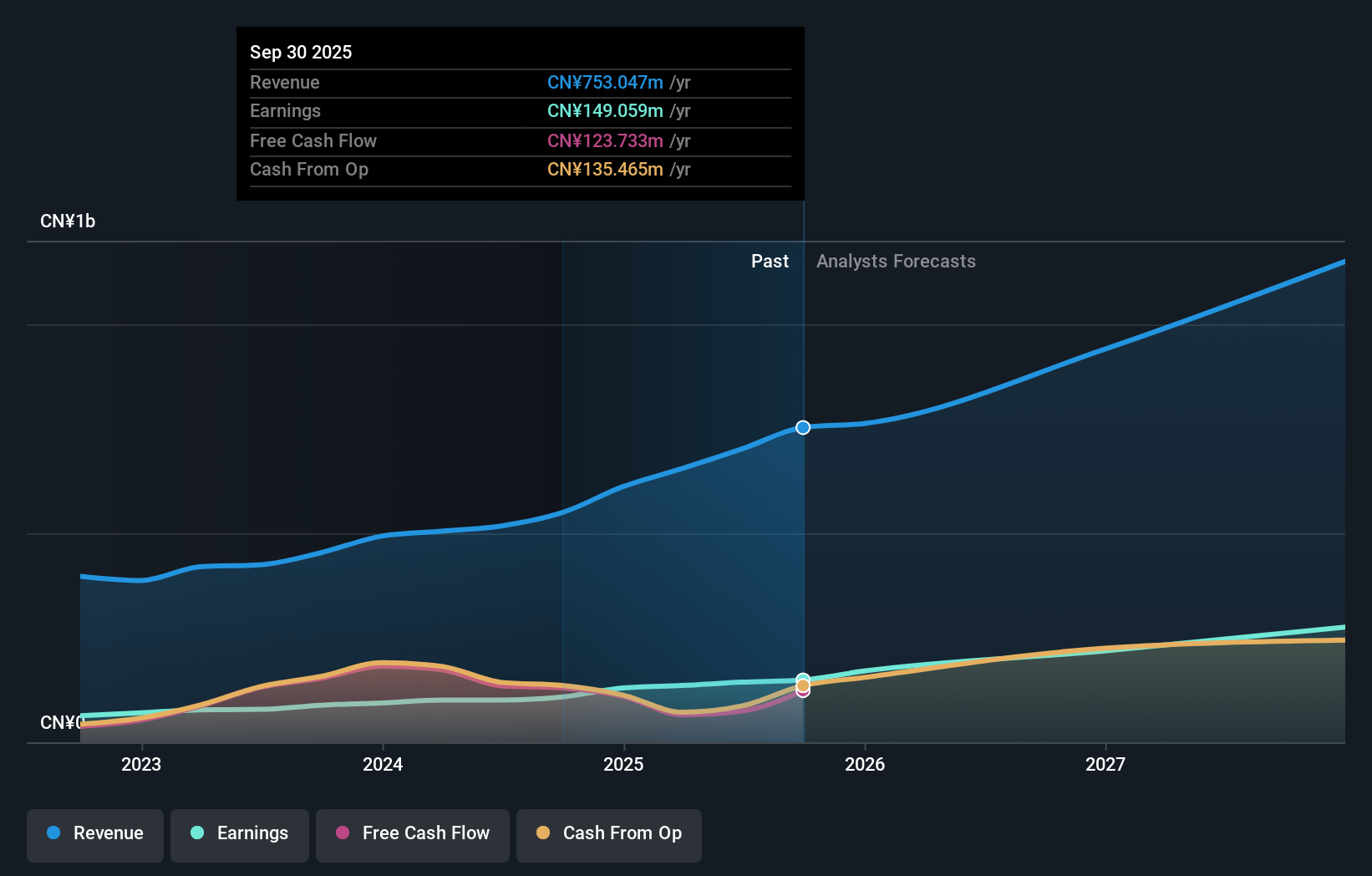

Insider Ownership: 38.9%

Beijing InHand Networks Technology is experiencing robust growth, with earnings forecasted to rise by 32.9% annually, surpassing the Chinese market average. Recent half-year results show a sales increase to CNY 260.92 million and net income growth to CNY 53.42 million. The company trades at a good value compared to its peers and has initiated a share repurchase program worth up to CNY 40 million, reflecting strong internal confidence despite recent share price volatility.

- Dive into the specifics of Beijing InHand Networks Technology here with our thorough growth forecast report.

- According our valuation report, there's an indication that Beijing InHand Networks Technology's share price might be on the cheaper side.

Shandong Minhe Animal Husbandry (SZSE:002234)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shandong Minhe Animal Husbandry Co., Ltd. operates in the breeding, production, slaughtering, processing, and sale of commercial broiler chickens in China with a market capitalization of CN¥3.04 billion.

Operations: Shandong Minhe Animal Husbandry Co., Ltd. generates revenue primarily through its integrated operations involving the breeding, production, slaughtering, processing, and sale of commercial broiler chickens in China.

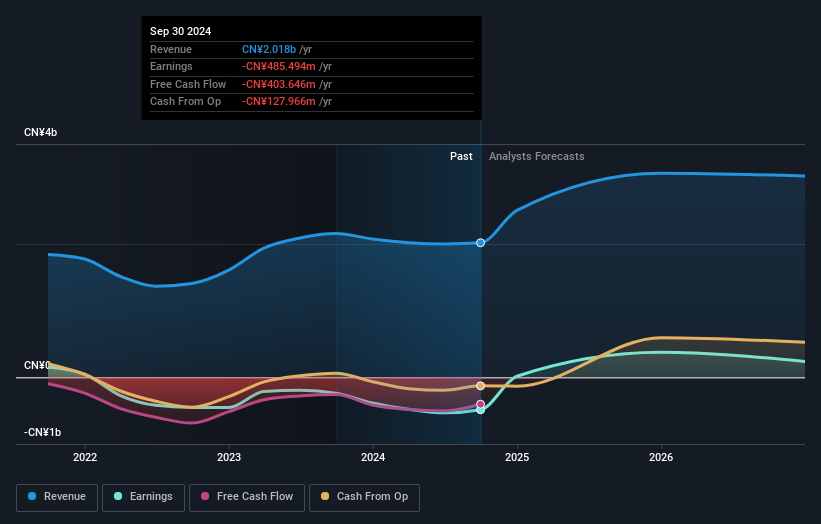

Insider Ownership: 33.9%

Shandong Minhe Animal Husbandry is projected to achieve profitability within three years, with earnings expected to grow significantly at 98.79% annually. Despite this potential, the company reported a net loss of CNY 217.23 million for the first nine months of 2024, with sales declining to CNY 1.58 billion from CNY 1.63 billion the previous year. Revenue growth is anticipated at a moderate pace of 15.5%, outpacing the broader Chinese market's growth rate but still below high-growth benchmarks.

- Navigate through the intricacies of Shandong Minhe Animal Husbandry with our comprehensive analyst estimates report here.

- The analysis detailed in our Shandong Minhe Animal Husbandry valuation report hints at an inflated share price compared to its estimated value.

Next Steps

- Delve into our full catalog of 1487 Fast Growing Companies With High Insider Ownership here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Norbit, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Norbit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NORBT

Norbit

Provides technology solutions to customers in a range of industries.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives