- Japan

- /

- Professional Services

- /

- TSE:6532

3 Global Growth Companies With Insider Ownership Up To 32%

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a notable upswing, driven by the temporary suspension of U.S.-China tariffs and cooling inflation rates in the U.S., which have bolstered investor confidence. Amid this backdrop of easing trade tensions and moderated inflationary pressures, stocks with strong growth potential and significant insider ownership can be particularly appealing as they often indicate management's confidence in their company's future performance.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| KebNi (OM:KEBNI B) | 38.3% | 67% |

| Vow (OB:VOW) | 13.1% | 81% |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| Elicera Therapeutics (OM:ELIC) | 23.8% | 107.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 57.1% |

| Lokotech Group (OB:LOKO) | 14.5% | 58.1% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60% |

Let's explore several standout options from the results in the screener.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management, with a market cap of ₩11.62 trillion.

Operations: HYBE's revenue is primarily derived from its Label segment at ₩2.62 trillion, followed by the Platform segment at ₩333.45 million and the Solution segment at ₩61.84 million.

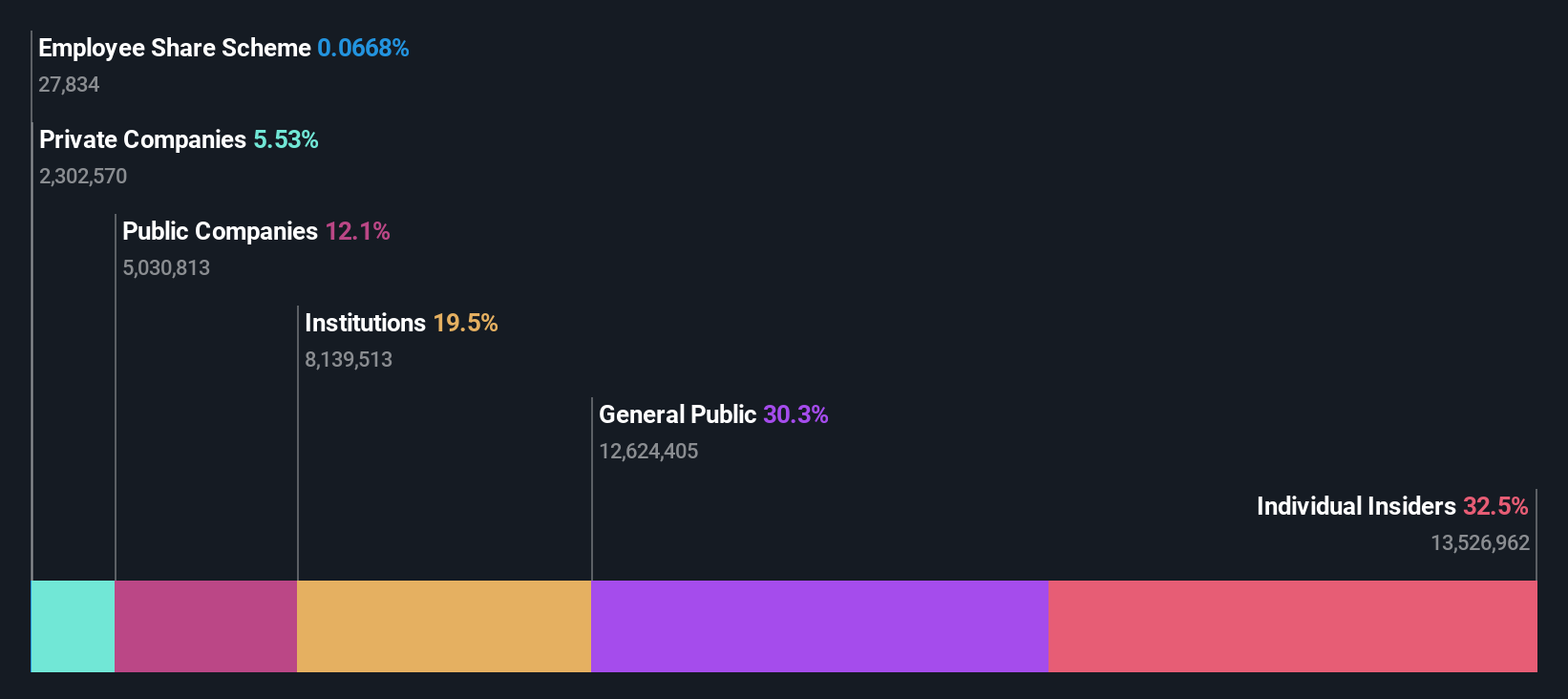

Insider Ownership: 32.5%

HYBE's earnings are forecast to grow significantly at 44% annually, outpacing the KR market's 20.6%, despite revenue growth being slower at 15% per year. The company's recent financial results show a decline in net income and sales compared to the previous year, with profit margins dropping from 8.6% to 0.4%. While insider ownership remains high, there has been no substantial insider trading activity recently.

- Click here and access our complete growth analysis report to understand the dynamics of HYBE.

- Our valuation report unveils the possibility HYBE's shares may be trading at a premium.

Norbit (OB:NORBT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Norbit ASA offers technology solutions across various industries and has a market cap of NOK12.42 billion.

Operations: Revenue Segments (in millions of NOK):

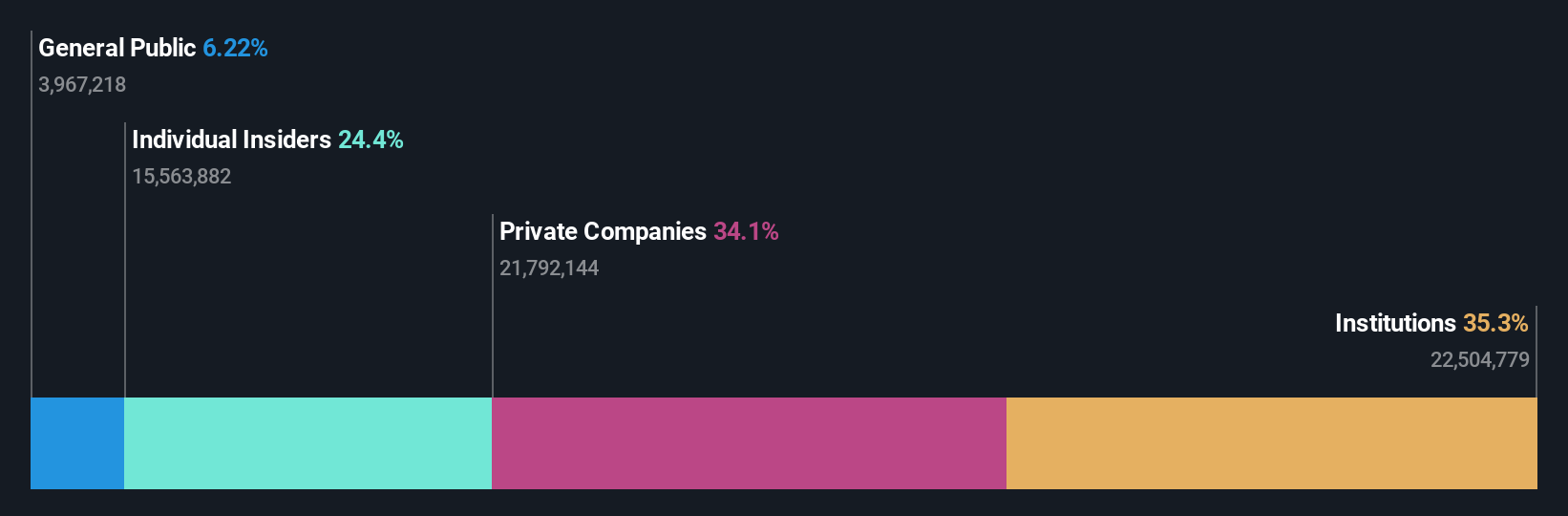

Insider Ownership: 13.2%

Norbit ASA's earnings are forecast to grow significantly at 23.4% annually, surpassing the Norwegian market's 8.7%, with revenue growth expected at 16.4% per year. Despite substantial insider selling recently, the company trades at a significant discount to its estimated fair value and reported strong Q1 results, with net income nearly tripling year-over-year. Recent contracts in the defence sector and positive earnings guidance for 2025 underscore its growth potential across diverse segments.

- Delve into the full analysis future growth report here for a deeper understanding of Norbit.

- The valuation report we've compiled suggests that Norbit's current price could be inflated.

Baycurrent (TSE:6532)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Baycurrent, Inc. offers consulting services in Japan and has a market cap of approximately ¥1.22 billion.

Operations: The company generates revenue primarily from its Consulting Business, which amounts to ¥116.06 million.

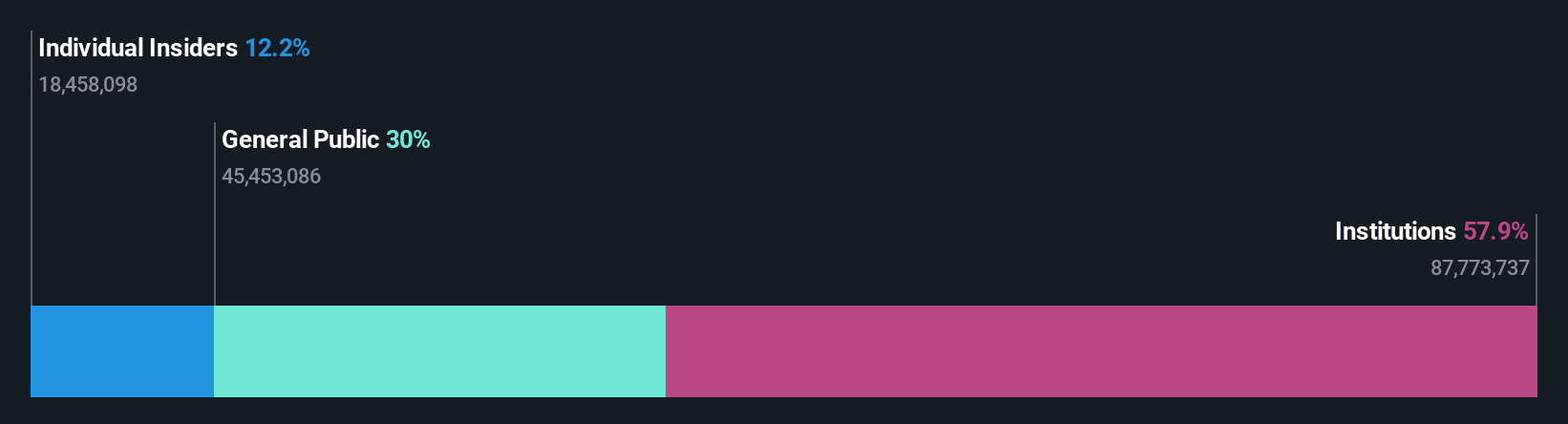

Insider Ownership: 12.9%

Baycurrent's earnings are projected to grow at 18.9% annually, outpacing the Japanese market's 7.6%, while revenue growth is forecasted at 18.3%. The company trades below its estimated fair value and offers a high return on equity forecast of 34%. Recently, Baycurrent announced a share buyback program worth ¥3 billion and increased its dividend payout ratio target to 40%, reflecting strong shareholder return strategies amid robust financial performance expectations.

- Dive into the specifics of Baycurrent here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Baycurrent's share price might be too optimistic.

Make It Happen

- Dive into all 844 of the Fast Growing Global Companies With High Insider Ownership we have identified here.

- Searching for a Fresh Perspective? AI is about to change healthcare. These 21 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Baycurrent might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6532

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)