IDEX Biometrics ASA's (OB:IDEX) Shift From Loss To Profit

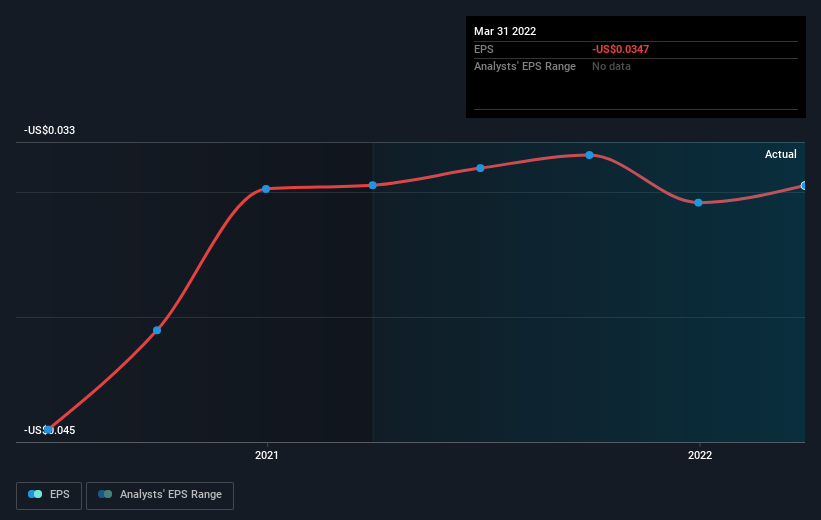

IDEX Biometrics ASA (OB:IDEX) is possibly approaching a major achievement in its business, so we would like to shine some light on the company. IDEX Biometrics ASA engages in the design, development, and sale of fingerprint authentication solutions in Europe, the Middle East, Africa, the Americas, and the Asia-Pacific regions. The company’s loss has recently broadened since it announced a US$33m loss in the full financial year, compared to the latest trailing-twelve-month loss of US$33m, moving it further away from breakeven. Many investors are wondering about the rate at which IDEX Biometrics will turn a profit, with the big question being “when will the company breakeven?” Below we will provide a high-level summary of the industry analysts’ expectations for the company.

Check out our latest analysis for IDEX Biometrics

According to the 2 industry analysts covering IDEX Biometrics, the consensus is that breakeven is near. They anticipate the company to incur a final loss in 2023, before generating positive profits of US$200k in 2024. So, the company is predicted to breakeven approximately 2 years from today. How fast will the company have to grow each year in order to reach the breakeven point by 2024? Working backwards from analyst estimates, it turns out that they expect the company to grow 78% year-on-year, on average, which signals high confidence from analysts. If this rate turns out to be too aggressive, the company may become profitable much later than analysts predict.

Underlying developments driving IDEX Biometrics' growth isn’t the focus of this broad overview, however, bear in mind that typically a high growth rate is not out of the ordinary, particularly when a company is in a period of investment.

Before we wrap up, there’s one aspect worth mentioning. IDEX Biometrics currently has no debt on its balance sheet, which is rare for a loss-making growth company, which typically has high debt relative to its equity. This means that the company has been operating purely on its equity investment and has no debt burden. This aspect reduces the risk around investing in the loss-making company.

Next Steps:

This article is not intended to be a comprehensive analysis on IDEX Biometrics, so if you are interested in understanding the company at a deeper level, take a look at IDEX Biometrics' company page on Simply Wall St. We've also put together a list of relevant factors you should further examine:

- Historical Track Record: What has IDEX Biometrics' performance been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on IDEX Biometrics' board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:IDEX

IDEX Biometrics

Designs, develops, and sells fingerprint authentication solutions in Norway, Europe, the Middle East, Africa, the Americas, and the Asia-Pacific regions.

Excellent balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)