- Norway

- /

- Semiconductors

- /

- OB:NOD

Does 5G IoT Via LEO Satellites Redefine the Growth Outlook for Nordic Semiconductor (OB:NOD)?

Reviewed by Sasha Jovanovic

- Earlier this month, Sateliot, Nordic Semiconductor, and Gatehouse Satcom achieved the world’s first 5G IoT data transmission between a standard commercial cellular IoT device and a Low Earth Orbit (LEO) satellite, meeting the 3GPP 5G NB-IoT Release 17 standard and enabling seamless global connectivity without hardware changes.

- This technical advance has the potential to transform Sateliot’s LEO satellites into “cell towers in space,” opening new markets by extending IoT coverage to 80% of the planet currently without terrestrial network access.

- We’ll examine how enabling 5G IoT connectivity worldwide via LEO satellites could reshape Nordic Semiconductor’s future growth outlook and differentiation.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Nordic Semiconductor Investment Narrative Recap

For investors considering Nordic Semiconductor, the core belief centers on the company’s ability to capture IoT’s global expansion through continued innovation and leadership in low-power wireless connectivity. The news of 5G IoT data transmission via LEO satellites is significant for long-term differentiation, but does not fundamentally alter immediate revenue catalysts, which remain tied to execution in key segments and ongoing demand normalization. The most pressing risk is the potential for slower long-term demand if macroeconomic volatility persists.

Among recent announcements, the June acquisition of Memfault is especially relevant. By integrating lifecycle management and chip-to-cloud capabilities, Nordic enhances its total solution offering just as satellite IoT opens new end-markets, reinforcing the catalyst of expanding addressable revenue through broad-based product innovation and deeper customer lock-in.

Yet, against this backdrop, it is important to remember that elevated valuation multiples could face pressure if ...

Read the full narrative on Nordic Semiconductor (it's free!)

Nordic Semiconductor's narrative projects $923.1 million in revenue and $100.0 million in earnings by 2028. This requires 13.7% yearly revenue growth and a $86.4 million increase in earnings from the current level of $13.6 million.

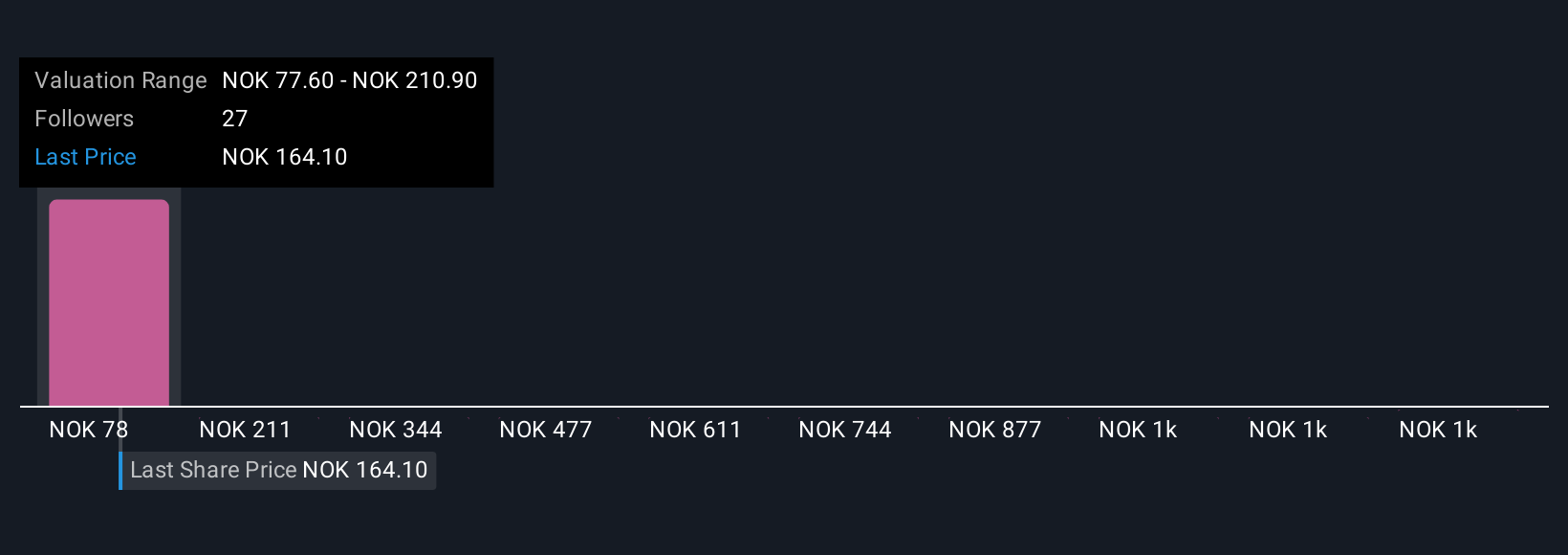

Uncover how Nordic Semiconductor's forecasts yield a NOK145.74 fair value, a 8% downside to its current price.

Exploring Other Perspectives

Fair value estimates from six Simply Wall St Community members stretch from NOK77.20 to NOK1,410.51. While many are optimistic about earnings growth, you will find sharply different views on what drives sustainable outperformance, inviting you to explore multiple perspectives.

Explore 6 other fair value estimates on Nordic Semiconductor - why the stock might be worth less than half the current price!

Build Your Own Nordic Semiconductor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nordic Semiconductor research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Nordic Semiconductor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nordic Semiconductor's overall financial health at a glance.

No Opportunity In Nordic Semiconductor?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordic Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NOD

Nordic Semiconductor

A fabless semiconductor company, develops and sells integrated circuits for use in short- and long- range wireless applications in Europe, the Americas, and the Asia Pacific.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives