Last Update 10 Dec 25

Fair value Decreased 0.73%NOD: Future Demand Recovery Will Support Shares Amid Mixed Sector Sentiment

Analysts have slightly reduced their price target on Nordic Semiconductor, with our fair value estimate decreasing from NOK 146.77 to NOK 145.70. This revision reflects modestly lower assumptions for top line growth and adjusted sector multiples, while long term profitability and valuation frameworks remain supportive.

Analyst Commentary

Recent Street research on Nordic Semiconductor reflects a nuanced shift in sentiment, with modest target price changes capturing both optimism on long term growth and caution around nearer term execution risks and sector dynamics.

Bullish Takeaways

- Bullish analysts continue to frame the stock as attractive on a medium to long term view, maintaining positive ratings even as they fine tune price targets, which supports the case for sustained value creation beyond the current cycle.

- Upward revisions to some targets highlight confidence that revenue growth can re accelerate as demand normalizes and as the company executes on design wins in connectivity and low power solutions.

- Comments that 2027 valuation multiples could provide support suggest that, on out year estimates, the shares may screen as reasonable or undervalued relative to the broader European technology hardware peer set.

- The resilience of secular drivers such as artificial intelligence and connected devices is seen as an indirect tailwind for Nordic Semiconductor, underpinning expectations for structurally higher long term growth than the wider hardware group.

Bearish Takeaways

- Bearish analysts are trimming price targets, indicating reduced confidence in near term upside as visibility on order momentum and end market recovery remains limited.

- A cautious stance on European technology hardware into the upcoming quarters points to the risk that Nordic Semiconductor could face multiple compression if sector sentiment weakens further.

- Some views suggest that near term benefits from artificial intelligence strength are likely to be modest for most component names, curbing expectations for a rapid acceleration in earnings or a re rating driven by AI exposure alone.

- Neutral ratings from major houses like JPMorgan reinforce the notion that execution and demand recovery must improve before the market is willing to ascribe a higher premium multiple to the shares.

Valuation Changes

- The fair value estimate has fallen slightly, moving from NOK 146.77 to NOK 145.70, reflecting a modest reset in expected upside.

- The discount rate has edged down marginally, from 9.77 percent to 9.74 percent, implying a slightly lower required return on equity.

- The revenue growth assumption has been trimmed slightly, decreasing from 14.14 percent to 14.10 percent, indicating a minor moderation in top-line expectations.

- The net profit margin forecast has risen slightly, from 11.21 percent to 11.23 percent, suggesting a small improvement in projected profitability.

- The future P/E multiple assumption has increased marginally, from 33.83x to 33.90x, pointing to a modestly higher valuation applied to forward earnings.

Key Takeaways

- Market optimism may be overestimating sustainable revenue growth, as cyclical benefits and external risks could limit long-term sales and profitability.

- High valuation is tied to growth in green technology and IoT, but rising costs, regulatory pressures, integration challenges, and increased competition threaten margins and earnings.

- Strong innovation, broadening market reach, and a strategic solutions shift position Nordic Semiconductor for sustained growth, margin resilience, and long-term competitive differentiation.

Catalysts

About Nordic Semiconductor- A fabless semiconductor company, develops and sells integrated circuits for use in short- and long- range wireless applications in Europe, the Americas, and the Asia Pacific.

- Investors may be overestimating Nordic Semiconductor's ability to sustain current high revenue growth rates as the company is currently benefitting from a cyclical rebound, inventory normalization, and restocking, while long-term consumer and industrial customer demand could slow due to macroeconomic volatility or shifts in global buying patterns; this could impact future revenue growth sustainability.

- Optimism about the company's exposure to green technology and sustainability trends could be inflating valuation, but tightening regulatory requirements and European climate policies may increase compliance costs and CapEx, potentially leading to downward pressure on net margins and earnings over time.

- The move toward a solution-oriented, chip-to-cloud provider and recent M&A (Newton AI, Memfault) are seen as strong long-term growth catalysts, but integration risks and consistently high R&D and OpEx requirements, especially for high-salary software talent, could weigh on profitability and net margins in the near term.

- Current multiples may reflect investor confidence that the ongoing proliferation of IoT, smart city, and digitalization trends will continue to drive above-market revenue and market share gains; if adoption rates plateau or competition intensifies (especially from low-cost or Asian providers), revenue growth and gross margins could disappoint relative to expectations.

- Elevated valuation could also be supported by expectations that Nordic's expansion in power management ICs and advanced SoCs (nRF54 series) will lead to accelerated sales traction and attach rates; a slower ramp due to extended customer design cycles, certification lags, or delays in broad-based adoption could limit earnings and revenue upside versus optimistic assumptions.

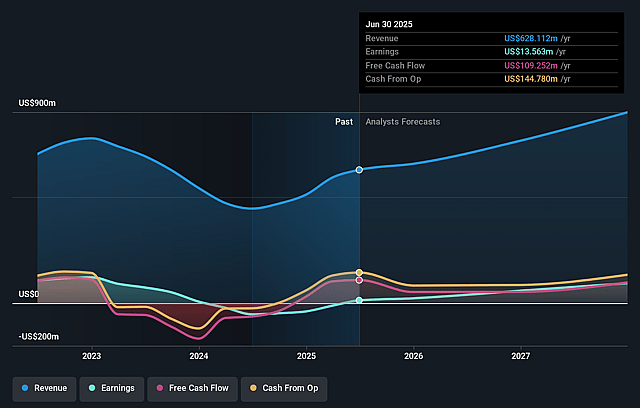

Nordic Semiconductor Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Nordic Semiconductor's revenue will grow by 13.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.2% today to 10.8% in 3 years time.

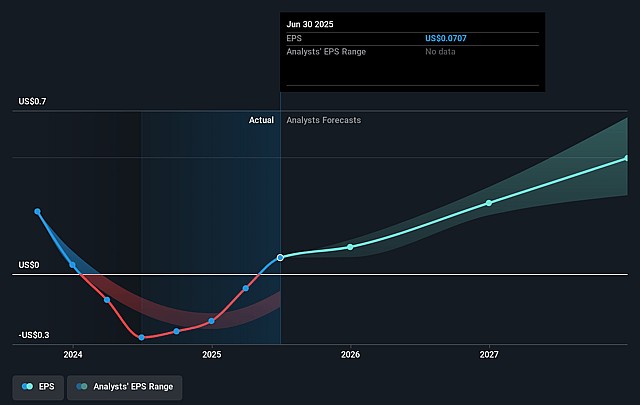

- Analysts expect earnings to reach $100.0 million (and earnings per share of $0.52) by about September 2028, up from $13.6 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $131.2 million in earnings, and the most bearish expecting $67.0 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.8x on those 2028 earnings, down from 218.8x today. This future PE is lower than the current PE for the GB Semiconductor industry at 218.8x.

- Analysts expect the number of shares outstanding to decline by 0.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.36%, as per the Simply Wall St company report.

Nordic Semiconductor Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Robust year-on-year revenue growth and recovery across both short

- and long-range product segments, with sustained demand from key customers in industrial, healthcare, and consumer markets, indicates potential for continued top-line expansion in the medium to long term, supporting future revenue growth.

- Ongoing product innovation and expansion, including the launch of the nRF54 series, extended PMIC offerings, and acquisitions like Newton AI and Memfault (cloud life cycle management), position Nordic as a leader in low-power, integrated semiconductor solutions and differentiated full-stack offerings, potentially enabling margin resilience and defending against commoditization.

- High customer engagement and a strong design pipeline for recently launched and upcoming products, along with significant leadership in Bluetooth Low Energy design certifications, suggest long-term customer stickiness, broadening market reach, and higher chances of recurring revenues and design win-driven growth.

- Commitment to sustainability and recognition as one of Europe's and the world's most sustainable companies increases Nordic's appeal to eco-conscious customers and partners across geographies, opening pathways to large, sustainability-driven contracts and long-term competitive differentiation, potentially leading to higher sales or improved margins.

- Strategic shift toward becoming a solutions provider (hardware, software, and cloud) diversifies Nordic's revenue streams, increases customer lock-in, and reduces business risk associated with reliance on single markets or product lines, supporting more stable EBITDA and earnings growth over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NOK139.485 for Nordic Semiconductor based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK190.0, and the most bearish reporting a price target of just NOK109.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $923.1 million, earnings will come to $100.0 million, and it would be trading on a PE ratio of 33.8x, assuming you use a discount rate of 9.4%.

- Given the current share price of NOK156.8, the analyst price target of NOK139.49 is 12.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.