Key Takeaways

- Integrated chip-to-cloud solutions and energy-efficient AI offerings are set to rapidly boost both margin expansion and recurring revenue, outpacing analyst expectations.

- Leadership in ultra-low power and sustainability uniquely positions Nordic to win design contracts and pricing power as global demand and green regulations intensify.

- Nordic faces margin and growth risks from heavy Bluetooth reliance, escalating competition, supply chain vulnerabilities, rising operational costs, and mounting sustainability and regulatory pressures.

Catalysts

About Nordic Semiconductor- A fabless semiconductor company, develops and sells integrated circuits for use in short- and long- range wireless applications in Europe, the Americas, and the Asia Pacific.

- Analyst consensus sees Nordic's move to chip-to-cloud solutions and recent AI/cloud M&A as long-term growth drivers, but actually this strategy could soon accelerate revenue, margin, and recurring revenue expansion as customers increasingly demand integrated silicon, software, and device lifecycle management and recognize Nordic's unique, energy-efficient positioning. This will likely drive revenue growth and gross margin expansion beyond consensus estimates.

- While analysts broadly agree that Nordic's exposure to green technology trends could boost demand, they may be underestimating how the company's leadership in ultra-low power design and recognized sustainability credentials can uniquely position it to win substantial new design wins and secure pricing power, directly supporting higher net margins and earnings resilience as global regulations tighten.

- Persistent and explosive growth in the number of IoT devices, combined with sharp penetration of edge AI (bolstered by the Neuton.AI acquisition), could trigger multi-year outperformance in both core connectivity chips and new edge intelligence solutions, delivering sustainable above-market revenue growth and an expanding addressable market.

- Nordic's rapid portfolio expansion into cellular IoT (LTE-M/NB-IoT), Wi-Fi, and power management ICs promises to significantly diversify revenue streams, shorten sales cycles, and deepen wallet share with top-tier and long-tail customers, supporting both topline growth and margin stability over the long term.

- The company's accelerating cadence of innovative product launches based on advanced 22-nanometer technology is energizing the engineering organization and customer base, setting up a multi-year innovation cycle likely to drive market share gains, premium attach rates, and consistent improvements in gross margin and overall profitability.

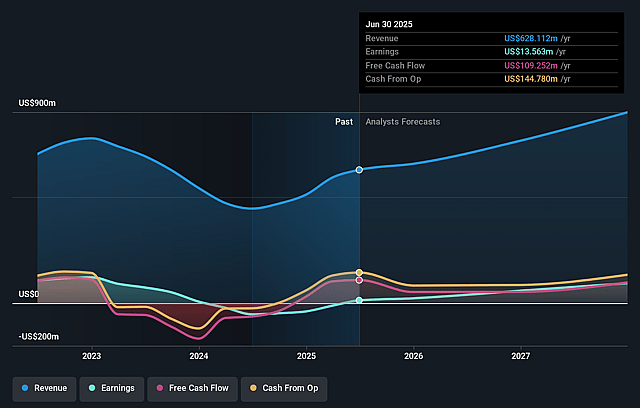

Nordic Semiconductor Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Nordic Semiconductor compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Nordic Semiconductor's revenue will grow by 21.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.2% today to 14.8% in 3 years time.

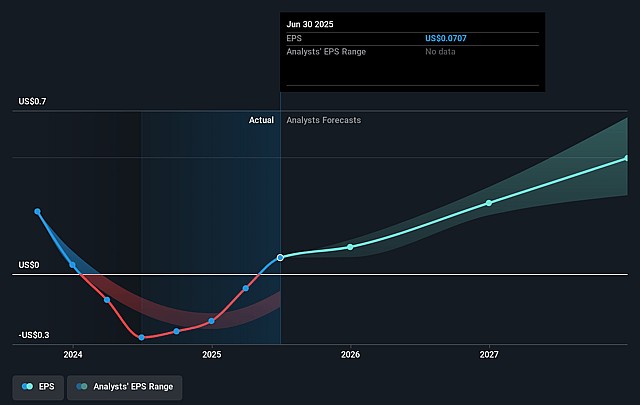

- The bullish analysts expect earnings to reach $164.8 million (and earnings per share of $0.87) by about September 2028, up from $13.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 29.2x on those 2028 earnings, down from 225.6x today. This future PE is lower than the current PE for the GB Semiconductor industry at 222.4x.

- Analysts expect the number of shares outstanding to decline by 0.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.26%, as per the Simply Wall St company report.

Nordic Semiconductor Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Nordic's heavy reliance on Bluetooth Low Energy, with 32% of industry design certifications but slowing share and ongoing transition from legacy nRF52/53 series to the nRF54, exposes the company to risk if market standards shift, potentially resulting in long-term revenue loss if alternative protocols gain traction.

- Intensifying competition from major semiconductor players and low-cost Asian manufacturers puts continued pressure on gross margins, and while Nordic reported improvement this quarter, the company's limited R&D investment compared to its larger peers may make sustaining net margin gains difficult in the face of ongoing commoditization in IoT chips and price competition.

- Supply chain complexity and risk from geopolitical tensions, tariffs, and tech sovereignty were acknowledged as longer-term risks; should these issues escalate, they could disrupt Nordic's production and delivery capabilities, ultimately impacting both revenue and earnings.

- Nordic's expansion into solutions, software, and services-while offering strategic diversification-comes with a notable increase in OpEx and R&D expenses (currently running above target), presenting margin compression risk if rising costs are not matched by corresponding high-margin revenue as the software and cloud businesses scale.

- Environmental and regulatory demands are increasing, and although Nordic is positioning itself as a sustainability leader, future compliance costs and requirements for greener manufacturing could require significant capital outlays, creating downward pressure on long-term margins and returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Nordic Semiconductor is NOK190.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Nordic Semiconductor's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NOK190.0, and the most bearish reporting a price target of just NOK109.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $164.8 million, and it would be trading on a PE ratio of 29.2x, assuming you use a discount rate of 9.3%.

- Given the current share price of NOK154.2, the bullish analyst price target of NOK190.0 is 18.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Nordic Semiconductor?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.