Here's Why Yara International (OB:YAR) Has Caught The Eye Of Investors

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Yara International (OB:YAR). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Yara International

Yara International's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. To the delight of shareholders, Yara International has achieved impressive annual EPS growth of 58%, compound, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

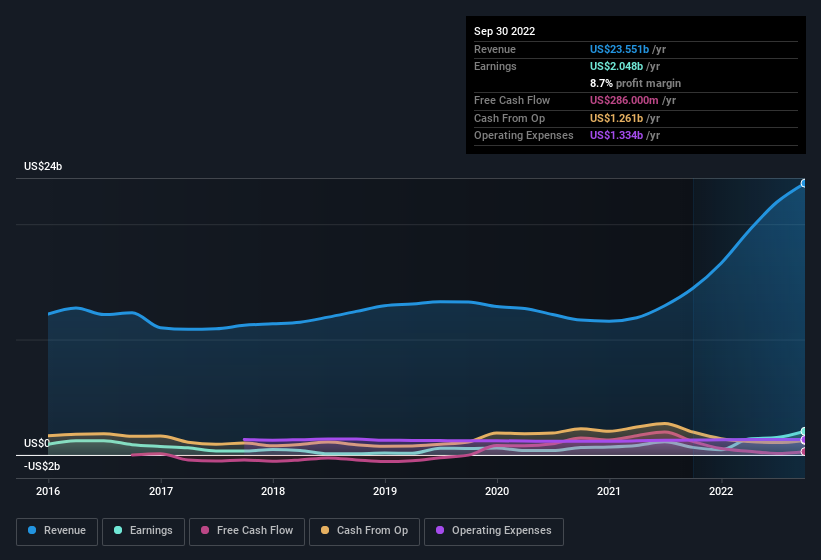

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Yara International is growing revenues, and EBIT margins improved by 4.1 percentage points to 14%, over the last year. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Yara International.

Are Yara International Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

While Yara International insiders did net US$116k selling stock over the last year, they invested US$4.5m, a much higher figure. You could argue that level of buying implies genuine confidence in the business. Zooming in, we can see that the biggest insider purchase was by President & CEO Svein Holsether for kr1m worth of shares, at about kr433 per share.

Should You Add Yara International To Your Watchlist?

Yara International's earnings have taken off in quite an impressive fashion. Growth-minded people will be intrigued by the incredible movement in EPS growth. And indeed, it could be a sign that the business is at an inflection point. If this is the case, then keeping a watch over Yara International could be in your best interest. Before you take the next step you should know about the 3 warning signs for Yara International (1 is a bit concerning!) that we have uncovered.

The good news is that Yara International is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:YAR

Yara International

Provides crop nutrition and industrial solutions in Norway, European Union, Europe, Africa, Asia, North and Latin America, Australia, and New Zealand.

Good value with reasonable growth potential.