- Norway

- /

- Metals and Mining

- /

- OB:RANA

Analysts Just Shipped A Sizeable Upgrade To Their Rana Gruber ASA (OB:RANA) Estimates

Celebrations may be in order for Rana Gruber ASA (OB:RANA) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. Consensus estimates suggest investors could expect greatly increased statutory revenues and earnings per share, with the analysts modelling a real improvement in business performance. Investor sentiment seems to be improving too, with the share price up 5.8% to kr58.00 over the past 7 days. Could this big upgrade push the stock even higher?

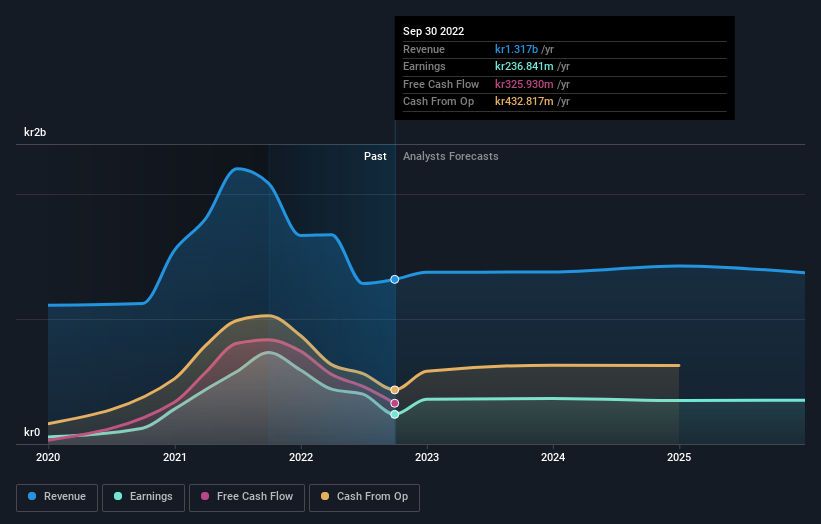

Following the upgrade, the current consensus from Rana Gruber's dual analysts is for revenues of kr1.4b in 2023 which - if met - would reflect a credible 4.5% increase on its sales over the past 12 months. Statutory earnings per share are presumed to surge 54% to kr9.83. Prior to this update, the analysts had been forecasting revenues of kr1.1b and earnings per share (EPS) of kr5.75 in 2023. So we can see there's been a pretty clear increase in analyst sentiment in recent times, with both revenues and earnings per share receiving a decent lift in the latest estimates.

Check out our latest analysis for Rana Gruber

With these upgrades, we're not surprised to see that the analysts have lifted their price target 17% to kr52.50 per share. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic Rana Gruber analyst has a price target of kr65.00 per share, while the most pessimistic values it at kr40.00. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await Rana Gruber shareholders.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Rana Gruber's past performance and to peers in the same industry. It's pretty clear that there is an expectation that Rana Gruber's revenue growth will slow down substantially, with revenues to the end of 2023 expected to display 3.5% growth on an annualised basis. This is compared to a historical growth rate of 6.0% over the past three years. Compare this with other companies in the same industry, which are forecast to see a revenue decline of 2.4% annually. Factoring in the forecast slowdown in growth, it's pretty clear that Rana Gruber is still expected to grow faster than the wider industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for next year. On the plus side, they also lifted their revenue estimates, and the company is expected to perform better than the wider market. Given that the consensus looks almost universally bullish, with a substantial increase to forecasts and a higher price target, Rana Gruber could be worth investigating further.

Analysts are definitely bullish on Rana Gruber, but no company is perfect. Indeed, you should know that there are several potential concerns to be aware of, including the risk of cutting its dividend. For more information, you can click through to our platform to learn more about this and the 1 other concern we've identified .

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:RANA

Rana Gruber

Engages in the mining, processing, and sale of iron ore concentrate in Norway, the United Kingdom, Sweden, the United States, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.