What Borregaard (OB:BRG)'s NOK200 Million Loan Guarantee for Alginor Means for Shareholders

Reviewed by Sasha Jovanovic

- Alginor recently announced that Borregaard, alongside Must Invest and Hatteland Group, will act as guarantors for a NOK200 million convertible loan to Alginor, which can be converted to shares at NOK10 per share and will be paid in two tranches during October 2025 and February 2026.

- This financial commitment highlights Borregaard's willingness to support sector innovation through direct investment, potentially increasing its exposure to new opportunities and risks within the biochemicals sector.

- We'll explore how Borregaard's role as guarantor for Alginor's loan could influence its growth outlook and risk profile.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Borregaard Investment Narrative Recap

To believe in Borregaard as a shareholder, it's essential to have conviction in the long-term demand for specialty biochemicals, particularly those with sustainable and high-value applications. The recent Alginor loan guarantee underscores Borregaard’s appetite for supporting sector innovation, but the move is unlikely to materially shift the near-term catalyst of rising agricultural demand or offset the immediate risk of increasing costs and potential price pressure in bioethanol markets. Among recent developments, Borregaard’s operational outage at Sarpsborg in September serves as a reminder of unplanned risks that can affect specialty cellulose production, shipment schedules, and ultimately near-term earnings, central considerations as volumes become increasingly important for the company’s growth momentum. These incidents, set against robust performance in agriculture-linked segments, frame the backdrop for current catalysts and risks. However, looking beyond innovation commitments, investors should also be mindful of potential shifts in European bioethanol supply that could…

Read the full narrative on Borregaard (it's free!)

Borregaard's narrative projects NOK 9.2 billion revenue and NOK 1.4 billion earnings by 2028. This requires 5.7% yearly revenue growth and a NOK 515 million earnings increase from the current NOK 885 million.

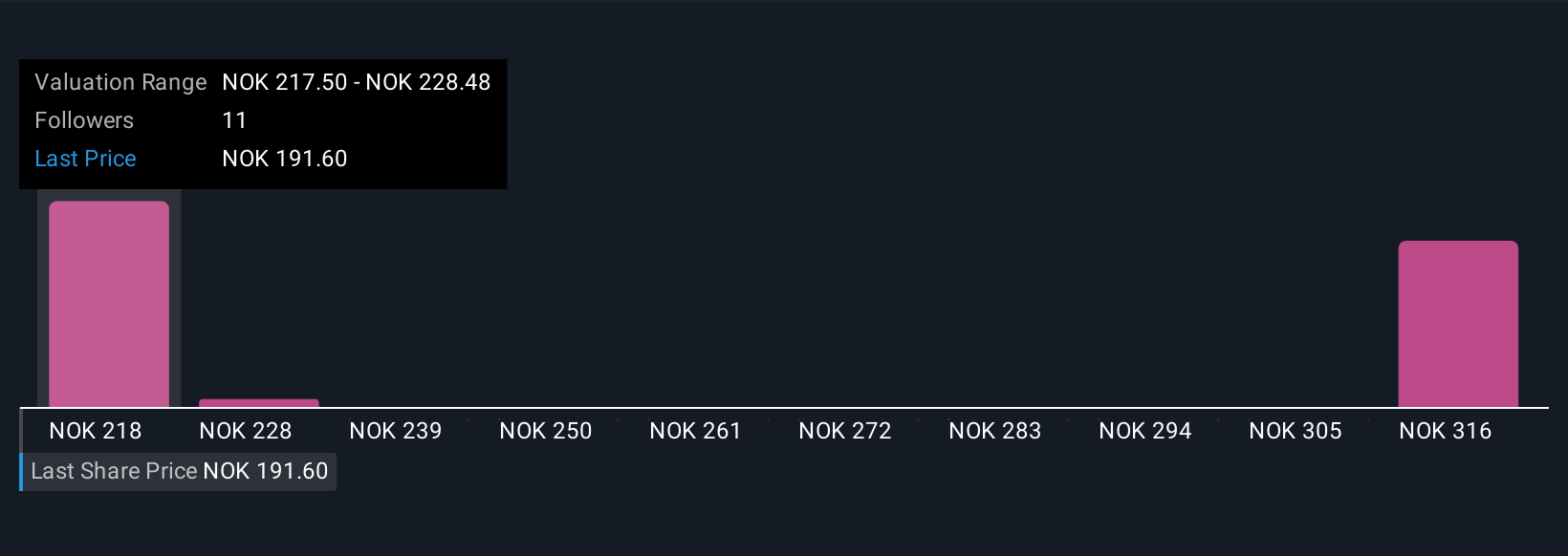

Uncover how Borregaard's forecasts yield a NOK217.50 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Fair value estimates from three Simply Wall St Community contributors cover a wide band from NOK217.50 to NOK327.14 per share. While predictions vary, ongoing cost inflation and margin pressures could meaningfully influence Borregaard’s results, making it valuable to consider several perspectives as you weigh expectations.

Explore 3 other fair value estimates on Borregaard - why the stock might be worth as much as 72% more than the current price!

Build Your Own Borregaard Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Borregaard research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Borregaard research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Borregaard's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Borregaard might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:BRG

Borregaard

Engages in the development, production, and marketing of specialized biochemicals and biomaterials in Norway, rest of Europe, Asia, the United States, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives