- Germany

- /

- Aerospace & Defense

- /

- XTRA:HAG

3 European Stocks Estimated To Be Up To 47.9% Below Intrinsic Value

Reviewed by Simply Wall St

Amidst the ongoing uncertainties surrounding U.S. trade tariffs and fluctuating monetary policies, European markets have experienced a mix of modest gains and losses, with the STOXX Europe 600 Index ending slightly lower due to concerns about economic growth. In this context, identifying undervalued stocks can be particularly appealing as investors seek opportunities that may offer potential value despite broader market challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sword Group (ENXTPA:SWP) | €32.15 | €64.13 | 49.9% |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK83.22 | SEK164.64 | 49.5% |

| Net Insight (OM:NETI B) | SEK4.83 | SEK9.58 | 49.6% |

| JOST Werke (XTRA:JST) | €50.30 | €98.61 | 49% |

| Storytel (OM:STORY B) | SEK92.25 | SEK180.58 | 48.9% |

| Star7 (BIT:STAR7) | €6.20 | €12.36 | 49.8% |

| dormakaba Holding (SWX:DOKA) | CHF686.00 | CHF1359.67 | 49.5% |

| Neosperience (BIT:NSP) | €0.538 | €1.06 | 49.2% |

| Groupe Airwell Société anonyme (ENXTPA:ALAIR) | €1.13 | €2.25 | 49.8% |

| Cavotec (OM:CCC) | SEK17.35 | SEK34.06 | 49.1% |

Let's uncover some gems from our specialized screener.

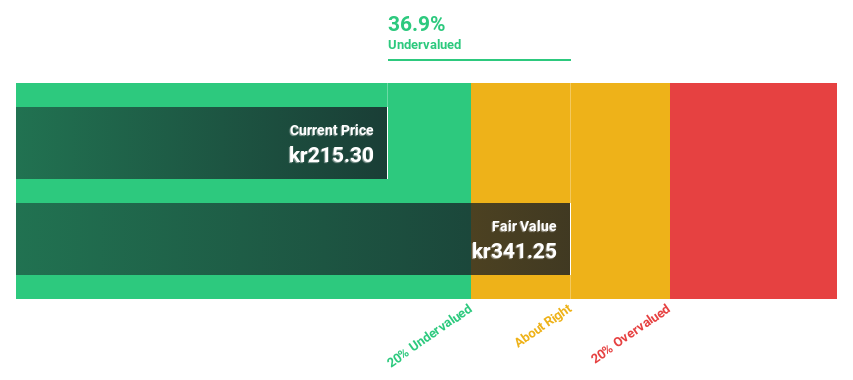

Mowi (OB:MOWI)

Overview: Mowi ASA is a seafood company that farms, produces, and supplies Atlantic salmon products globally, with a market cap of NOK105.39 billion.

Operations: The company's revenue is primarily derived from its Farming segment (€3.51 billion), Sales & Marketing - Markets (€4.00 billion), and Sales & Marketing - Consumer Products (€3.70 billion), with additional contributions from the Feed segment (€1.12 billion).

Estimated Discount To Fair Value: 39.7%

Mowi ASA, trading at NOK 203.8, is significantly undervalued based on discounted cash flow analysis with a fair value estimate of NOK 338.09. The company forecasts strong earnings growth of 22.9% annually over the next three years, outpacing the Norwegian market's growth rate. However, Mowi carries a high level of debt and has a forecasted low return on equity in three years (19.5%). Recent strategic reviews could impact future operations and financials positively or negatively depending on outcomes.

- The analysis detailed in our Mowi growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Mowi's balance sheet health report.

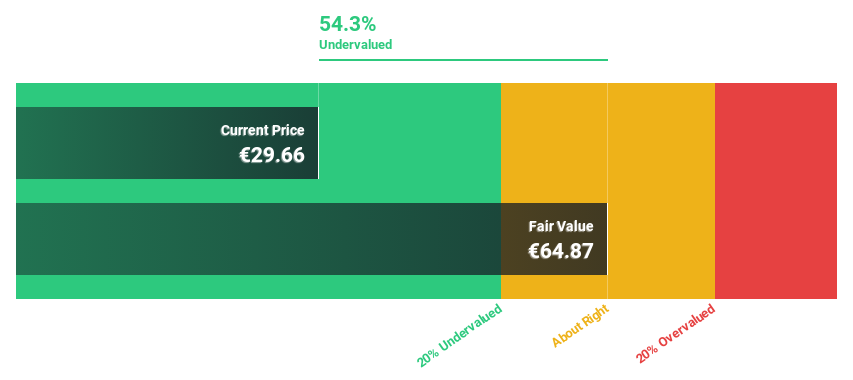

Wienerberger (WBAG:WIE)

Overview: Wienerberger AG is a European company that produces and sells clay blocks, facing bricks, roof tiles, and pavers with a market cap of €4.06 billion.

Operations: Revenue Segments (in millions of €): The company's revenue is derived from the sale of clay blocks, facing bricks, roof tiles, and pavers across Europe.

Estimated Discount To Fair Value: 47.9%

Wienerberger AG, trading at €36.46, is highly undervalued with a fair value estimate of €69.92 based on discounted cash flow analysis. Despite recent earnings volatility due to large one-off items, the company forecasts robust annual profit growth of 42%, surpassing the Austrian market's 9.4%. Wienerberger's strategic expansion through Wioniq offers significant growth potential in infrastructure sectors, although it maintains a high debt level and faces low forecasted return on equity (12.1%).

- According our earnings growth report, there's an indication that Wienerberger might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Wienerberger.

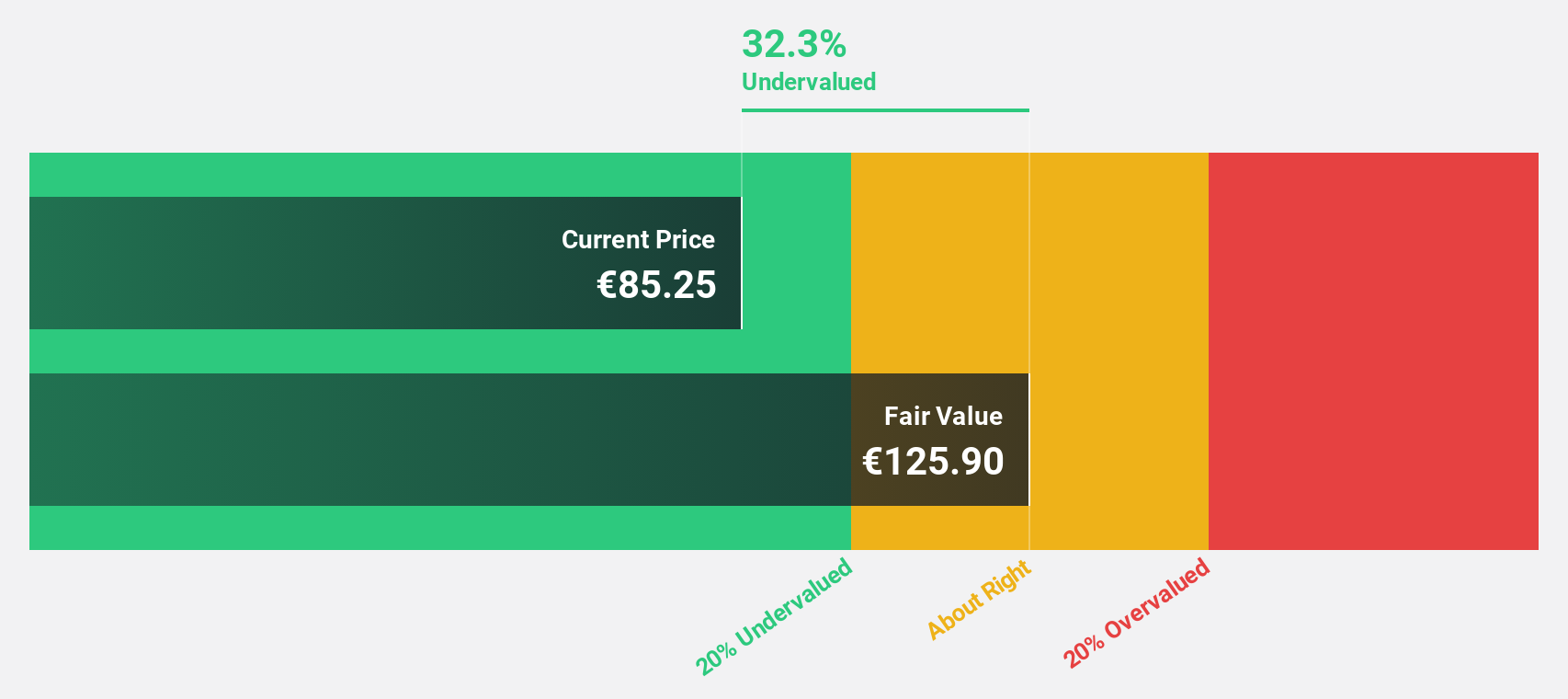

Hensoldt (XTRA:HAG)

Overview: HENSOLDT AG, along with its subsidiaries, offers defense and security electronic sensor solutions globally and has a market cap of €8.57 billion.

Operations: The company's revenue is primarily derived from its Sensors segment, which accounts for €1.91 billion, followed by the Optronics segment at €348 million.

Estimated Discount To Fair Value: 30.3%

Hensoldt AG, trading at €74.20, is significantly undervalued with a fair value estimate of €106.43 based on discounted cash flow analysis. The company reported strong earnings growth last year, doubling its net income to €108 million and increasing sales to €2.24 billion from the previous year. Despite high share price volatility recently, Hensoldt's earnings are forecast to grow substantially at 28.6% annually over the next three years, outpacing the German market average growth rate.

- Our earnings growth report unveils the potential for significant increases in Hensoldt's future results.

- Delve into the full analysis health report here for a deeper understanding of Hensoldt.

Seize The Opportunity

- Discover the full array of 201 Undervalued European Stocks Based On Cash Flows right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hensoldt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HAG

Hensoldt

Provides sensor solutions for defense and security applications worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives