- Netherlands

- /

- Hospitality

- /

- ENXTAM:BFIT

European Growth Stocks With High Insider Ownership And 76% Earnings Growth

Reviewed by Simply Wall St

As the European market navigates a mixed landscape with the pan-European STOXX Europe 600 Index seeing modest gains and major indices showing varied performances, investors are keenly observing growth opportunities amidst economic uncertainties such as fluctuating industrial output and labor market shifts. In this context, stocks with high insider ownership can be particularly appealing, as they often indicate strong confidence from those closest to the company in its potential for sustained earnings growth.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Xbrane Biopharma (OM:XBRANE) | 13% | 112.0% |

| Pharma Mar (BME:PHM) | 11.9% | 44.2% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 90.4% |

| KebNi (OM:KEBNI B) | 36.3% | 74% |

| Elliptic Laboratories (OB:ELABS) | 22.5% | 97.9% |

| Egetis Therapeutics (OM:EGTX) | 10.3% | 85% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.1% | 67.1% |

| CD Projekt (WSE:CDR) | 29.7% | 41.6% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 59.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Basic-Fit (ENXTAM:BFIT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Basic-Fit N.V. operates fitness clubs through its subsidiaries and has a market cap of approximately €1.84 billion.

Operations: The company generates revenue from its fitness clubs primarily in two segments: €541.70 million from Benelux and €766 million from France, Spain, and Germany.

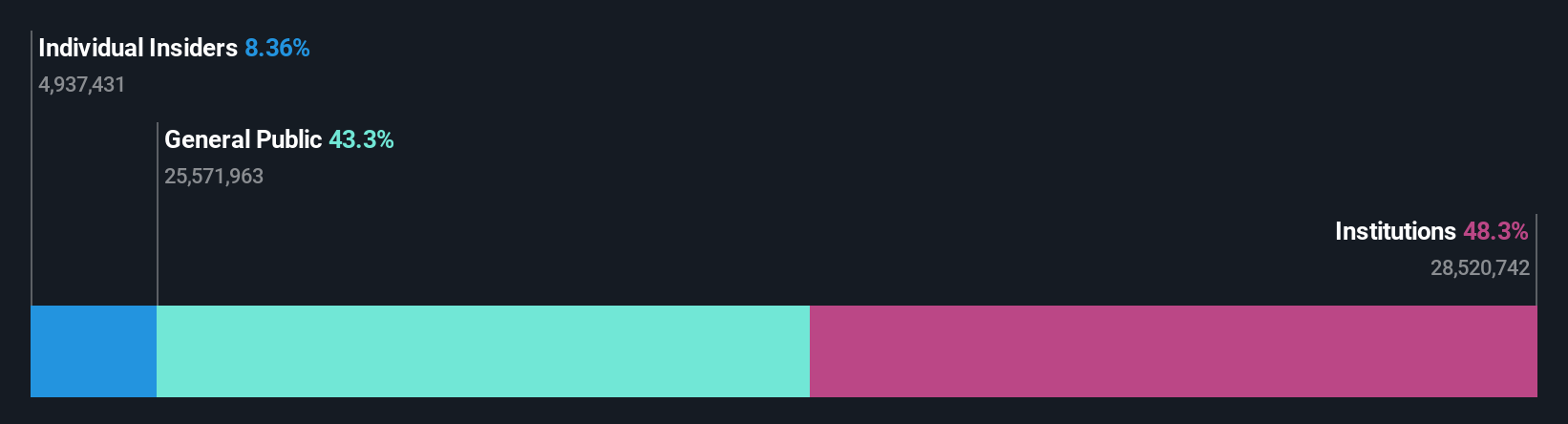

Insider Ownership: 12.1%

Earnings Growth Forecast: 46.8% p.a.

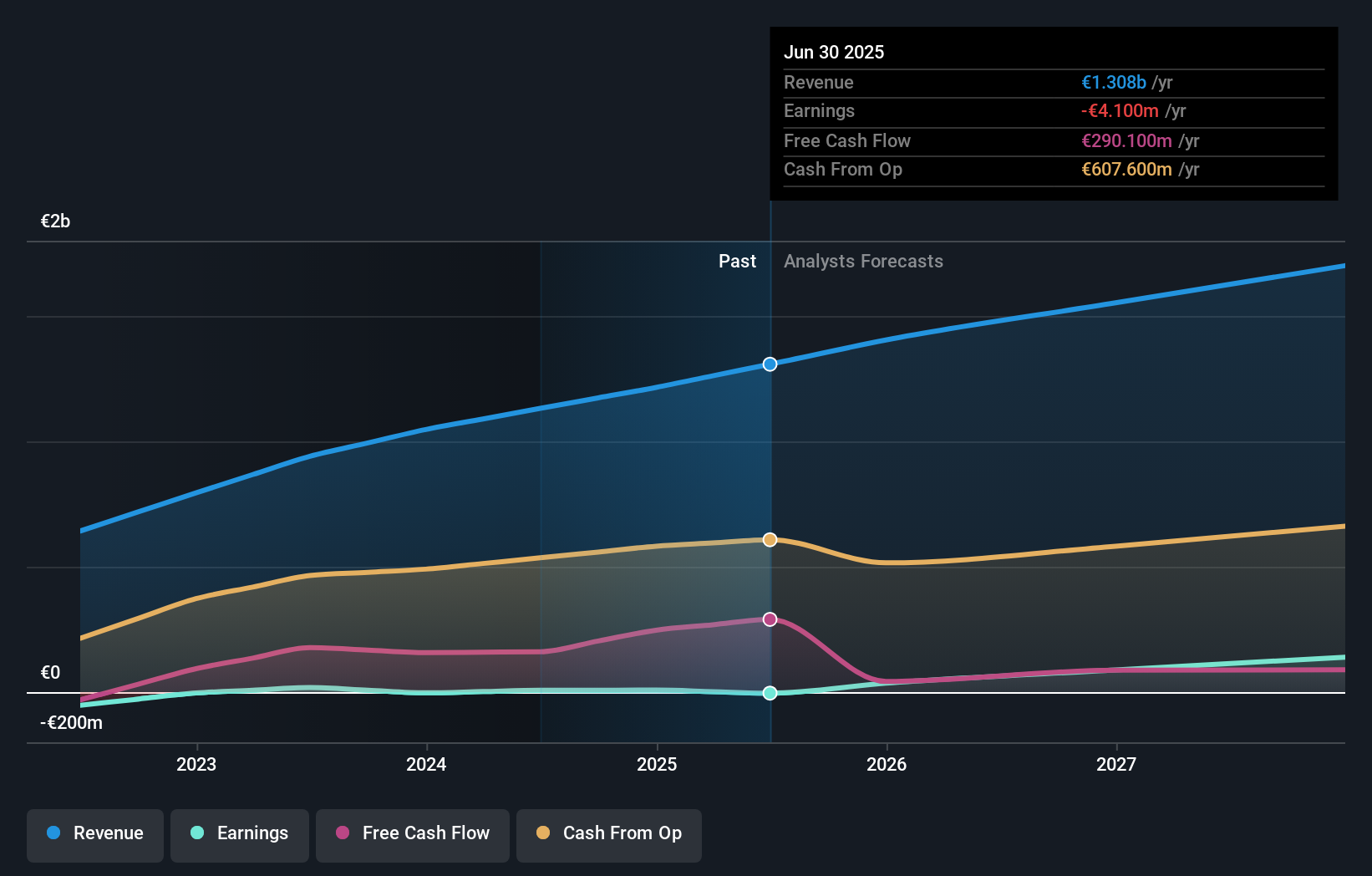

Basic-Fit has demonstrated significant revenue growth, reporting €1.034 billion for the first nine months of 2025, a 60% increase from last year, and remains on track to meet its annual guidance. Despite recent volatility in its share price, insider activity shows more buying than selling over the past three months. The company's revenue is forecasted to grow faster than the Dutch market but slower than 20% per year, with profitability expected within three years.

- Take a closer look at Basic-Fit's potential here in our earnings growth report.

- Our valuation report unveils the possibility Basic-Fit's shares may be trading at a discount.

P/F Bakkafrost (OB:BAKKA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: P/F Bakkafrost, along with its subsidiaries, is engaged in the production and sale of salmon products across North America, Western Europe, Eastern Europe, Asia, and other international markets; it has a market capitalization of NOK29.03 billion.

Operations: The company's revenue segments include Sales and Other (DKK9.80 billion), Farming Faroe Islands (DKK3.85 billion), Fishmeal, Oil and Feed (DKK2.46 billion), Farming Scotland (DKK1.15 billion), Services (DKK864.21 million), Freshwater Faroe Islands (DKK889.79 million), and Freshwater Scotland (DKK89.31 million).

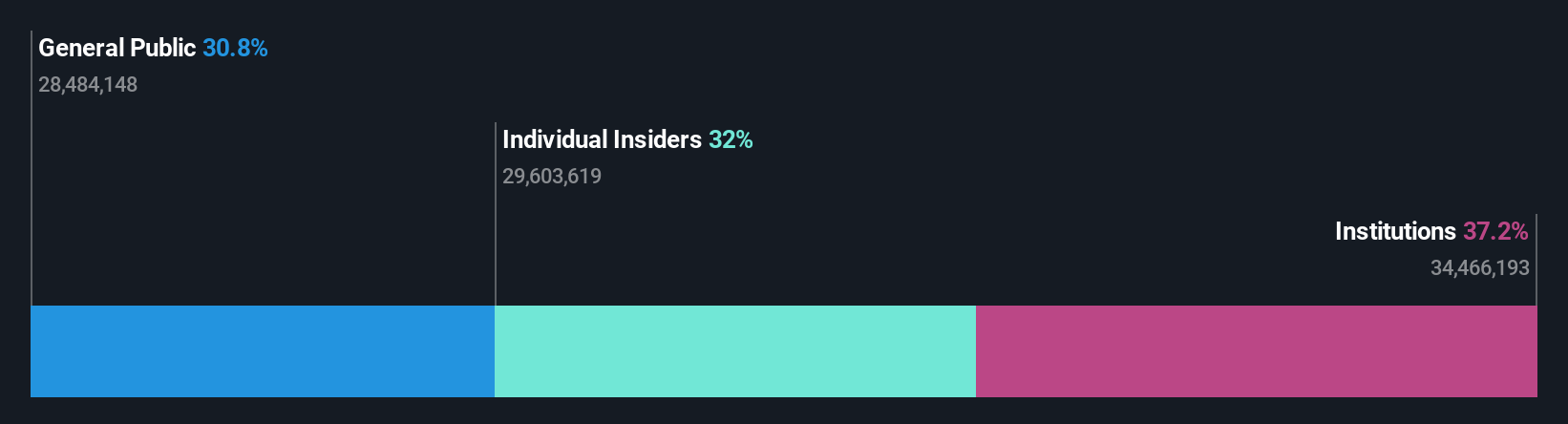

Insider Ownership: 24%

Earnings Growth Forecast: 76.5% p.a.

P/F Bakkafrost is experiencing significant earnings growth, forecasted at 76.5% annually, well above the Norwegian market average. Despite a recent decline in profit margins and net losses for the first half of 2025, insider activity has shown more buying than selling in the past three months. The company has increased its production guidance for 2026 due to strong performance in both Faroes and Scotland, indicating potential operational expansion despite current financial challenges.

- Click here and access our complete growth analysis report to understand the dynamics of P/F Bakkafrost.

- Our valuation report here indicates P/F Bakkafrost may be overvalued.

Bilia (OM:BILI A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bilia AB (publ) is a full-service supplier for car ownership in Sweden, Norway, Luxembourg, and Belgium with a market cap of SEK10.59 billion.

Operations: The company's revenue segments include SEK19.52 billion from Car - Sweden, SEK7.66 billion from Car - Norway, SEK4.08 billion from Car - Western Europe, SEK6.62 billion from Service - Sweden, SEK2.45 billion from Service - Norway, and SEK780 million from Service - Western Europe, with an additional contribution of SEK825 million from Fuel and SEK1.26 billion attributed to Corporate Functions.

Insider Ownership: 32%

Earnings Growth Forecast: 20.2% p.a.

Bilia is positioned for substantial earnings growth at 20.2% annually, outpacing the Swedish market. While insider buying has occurred recently, volumes are not substantial. The company's expansion in Sweden with three new operations suggests strategic growth potential, leveraging existing properties to maintain cost efficiency. However, challenges include a dividend not well covered by free cash flows and interest payments that strain earnings coverage. Despite these issues, Bilia trades below its fair value estimate and relative to peers.

- Dive into the specifics of Bilia here with our thorough growth forecast report.

- According our valuation report, there's an indication that Bilia's share price might be on the cheaper side.

Key Takeaways

- Dive into all 195 of the Fast Growing European Companies With High Insider Ownership we have identified here.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Basic-Fit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:BFIT

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives