- Norway

- /

- Oil and Gas

- /

- OB:VAR

Vår Energi (OB:VAR): A Fresh Look at Valuation Following Steady Gains

Reviewed by Kshitija Bhandaru

Vår Energi (OB:VAR) has posted a 5% gain over the past week, drawing some fresh interest to the energy producer’s recent performance. Investors are watching closely, as the stock’s one-year return now stands at 15%.

See our latest analysis for Vår Energi.

The recent momentum in Vår Energi’s share price is attracting attention, especially following last week’s 5% gain. While there have not been any headline announcements, the company’s 1-year total shareholder return of 15% suggests steady value for investors who have stayed the course. This points to growing confidence in its long-term prospects.

If today’s energy gains have sparked your curiosity, you might want to broaden your outlook and discover fast growing stocks with high insider ownership.

With Vår Energi trading at a modest discount to analyst price targets and recent earnings showing steady growth, investors must ask themselves whether the stock is still undervalued or if the market has already factored in its future gains.

Most Popular Narrative: 9.1% Undervalued

Vår Energi’s most closely followed valuation narrative currently sets fair value at NOK 38.62, about 9% above the last close. Market watchers are considering how this upside could be realized as industry catalysts gain momentum.

Material, near-term production ramp from 9 new project startups and successful ramp-up at Jotun FPSO and Johan Castberg will nearly double output versus 2023, underpinning robust top-line growth and EBITDA expansion.

Curious what’s fueling this premium valuation? The narrative is based on expectations for a high-conviction production surge, aggressive pipeline expansion, and ambitious margin enhancement targets. Want to see the exact projections that analysts believe can drive results past the current share price? The detailed numbers and the factors shaping this outlook are all just a click away.

Result: Fair Value of NOK 38.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tougher climate policies or a faster shift away from oil could weaken Vår Energi’s outlook and impact future earnings projections.

Find out about the key risks to this Vår Energi narrative.

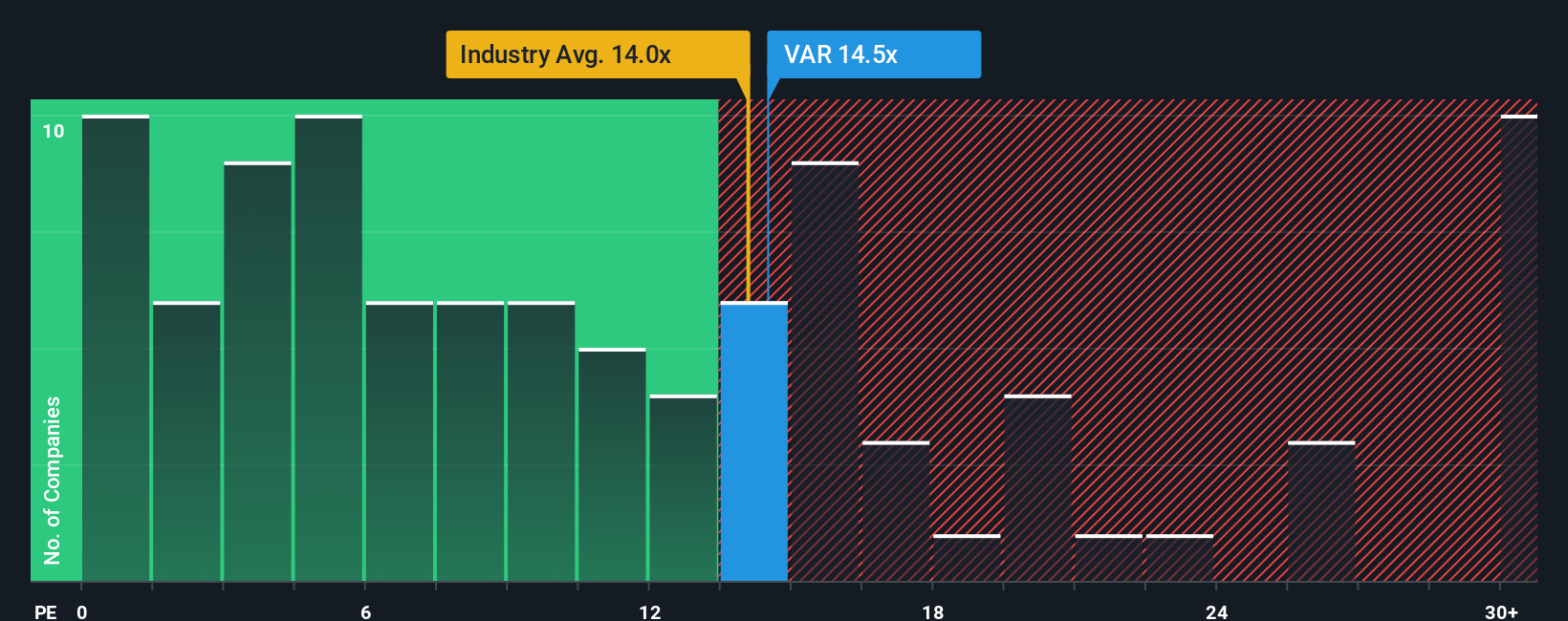

Another View: Market Ratios Tell a Different Story

While fair value models suggest Vår Energi is undervalued, looking at the price-to-earnings ratio paints a less optimistic picture. The stock trades at 14.4x earnings, higher than both the peer average of 10.5x and a fair ratio of 8.4x. This may signal possible valuation risk if the market adjusts downward. Could this mean future gains are already priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vår Energi Narrative

If you have your own perspective or want to dig deeper, try building a narrative based on your own research, and see how your view stacks up. Do it your way

A great starting point for your Vår Energi research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your strategy to just one opportunity. Take control and act now. Expand your search using powerful tools designed to surface stocks primed for growth and innovation.

- Unlock the advantages of strong recurring income by targeting steady yields through these 19 dividend stocks with yields > 3%.

- Tap into tomorrow’s tech breakthroughs by following leading-edge companies with these 25 AI penny stocks.

- Seize value opportunities others might miss by screening for hidden gems among these 894 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:VAR

Vår Energi

Operates as an independent upstream oil and gas company on the Norwegian continental shelf in Norway.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives