The European market has recently experienced a mixed performance, with the pan-European STOXX Europe 600 Index ending slightly higher amid hopes of increased government spending, despite concerns over potential U.S. tariffs. Penny stocks, often associated with smaller or newer companies, continue to present intriguing opportunities for investors looking for growth at lower price points. By focusing on those with strong financials and clear growth trajectories, these stocks can offer both stability and potential upside in today's complex market landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.08 | SEK1.99B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.25 | SEK218.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.83 | SEK287.19M | ✅ 3 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.94 | SEK239.71M | ✅ 2 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.62 | €55.17M | ✅ 4 ⚠️ 2 View Analysis > |

| I.M.D. International Medical Devices (BIT:IMD) | €1.47 | €25.46M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €1.00 | €33.49M | ✅ 4 ⚠️ 3 View Analysis > |

| High (ENXTPA:HCO) | €3.12 | €61.28M | ✅ 2 ⚠️ 3 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €5.00 | €18.68M | ✅ 2 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.19 | €302.36M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 436 stocks from our European Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Cairo Communication (BIT:CAI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cairo Communication S.p.A. operates as a communication company primarily in Italy and Spain, with a market cap of €391.82 million.

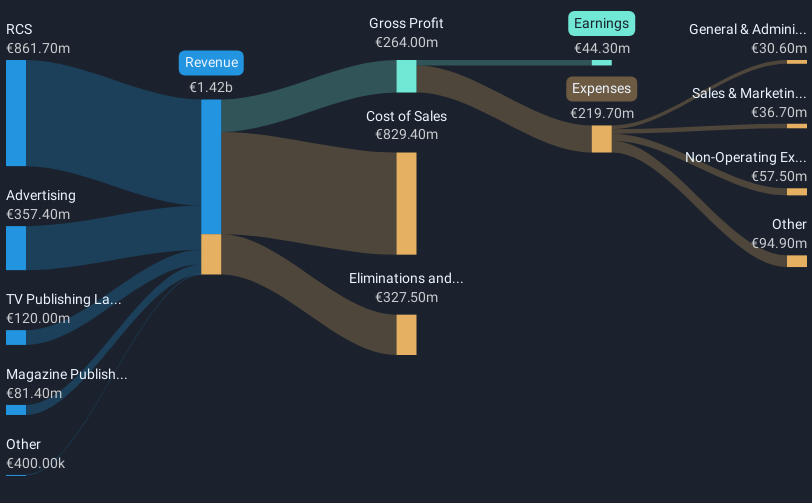

Operations: Cairo Communication's revenue is primarily derived from RCS (€861.7 million), Advertising (€357.4 million), Magazine Publishing Cairo Editore (€81.4 million), and TV Publishing La7 and Network Operator (€120 million).

Market Cap: €391.82M

Cairo Communication S.p.A. presents a mixed investment profile. The company has demonstrated strong earnings growth of 28% over the past year, outpacing the media industry average. It trades at a significant discount to its estimated fair value and maintains high-quality earnings with improved profit margins. However, its return on equity is low at 7.7%, and short-term assets do not cover short-term or long-term liabilities adequately. Despite having more cash than debt and well-covered interest payments, its dividend track record remains unstable, which may concern potential investors looking for consistent income streams from dividends.

- Click to explore a detailed breakdown of our findings in Cairo Communication's financial health report.

- Assess Cairo Communication's future earnings estimates with our detailed growth reports.

Petrolia (OB:PSE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Petrolia SE, with a market cap of NOK249.12 million, operates by selling and renting energy service equipment to the energy industry across Norway, the rest of Europe, Asia, and Australia.

Operations: The company generates revenue of $53.47 million from its energy service segment, which involves the sale and rental of equipment to the energy industry.

Market Cap: NOK249.12M

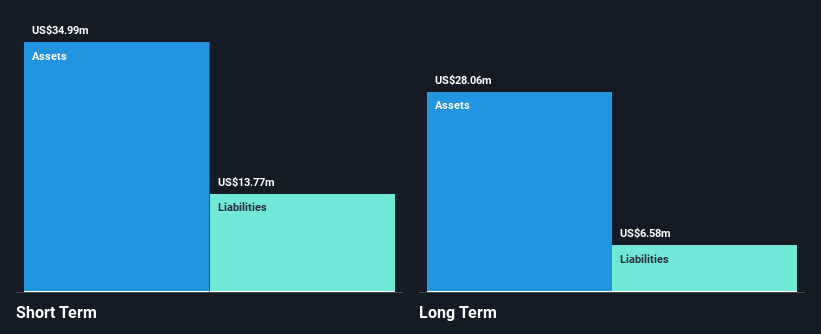

Petrolia SE showcases a robust financial position with short-term assets of $35 million exceeding both its short and long-term liabilities, while also having more cash than total debt. The company reported earnings growth of 87.6% over the past year, significantly outpacing the energy services industry average. Its net profit margin improved to 7%, and it achieved high-quality earnings without shareholder dilution. Petrolia trades at a substantial discount to its estimated fair value, yet its return on equity remains low at 7.2%. Despite these strengths, potential investors should consider the volatility in weekly returns when evaluating this stock.

- Click here to discover the nuances of Petrolia with our detailed analytical financial health report.

- Examine Petrolia's past performance report to understand how it has performed in prior years.

Atende (WSE:ATD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Atende S.A. specializes in integrating IT systems and developing ICT infrastructures in Poland, with a market cap of PLN 90.86 million.

Operations: The company generates revenue primarily through the integration of its ICT systems, amounting to PLN 279.87 million, and the integration of tele-information systems by its subsidiary entities, contributing PLN 51.11 million.

Market Cap: PLN90.86M

Atende S.A. presents a mixed financial picture with its IT system integration business generating PLN 279.87 million in revenue, complemented by PLN 51.11 million from tele-information systems via subsidiaries. Despite a seasoned management team averaging 7.7 years of tenure, the company faces challenges with declining earnings over the past five years and net profit margins dropping to 0.9% from last year's 4.2%. While its debt is well-covered by operating cash flow, and short-term assets exceed liabilities, Atende's return on equity remains low at -0.8%, and its dividend is not well-supported by earnings or free cash flows.

- Unlock comprehensive insights into our analysis of Atende stock in this financial health report.

- Learn about Atende's historical performance here.

Next Steps

- Embark on your investment journey to our 436 European Penny Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Cairo Communication, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:CAI

Cairo Communication

Operates as a communication company primarily in Italy and Spain.

Undervalued with solid track record.

Market Insights

Community Narratives