It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Equinor (OB:EQNR). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Equinor with the means to add long-term value to shareholders.

See our latest analysis for Equinor

Equinor's Improving Profits

Equinor has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Equinor's EPS skyrocketed from US$5.04 to US$8.12, in just one year; a result that's bound to bring a smile to shareholders. That's a fantastic gain of 61%.

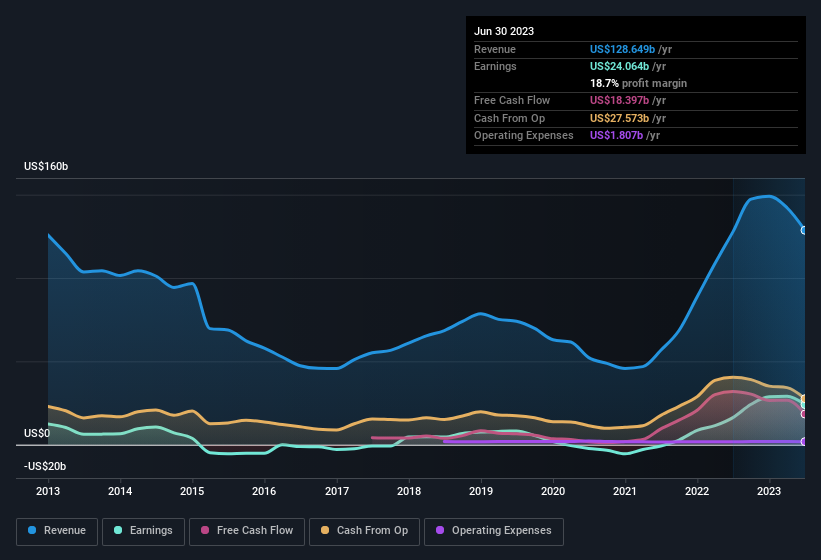

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It was a year of stability for Equinor as both revenue and EBIT margins remained have been flat over the past year. While this doesn't ring alarm bells, it may not meet the expectations of growth-minded investors.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Equinor?

Are Equinor Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Despite some Equinor insiders disposing of some shares, we note that there was US$969k more in buying interest among those who know the company best Shareholders who may have questioned insiders selling will find some reassurance in this fact. We also note that it was the Executive VP & CFO, Torgrim Reitan, who made the biggest single acquisition, paying kr1.0m for shares at about kr374 each.

On top of the insider buying, it's good to see that Equinor insiders have a valuable investment in the business. To be specific, they have US$160m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. While their ownership only accounts for 0.02%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Should You Add Equinor To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Equinor's strong EPS growth. Furthermore, company insiders have been adding to their significant stake in the company. These things considered, this is one stock worth watching. Even so, be aware that Equinor is showing 2 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

The good news is that Equinor is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Equinor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:EQNR

Equinor

An energy company, engages in the exploration, production, transportation, refining, and marketing of petroleum and other forms of energy in Norway and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives