Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Eidesvik Offshore ASA (OB:EIOF) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Eidesvik Offshore

What Is Eidesvik Offshore's Debt?

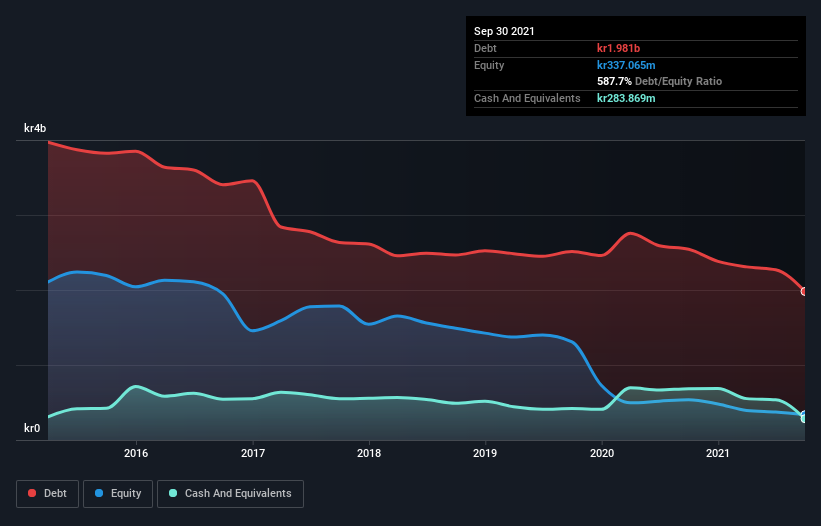

As you can see below, Eidesvik Offshore had kr1.98b of debt at September 2021, down from kr2.54b a year prior. However, because it has a cash reserve of kr283.9m, its net debt is less, at about kr1.70b.

How Healthy Is Eidesvik Offshore's Balance Sheet?

The latest balance sheet data shows that Eidesvik Offshore had liabilities of kr227.5m due within a year, and liabilities of kr1.95b falling due after that. On the other hand, it had cash of kr283.9m and kr216.5m worth of receivables due within a year. So its liabilities total kr1.67b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the kr331.9m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Eidesvik Offshore would likely require a major re-capitalisation if it had to pay its creditors today. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Eidesvik Offshore will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Eidesvik Offshore had a loss before interest and tax, and actually shrunk its revenue by 3.6%, to kr532m. We would much prefer see growth.

Caveat Emptor

Importantly, Eidesvik Offshore had an earnings before interest and tax (EBIT) loss over the last year. Its EBIT loss was a whopping kr69m. Combining this information with the significant liabilities we already touched on makes us very hesitant about this stock, to say the least. Of course, it may be able to improve its situation with a bit of luck and good execution. Nevertheless, we would not bet on it given that it lost kr190m in just last twelve months, and it doesn't have much by way of liquid assets. So we think this stock is quite risky. We'd prefer to pass. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 3 warning signs for Eidesvik Offshore (1 can't be ignored!) that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Eidesvik Offshore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:EIOF

Eidesvik Offshore

Provides services to the offshore supply, subsea, and offshore wind market in Norway.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives