- Norway

- /

- Energy Services

- /

- OB:EIOF

Here's Why Eidesvik Offshore (OB:EIOF) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Eidesvik Offshore (OB:EIOF). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Eidesvik Offshore with the means to add long-term value to shareholders.

See our latest analysis for Eidesvik Offshore

Eidesvik Offshore's Improving Profits

Eidesvik Offshore has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. Eidesvik Offshore's EPS shot up from kr5.38 to kr7.51; a result that's bound to keep shareholders happy. That's a fantastic gain of 40%.

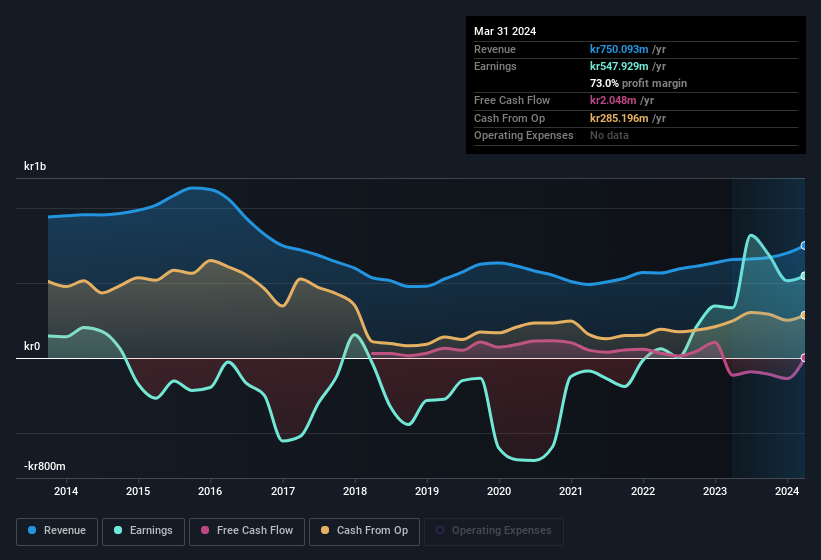

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Eidesvik Offshore shareholders can take confidence from the fact that EBIT margins are up from 13% to 17%, and revenue is growing. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Eidesvik Offshore isn't a huge company, given its market capitalisation of kr1.2b. That makes it extra important to check on its balance sheet strength.

Are Eidesvik Offshore Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news for Eidesvik Offshore shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that Gitte Talmo, the President & CEO of the company, paid kr100k for shares at around kr13.87 each. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

Does Eidesvik Offshore Deserve A Spot On Your Watchlist?

You can't deny that Eidesvik Offshore has grown its earnings per share at a very impressive rate. That's attractive. Growth in EPS isn't the only striking feature with company insiders adding to their holdings being another noteworthy vote of confidence for the company. In essence, your time will not be wasted checking out Eidesvik Offshore in more detail. You still need to take note of risks, for example - Eidesvik Offshore has 1 warning sign we think you should be aware of.

Keen growth investors love to see insider activity. Thankfully, Eidesvik Offshore isn't the only one. You can see a a curated list of Norwegian companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Eidesvik Offshore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:EIOF

Eidesvik Offshore

Provides services to the offshore supply, subsea, and offshore wind market in Norway.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives