- Norway

- /

- Energy Services

- /

- OB:DOFG

The Bull Case For DOF Group (OB:DOFG) Could Change Following Over $60M in New North America Contracts

Reviewed by Sasha Jovanovic

- DOF Group ASA announced several new project awards in North America, securing more than 300 days of vessel utilisation for a combined contract value exceeding US$60 million, with vessel work awarded in Guyana, Mexico, and off the East Coast of the USA.

- These multi-location contracts increase short-term revenue visibility by deploying existing assets and offering additional contract options for further vessel utilisation in the region.

- We'll explore how this significant boost in vessel utilisation may influence DOF Group's earnings outlook and risk profile.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

DOF Group Investment Narrative Recap

To own DOF Group stock, you need conviction in the company's ability to increase vessel utilisation and diversify beyond its traditional core regions, especially Brazil. The recent US$60 million contract wins in North America enhance near-term revenue visibility and partly address the key risk of regional client concentration, but do not fully resolve longer-term concerns around high capex and upcoming debt maturities.

Of all recent announcements, the sizeable Petrobras service contracts awarded in late September for over US$390 million are the most relevant in highlighting DOF Group's continued execution in core markets while it grows offshore revenue in new geographies. This blend of solid backlog in Brazil and contract gains abroad underpins investor focus on utilisation and margin expansion as the most important near-term catalyst.

By contrast, what remains crucial for investors to monitor is the company's sizable refinancing needs and how new contracts impact leverage and cash flow coverage...

Read the full narrative on DOF Group (it's free!)

DOF Group's narrative projects $2.1 billion revenue and $462.6 million earnings by 2028. This requires 8.9% yearly revenue growth and a $85.6 million earnings increase from $377.0 million today.

Uncover how DOF Group's forecasts yield a NOK125.00 fair value, a 29% upside to its current price.

Exploring Other Perspectives

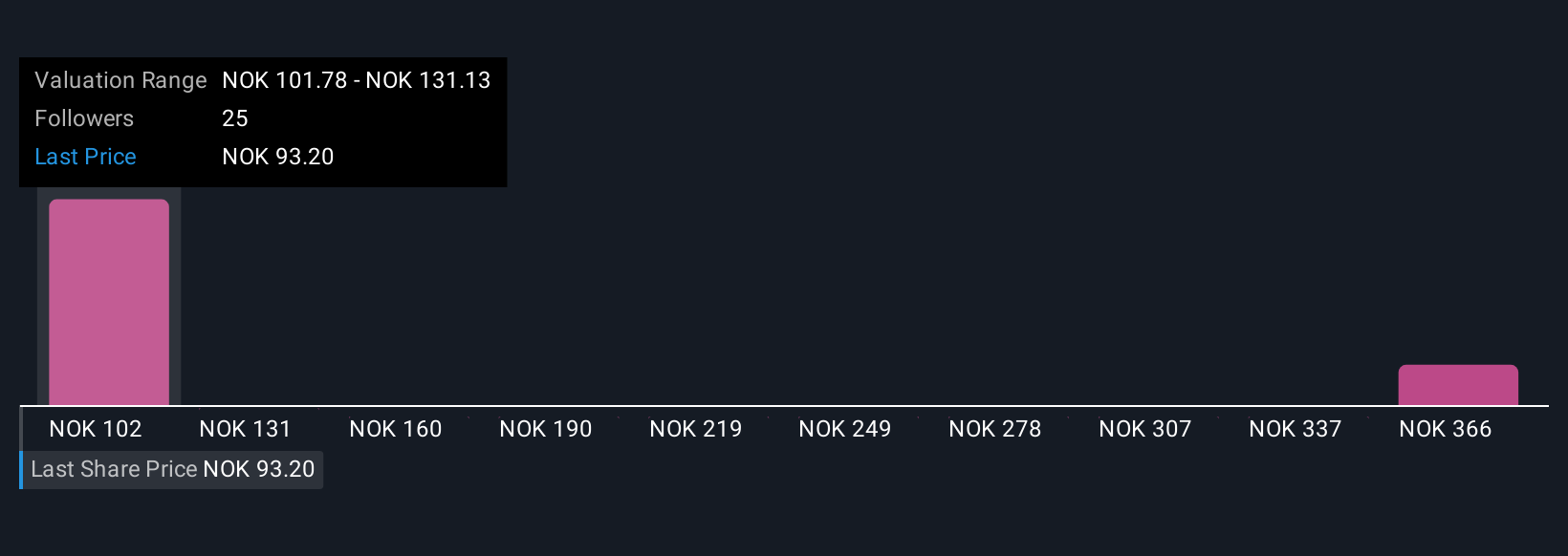

Five members from the Simply Wall St Community place DOF Group's fair value between NOK101.78 and NOK399.84 per share. As you consider these varied estimates, balancing robust vessel utilisation growth with persistent debt risks can play a critical role in shaping future returns; explore more viewpoints to inform your decision.

Explore 5 other fair value estimates on DOF Group - why the stock might be worth just NOK101.78!

Build Your Own DOF Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DOF Group research is our analysis highlighting 5 key rewards and 4 important warning signs that could impact your investment decision.

- Our free DOF Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DOF Group's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:DOFG

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives