- Norway

- /

- Oil and Gas

- /

- OB:DNO

Why DNO (OB:DNO) Is Up After North Sea Output Surges and Bridge Loan Is Repaid

Reviewed by Sasha Jovanovic

- DNO ASA announced its third quarter 2025 operating results, highlighting a sharp increase in North Sea production and a decline in Kurdistan output, as well as the repayment of a US$300 million bridge loan related to the Sval Energi acquisition.

- An interesting shift is the surge in North Sea net entitlement production and sales, which now significantly outpace Kurdistan figures, reflecting the impact of recent acquisitions and changes in operational focus.

- We'll examine how the substantial increase in North Sea production reshapes DNO's investment narrative and future cash flow outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

DNO Investment Narrative Recap

To be a DNO shareholder, you need to believe the company’s pivot to significantly greater North Sea production and reserves can offset ongoing challenges in its Kurdistan assets. The latest results reinforce this narrative, as North Sea output now far surpasses Kurdistan, helping to reduce exposure to geopolitical volatility. However, the main short-term catalyst, unlocking value from recent acquisitions, remains tempered by the immediate risk of further disruption or non-payment in Kurdistan, though the impact of this quarter’s changes appears non-material for now.

The repayment of DNO’s US$300 million bridge loan, originally taken to acquire Sval Energi, is particularly relevant as it strengthens the company’s balance sheet and clarifies its ability to manage new debt from major acquisitions. This action further supports investor optimism around the North Sea production ramp-up and underpins expectations for more predictable cash flows ahead, even as operational risks in other regions persist.

Yet, it’s important for investors to recognize that, despite operational improvements elsewhere, the security and receivables risk tied to DNO’s Kurdistan operations remains a concern for those watching...

Read the full narrative on DNO (it's free!)

DNO's narrative projects $2.7 billion revenue and $453.5 million earnings by 2028. This requires 50.4% yearly revenue growth and a $544.3 million increase in earnings from the current $-90.8 million.

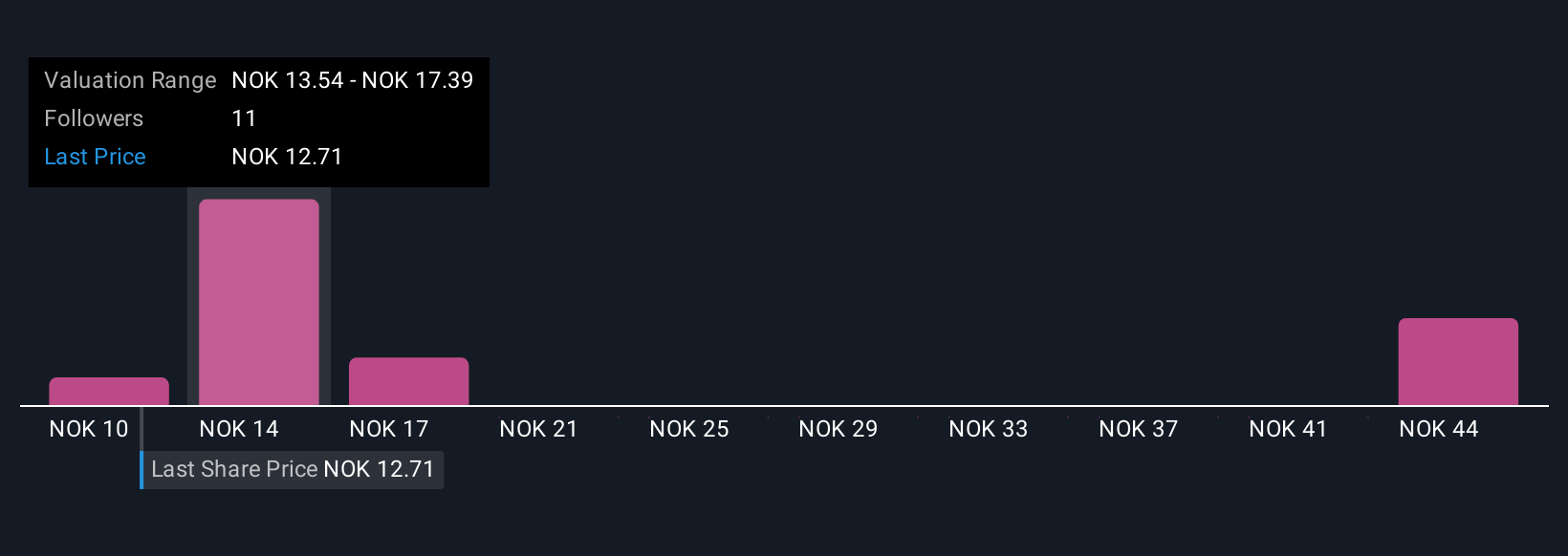

Uncover how DNO's forecasts yield a NOK17.00 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Six retail investors in the Simply Wall St Community value DNO between NOK9.68 and NOK49.44 per share. As North Sea expansion alters the company’s earnings potential, consider how diverse views on geopolitical risks can shape your outlook.

Explore 6 other fair value estimates on DNO - why the stock might be worth 30% less than the current price!

Build Your Own DNO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DNO research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free DNO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DNO's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:DNO

DNO

Engages in the exploration, development, and production of oil and gas assets in the Middle East, the North Sea, and West Africa.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives