- Norway

- /

- Oil and Gas

- /

- OB:DNO

3 Growth Companies With Insider Ownership Up To 16%

Reviewed by Simply Wall St

In a week marked by geopolitical tensions and consumer spending concerns, global markets experienced volatility, with major indexes like the S&P 500 seeing sharp declines after initial gains. As investors navigate these uncertain times, identifying growth companies with high insider ownership can be an appealing strategy, as such ownership often signals confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.1% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| On Holding (NYSE:ONON) | 19.1% | 30.2% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

Here's a peek at a few of the choices from the screener.

DNO (OB:DNO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DNO ASA is involved in the exploration, development, and production of oil and gas assets across the Middle East, North Sea, and West Africa with a market cap of NOK12.22 billion.

Operations: The company generates revenue of $666.80 million from its oil and gas activities across its operational regions.

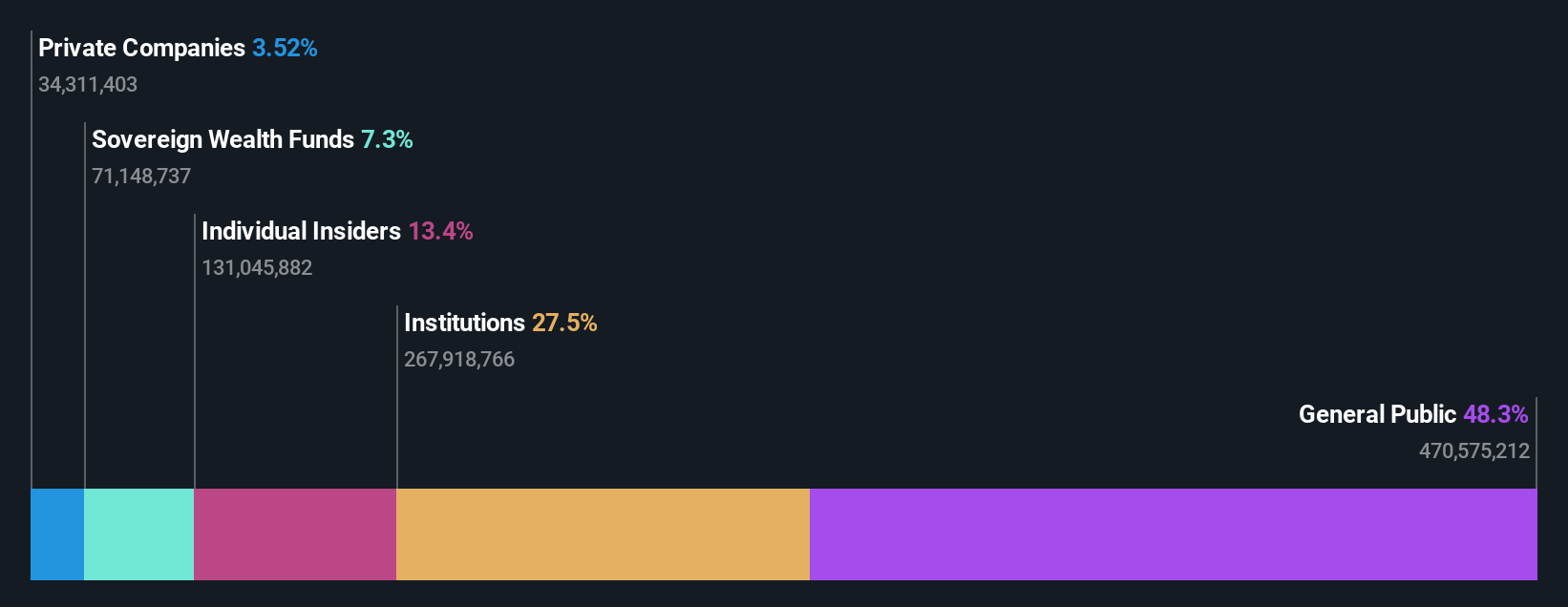

Insider Ownership: 13.1%

DNO's growth potential is highlighted by its forecasted earnings increase of 70.06% annually, outpacing the Norwegian market's revenue growth rate. Despite a low projected return on equity of 16.3%, DNO trades at a significant discount to its estimated fair value, suggesting potential upside. Recent operational developments include the Trym field resumption and new oil discoveries in Norway, which could enhance future production capacity and profitability despite current dividend sustainability concerns due to insufficient earnings coverage.

- Navigate through the intricacies of DNO with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility DNO's shares may be trading at a discount.

Baowu Magnesium Technology (SZSE:002182)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Baowu Magnesium Technology Co., Ltd. is involved in mining and non-ferrous metal smelting and processing both in China and internationally, with a market cap of CN¥12.76 billion.

Operations: The company's revenue primarily comes from its Non-Ferrous Metal Smelting and Rolling Processing segment, which generated CN¥8.15 billion.

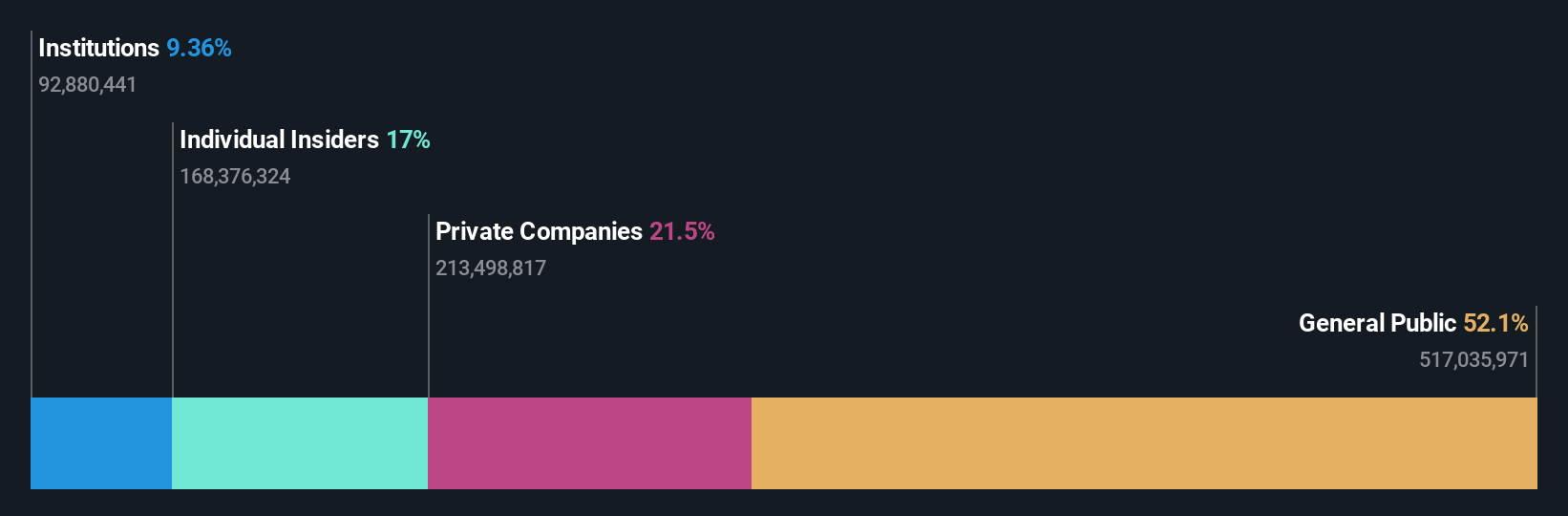

Insider Ownership: 17%

Baowu Magnesium Technology is poised for substantial growth, with earnings forecasted to increase by 61.21% annually, surpassing the Chinese market's average. Revenue is also expected to grow at a robust 25% per year. Despite these positive projections, the company's dividend yield of 0.72% isn't well-supported by free cash flows and its return on equity is anticipated to remain low at 14.2%. Recent developments include an upcoming shareholder meeting addressing financial service agreements and related risks.

- Unlock comprehensive insights into our analysis of Baowu Magnesium Technology stock in this growth report.

- Upon reviewing our latest valuation report, Baowu Magnesium Technology's share price might be too optimistic.

PharmaResources (Shanghai) (SZSE:301230)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PharmaResources (Shanghai) Co., Ltd. operates as a CRO, CDMO, and CMO service provider for drug discovery in China with a market cap of CN¥5.54 billion.

Operations: PharmaResources (Shanghai) Co., Ltd. generates revenue through its roles as a contract research organization (CRO), contract development and manufacturing organization (CDMO), and contract manufacturing organization (CMO) in the field of drug discovery within China.

Insider Ownership: 13.9%

PharmaResources (Shanghai) is projected to experience significant growth, with earnings expected to rise 50.8% annually, outpacing the Chinese market average. Revenue is forecasted to grow at a strong rate of 20.9% per year. However, the company's profit margins have decreased from last year and its return on equity remains low at 7%. Recent buyback activities saw the completion of a share repurchase plan totaling CNY 53.08 million for 1.47% of shares.

- Click here and access our complete growth analysis report to understand the dynamics of PharmaResources (Shanghai).

- Insights from our recent valuation report point to the potential overvaluation of PharmaResources (Shanghai) shares in the market.

Taking Advantage

- Explore the 1454 names from our Fast Growing Companies With High Insider Ownership screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:DNO

DNO

Engages in the exploration, development, and production of oil and gas assets in the Middle East, the North Sea, and West Africa.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives