- Norway

- /

- Oil and Gas

- /

- OB:BWE

Should BW Energy’s Kudu Basin Drilling Push Prompt Fresh Evaluation by OB:BWE Investors?

Reviewed by Sasha Jovanovic

- Earlier this month, BW Energy announced progress on its plan to triple oil production within three years, centered on drilling the Kharas-1 well in Namibia’s Kudu Basin to explore deeper oil targets beneath established gas fields.

- This activity not only signals a potential new oil discovery but also highlights BW Energy's drive to expand its footprint across Africa and South America through both exploration and acquisition initiatives.

- We'll explore how the ambitious Kudu Basin drilling campaign and focus on deeper oil horizons may influence BW Energy’s investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

BW Energy Investment Narrative Recap

To be a BW Energy shareholder, you need to believe in the company's ability to sustain and expand production through continuous exploration, reserve replacement, and successful project execution. The recent update on the Kharas-1 well in Namibia is now a critical short-term catalyst, as drilling outcomes could accelerate reserve additions, but it does not remove the major risk of operational delays or capital overruns, especially for large-scale ventures like Maromba, that could strain financials and profitability.

Among recent developments, BW Energy’s completion of a US$365 million project finance facility for the Maromba FPSO refurbishment is highly relevant. Securing this funding addresses a key execution risk for one of its major growth projects and bolsters its ability to unlock future production, complementing the exploration momentum in Namibia.

By contrast, investors should also be aware of the potential for unplanned project delays or financing hurdles that could impact...

Read the full narrative on BW Energy (it's free!)

BW Energy's narrative projects $880.7 million revenue and $403.4 million earnings by 2028. This requires a 0.9% yearly revenue decline and a $189.7 million earnings increase from $213.7 million.

Uncover how BW Energy's forecasts yield a NOK48.84 fair value, in line with its current price.

Exploring Other Perspectives

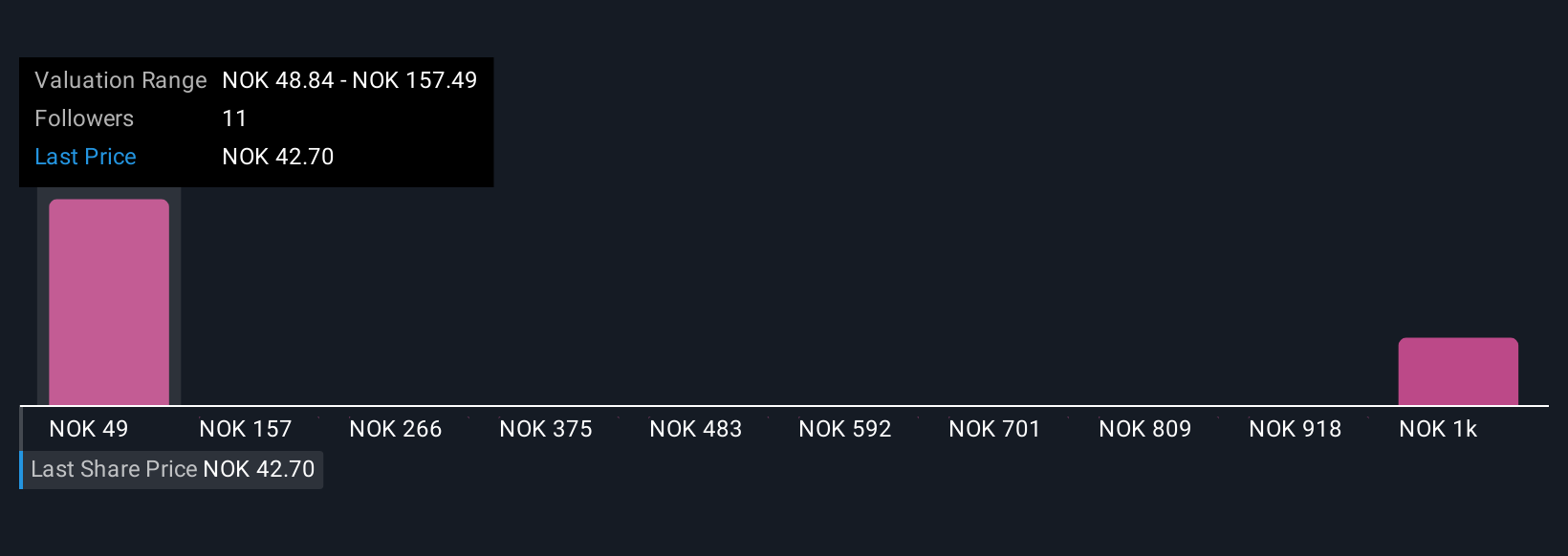

BW Energy’s fair value estimates from four Simply Wall St Community members range widely from NOK48.84 to NOK1,135.46. While some see deep upside, persistent risk around major capital projects like Maromba remains a central concern for long-term performance, explore the range of perspectives to see how views differ on this key issue.

Explore 4 other fair value estimates on BW Energy - why the stock might be a potential multi-bagger!

Build Your Own BW Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BW Energy research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BW Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BW Energy's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BW Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:BWE

BW Energy

Engages in the exploration and production of oil and gas properties.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives