- Norway

- /

- Oil and Gas

- /

- OB:BWE

A Look at BW Energy (OB:BWE)’s Valuation Following Bold Production Expansion in the Kudu Basin

Reviewed by Kshitija Bhandaru

BW Energy (OB:BWE) is taking bold steps to expand its oil output, recently accelerating efforts to triple production through a focused drilling campaign in Namibia’s Kudu Basin and active expansion across Africa and South America.

See our latest analysis for BW Energy.

BW Energy’s ambition to triple production has clearly gotten the market’s attention, with the 1-month share price return surging 45.07% and year-to-date gains now topping 100%. This comes on the back of recent drilling progress and ongoing expansion, reinforcing a long-term narrative of building momentum and strong investor confidence. This is reflected in a 1-year total shareholder return of 101.43%.

If you’re looking to keep the momentum going, now’s an ideal moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

But with share prices already up over 100% this year and trading near analyst targets, investors are left wondering if the current rally is just the start or if BW Energy’s future growth is already priced in.

Most Popular Narrative: 0.8% Overvalued

BW Energy’s last close price of NOK49.25 is almost identical to the narrative fair value of NOK48.84, indicating market consensus is tightly aligned with these future projections. This makes understanding the drivers of this valuation even more important as investors weigh up potential upside.

Disciplined, low-cost project expansion and phased development support strong revenue growth, margin expansion, and asset longevity amid rising energy demand in emerging markets. Robust financial position and operational synergies enable resilience, self-funded growth, and potential for broader capital access. These factors underpin long-term earnings stability and value creation.

Curious which three powerful trends and bold financial projections are baked into this sky-high price target? Some assumptions here may surprise even market veterans. Find out how future profits, leaner operations, and capital discipline shape the company’s valuation story. Dive into the full narrative to see what’s driving the hype.

Result: Fair Value of NOK48.84 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks such as delays in key project approvals or sustained declines from mature fields could challenge BW Energy’s ambitious growth narrative.

Find out about the key risks to this BW Energy narrative.

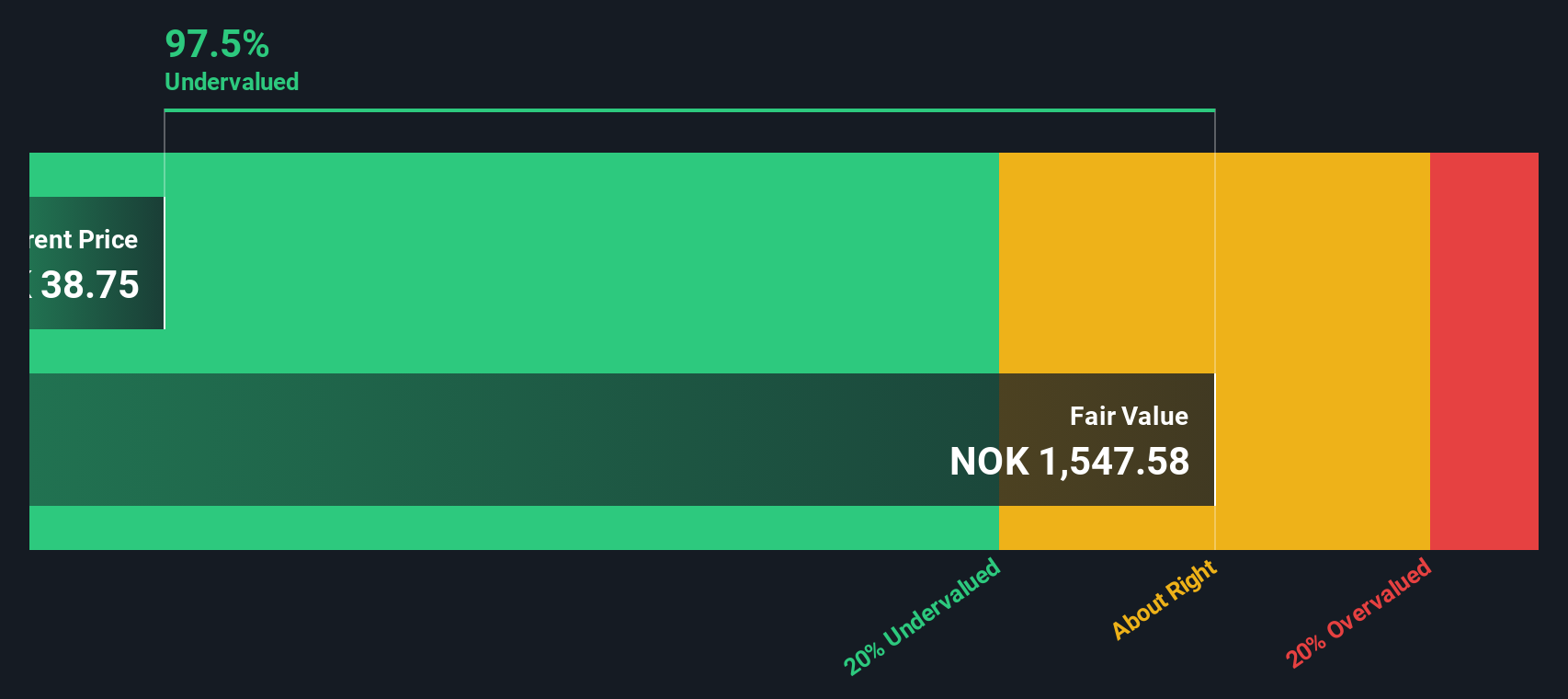

Another View: Discounted Cash Flow Suggests Deeper Value

Our DCF model provides a very different picture, suggesting BW Energy is drastically undervalued at current prices. The implied fair value sits far above the market. This raises questions about whether the stock’s potential is being overlooked or if risks are yet to be fully priced in.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own BW Energy Narrative

Prefer a hands-on approach? If you have a different perspective or want to dive deeper into the numbers, you can create your own view in just a few minutes, and Do it your way.

A great starting point for your BW Energy research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

You don’t want to miss the potential in other sectors. Expand your watchlist with three unique investment angles you can act on right now:

- Grow your income with companies offering attractive yields, and get ahead of the curve by checking out these 18 dividend stocks with yields > 3%.

- Tap into the future by targeting breakthrough opportunities among these 25 AI penny stocks set to benefit from the artificial intelligence boom.

- Cement your portfolio’s edge by seizing value in these 890 undervalued stocks based on cash flows, where strong fundamentals meet discounted prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BW Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:BWE

BW Energy

Engages in the exploration and production of oil and gas properties.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives