- Norway

- /

- Oil and Gas

- /

- OB:AKRBP

Strong Q3 Production Results Could Be a Game Changer for Aker BP (OB:AKRBP)

Reviewed by Sasha Jovanovic

- Aker BP ASA recently announced its third quarter 2025 operating results, reporting production of 414,000 barrels of oil equivalents per day and net sales volume of 396,100 barrels per day.

- This production update provides crucial insight into the company’s operational performance, a key metric for oil and gas sector investors assessing ongoing output strength.

- We’ll explore how these robust production figures may shape Aker BP’s investment narrative moving forward.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Aker BP Investment Narrative Recap

To be a shareholder in Aker BP, you need to believe in its ability to maintain large-scale oil production and translate operational efficiency into steady cash flows, even as the industry evolves. The recent Q3 production update, showing continued output well within guidance, is positive but does not materially shift the primary short-term catalyst: delivering new low-emission projects on time. The biggest risk remains potential cost overruns or delays in key developments, which could disrupt financial performance.

The completion of the Omega Alfa exploration campaign in August is especially relevant here, as it underscores Aker BP’s effort to expand reserves near its existing Yggdrasil project, an important part of future growth plans and operational stability. This development supports the company’s drive to extend production capabilities but also highlights the ongoing execution risks inherent in ramping up new assets.

However, while robust production figures hint at operational strength, investors should also be aware that...

Read the full narrative on Aker BP (it's free!)

Aker BP's outlook expects revenue of $12.1 billion and earnings of $1.6 billion by 2028. This forecast implies annual revenue growth of 1.0% and an earnings increase of $872.7 million from current earnings of $727.3 million.

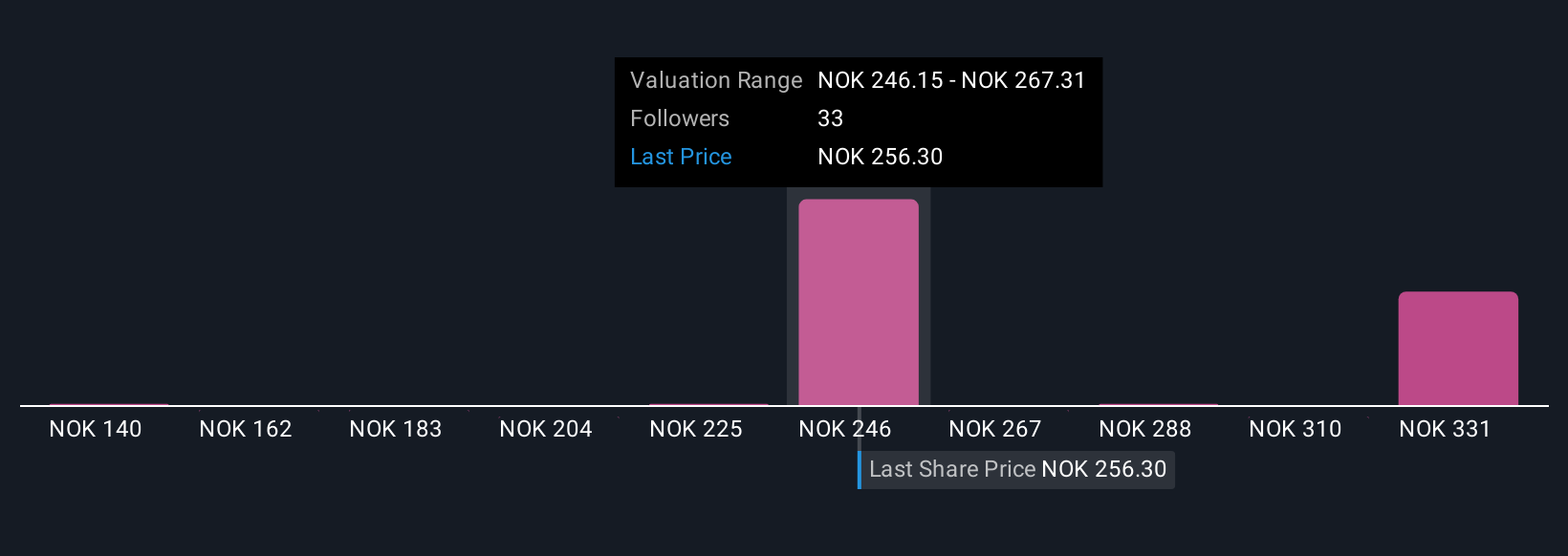

Uncover how Aker BP's forecasts yield a NOK256.82 fair value, in line with its current price.

Exploring Other Perspectives

Ten different Simply Wall St Community fair value estimates for Aker BP range from NOK140.37 to NOK358.26 per share. While production strength supports reserve and revenue projections, cost overruns in major projects remain a topic on many investors' minds; examine multiple viewpoints on what could influence Aker BP’s future results.

Explore 10 other fair value estimates on Aker BP - why the stock might be worth 45% less than the current price!

Build Your Own Aker BP Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aker BP research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Aker BP research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aker BP's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:AKRBP

Aker BP

Explores for, develops, and produces oil and gas on the Norwegian Continental Shelf.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives