- Norway

- /

- Consumer Finance

- /

- OB:B2I

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative Leads 3 Undiscovered European Gems with Promising Potential

Reviewed by Simply Wall St

As European markets continue to show resilience, with the STOXX Europe 600 Index closing 2.35% higher and major indices like Germany's DAX and France's CAC 40 also seeing gains, investors are increasingly turning their attention to lesser-known opportunities within the region. In this environment of steady inflation and cautious optimism, identifying stocks that exhibit strong fundamentals and growth potential can offer intriguing prospects for those looking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 5.37% | 4.80% | 13.56% | ★★★★★★ |

| Dekpol | 61.42% | 9.03% | 14.54% | ★★★★★★ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative (ENXTPA:CRBP2)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative offers a variety of banking and financial products and services to individuals, farmers, professionals, businesses, and public authorities in France, with a market cap of approximately €1.51 billion.

Operations: Crédit Agricole Brie Picardie generates revenue primarily from its retail banking segment, amounting to €662.31 million. The company's financial performance is reflected in its market capitalization of approximately €1.51 billion.

CRBP2, with total assets of €41.6 billion and equity of €5.7 billion, stands out for its robust financial health and low-risk funding structure, as 91% of its liabilities are customer deposits. The company reported a net income increase to €165.58 million for the first half of 2025 compared to €146.24 million the previous year, showcasing earnings growth that outpaces the industry average by 6.7%. Trading at 12.6% below estimated fair value adds appeal, while maintaining an appropriate bad loans ratio at 1.6% and sufficient allowance for bad loans at 106%, indicating sound risk management practices.

B2 Impact (OB:B2I)

Simply Wall St Value Rating: ★★★★☆☆

Overview: B2 Impact ASA, with a market cap of NOK 6.23 billion, operates through its subsidiaries to offer a range of debt solutions.

Operations: B2 Impact generates revenue primarily from its Investments segment, contributing NOK 3.22 billion, followed by the Servicing segment at NOK 1.34 billion.

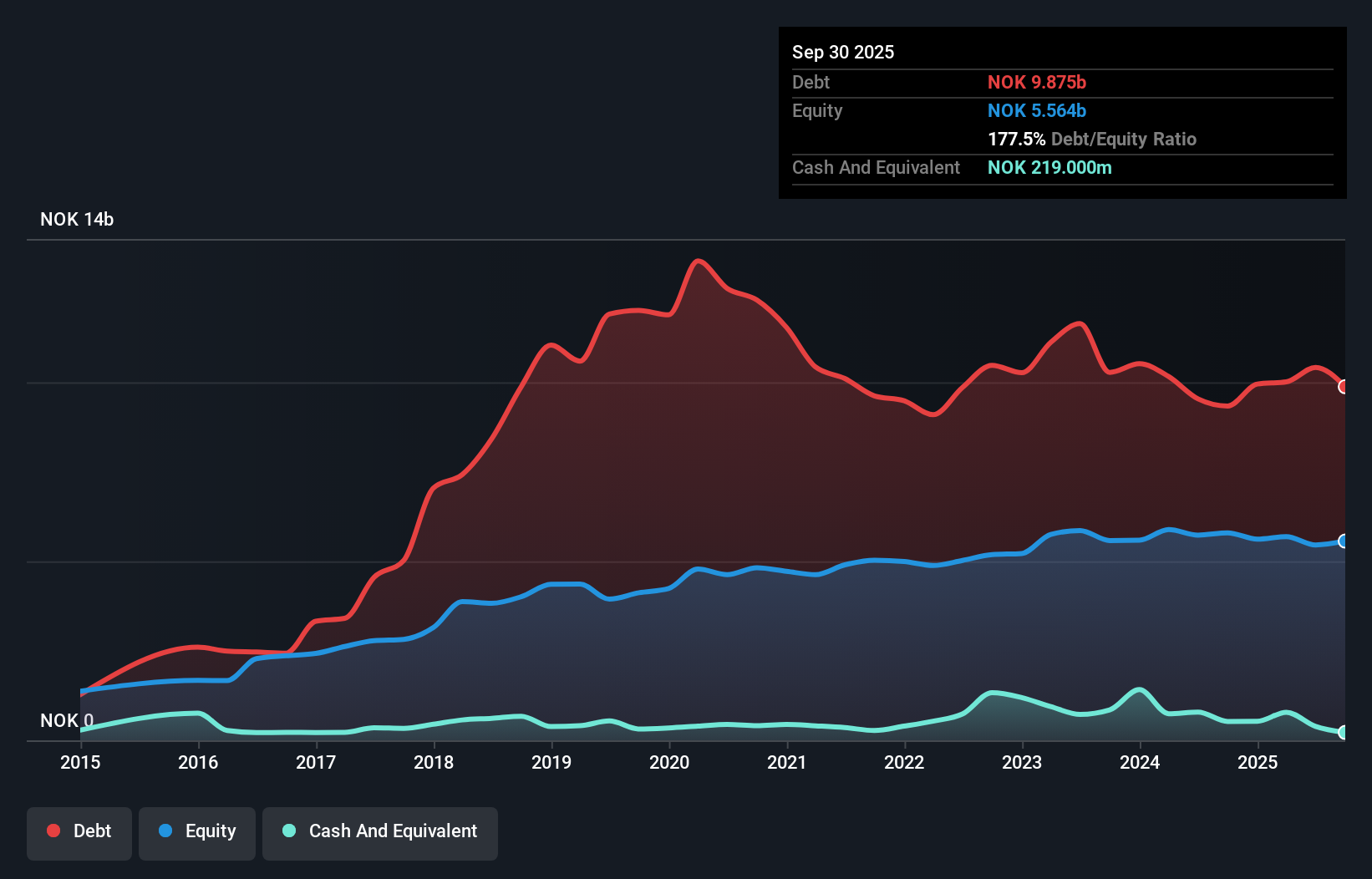

B2 Impact ASA, a notable player in the consumer finance sector, has been making waves with its impressive earnings growth of 51.7% over the past year, outpacing industry averages. Despite a high net debt to equity ratio of 173.5%, which is considered elevated, the company has managed to reduce this from 255.2% over five years, indicating improved financial health. Recent earnings reports show a substantial turnaround with Q3 revenue hitting NOK 977 million and net income at NOK 137 million compared to last year's loss. The price-to-earnings ratio stands attractively at 12.7x against Norway's market average of 13.7x, suggesting potential value for investors seeking opportunities in smaller companies with strong growth prospects and high-quality earnings performance.

- Take a closer look at B2 Impact's potential here in our health report.

Understand B2 Impact's track record by examining our Past report.

VP Bank (SWX:VPBN)

Simply Wall St Value Rating: ★★★★★☆

Overview: VP Bank AG, along with its subsidiaries, offers wealth management and investment advisory services to private and institutional investors across Liechtenstein, Europe, and globally, with a market capitalization of CHF509.39 million.

Operations: VP Bank AG's revenue streams primarily include operations in Liechtenstein & BVI, generating CHF178.39 million, followed by the International segment at CHF112.56 million and Asset Servicing at CHF54.72 million. The Corporate Center reported a negative contribution of CHF2.61 million.

VP Bank, with total assets of CHF11.4 billion and equity of CHF1.1 billion, demonstrates a robust financial foundation. Its deposits stand at CHF9.4 billion against loans of CHF5.9 billion, highlighting a conservative lending approach supported by primarily low-risk funding sources (91% from customer deposits). The bank's allowance for bad loans is 28%, ensuring coverage for its 1.5% non-performing loan ratio—both indicators of prudent risk management practices. Despite earnings declining by 12% annually over the past five years, VP Bank's price-to-earnings ratio at 14x remains attractive compared to the Swiss market average of 20x, suggesting potential value for investors seeking overlooked opportunities in Europe’s financial sector landscape.

Next Steps

- Take a closer look at our European Undiscovered Gems With Strong Fundamentals list of 313 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if B2 Impact might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:B2I

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026