- Norway

- /

- Hospitality

- /

- OB:HKY

Revenues Not Telling The Story For Havila Kystruten AS (OB:HKY) After Shares Rise 31%

Havila Kystruten AS (OB:HKY) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 84% share price drop in the last twelve months.

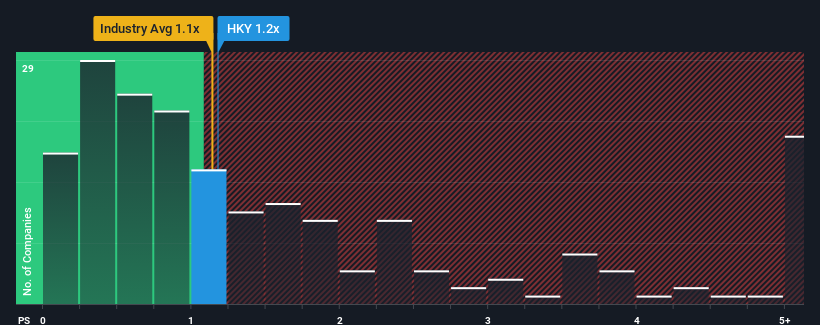

Although its price has surged higher, it's still not a stretch to say that Havila Kystruten's price-to-sales (or "P/S") ratio of 1.2x right now seems quite "middle-of-the-road" compared to the Hospitality industry in Norway, where the median P/S ratio is around 1.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Havila Kystruten

What Does Havila Kystruten's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Havila Kystruten has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Havila Kystruten.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Havila Kystruten would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 130% gain to the company's top line. Still, revenue has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 35% per annum during the coming three years according to the two analysts following the company. With the industry predicted to deliver 84% growth per annum, the company is positioned for a weaker revenue result.

In light of this, it's curious that Havila Kystruten's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Havila Kystruten's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

When you consider that Havila Kystruten's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

You need to take note of risks, for example - Havila Kystruten has 4 warning signs (and 1 which is significant) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Havila Kystruten might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:HKY

Undervalued with reasonable growth potential.

Market Insights

Community Narratives