- Norway

- /

- Commercial Services

- /

- OB:QFUEL

We Don’t Think Quantafuel's (OB:QFUEL) Earnings Should Make Shareholders Too Comfortable

Following the release of a positive earnings report recently, Quantafuel ASA's (OB:QFUEL) stock performed well. Investors should be cautious however, as there some causes of concern deeper in the numbers.

Check out our latest analysis for Quantafuel

A Closer Look At Quantafuel's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

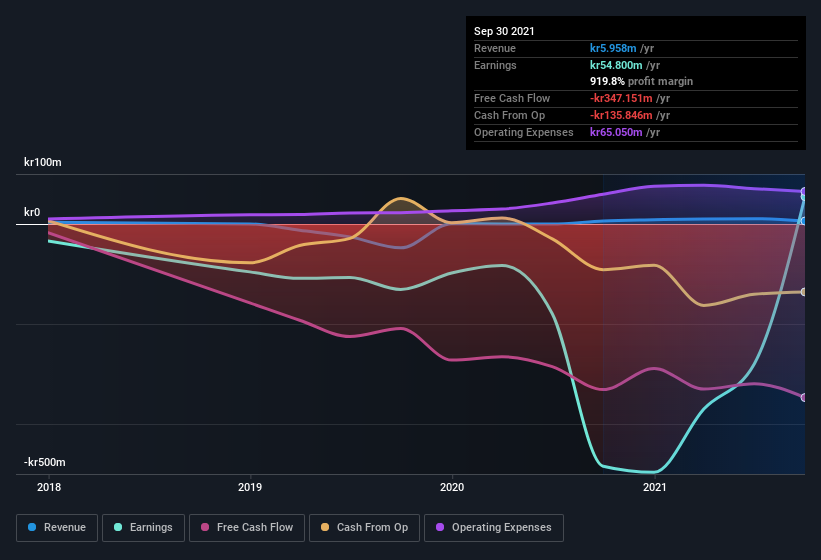

For the year to September 2021, Quantafuel had an accrual ratio of 0.66. Statistically speaking, that's a real negative for future earnings. And indeed, during the period the company didn't produce any free cash flow whatsoever. Even though it reported a profit of kr54.8m, a look at free cash flow indicates it actually burnt through kr347m in the last year. We also note that Quantafuel's free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of kr347m. Notably, the company has issued new shares, thus diluting existing shareholders and reducing their share of future earnings. One positive for Quantafuel shareholders is that it's accrual ratio was significantly better last year, providing reason to believe that it may return to stronger cash conversion in the future. Shareholders should look for improved cashflow relative to profit in the current year, if that is indeed the case.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, Quantafuel issued 10% more new shares over the last year. Therefore, each share now receives a smaller portion of profit. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of Quantafuel's EPS by clicking here.

How Is Dilution Impacting Quantafuel's Earnings Per Share? (EPS)

Quantafuel was losing money three years ago. Zooming in to the last year, we still can't talk about growth rates coherently, since it made a loss last year. What we do know is that while it's great to see a profit over the last twelve months, that profit would have been better, on a per share basis, if the company hadn't needed to issue shares. And so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, if Quantafuel's earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Our Take On Quantafuel's Profit Performance

As it turns out, Quantafuel couldn't match its profit with cashflow and its dilution means that shareholders own less of the company than the did before (unless they bought more shares). For the reasons mentioned above, we think that a perfunctory glance at Quantafuel's statutory profits might make it look better than it really is on an underlying level. If you'd like to know more about Quantafuel as a business, it's important to be aware of any risks it's facing. To help with this, we've discovered 3 warning signs (2 are concerning!) that you ought to be aware of before buying any shares in Quantafuel.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Quantafuel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OB:QFUEL

Quantafuel

Quantafuel ASA, a technology-based energy company engages in converting plastic waste to low-carbon synthetic oil products replacing virgin oil products in Norway.

High growth potential and overvalued.