There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

So, the natural question for Pryme B.V (OB:PRYME) shareholders is whether they should be concerned by its rate of cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

See our latest analysis for Pryme B.V

How Long Is Pryme B.V's Cash Runway?

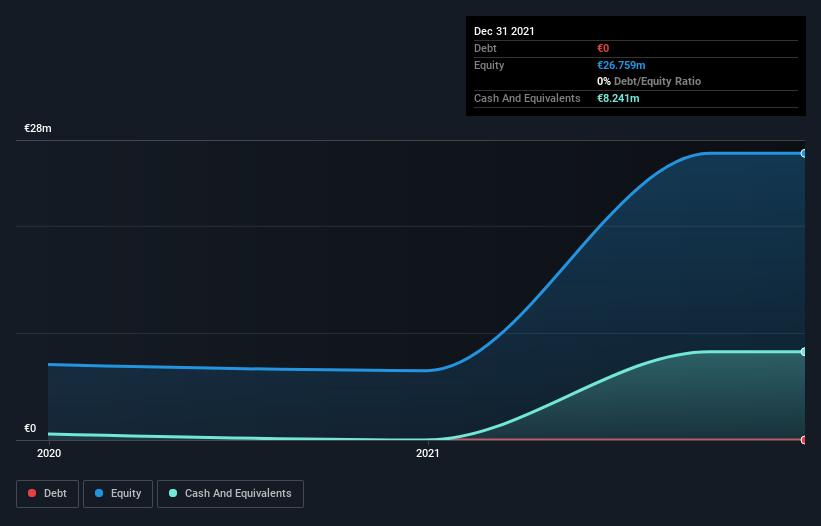

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. In December 2021, Pryme B.V had €8.2m in cash, and was debt-free. In the last year, its cash burn was €14m. That means it had a cash runway of around 7 months as of December 2021. Notably, analysts forecast that Pryme B.V will break even (at a free cash flow level) in about 3 years. That means unless the company reduces its cash burn quickly, it may well look to raise more cash. The image below shows how its cash balance has been changing over the last few years.

How Is Pryme B.V's Cash Burn Changing Over Time?

Pryme B.V didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. Remarkably, it actually increased its cash burn by 2,419% in the last year. Given that sharp increase in spending, the company's cash runway will shrink rapidly as it depletes its cash reserves. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Hard Would It Be For Pryme B.V To Raise More Cash For Growth?

Given its cash burn trajectory, Pryme B.V shareholders should already be thinking about how easy it might be for it to raise further cash in the future. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Pryme B.V's cash burn of €14m is about 73% of its €20m market capitalisation. Given how large that cash burn is, relative to the market value of the entire company, we'd consider it to be a high risk stock, with the real possibility of extreme dilution.

Is Pryme B.V's Cash Burn A Worry?

There are no prizes for guessing that we think Pryme B.V's cash burn is a bit of a worry. In particular, we think its increasing cash burn suggests it isn't in a good position to keep funding growth. While not as bad as its increasing cash burn, its cash runway is also a concern, and considering everything mentioned above, we're struggling to find much to be optimistic about. Shareholders can take heart from the fact that analysts are forecasting it will reach breakeven. Looking at the metrics in this article all together, we consider its cash burn situation to be rather dangerous, and likely to cost shareholders one way or the other. Taking a deeper dive, we've spotted 4 warning signs for Pryme B.V you should be aware of, and 1 of them is a bit unpleasant.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:PRYME

Pryme

A cleantech company, engages in converting mixed plastic waste streams into pyrolysis oil through chemical recycling technologies in the Netherlands.

Moderate with mediocre balance sheet.

Market Insights

Community Narratives