There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So should Norsk Titanium (OB:NTI) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). Let's start with an examination of the business' cash, relative to its cash burn.

Check out our latest analysis for Norsk Titanium

Does Norsk Titanium Have A Long Cash Runway?

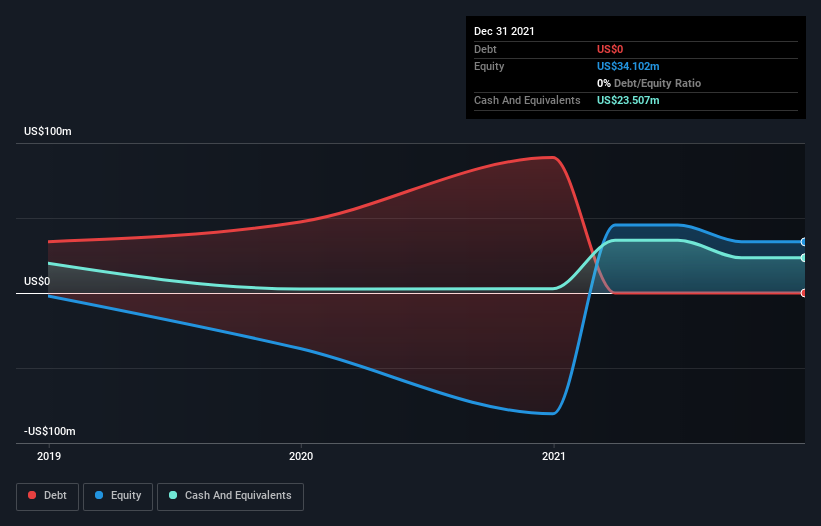

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When Norsk Titanium last reported its balance sheet in December 2021, it had zero debt and cash worth US$24m. Looking at the last year, the company burnt through US$21m. Therefore, from December 2021 it had roughly 13 months of cash runway. Notably, one analyst forecasts that Norsk Titanium will break even (at a free cash flow level) in about 4 years. That means unless the company reduces its cash burn quickly, it may well look to raise more cash. The image below shows how its cash balance has been changing over the last few years.

How Is Norsk Titanium's Cash Burn Changing Over Time?

In our view, Norsk Titanium doesn't yet produce significant amounts of operating revenue, since it reported just US$1.3m in the last twelve months. As a result, we think it's a bit early to focus on the revenue growth, so we'll limit ourselves to looking at how the cash burn is changing over time. While it hardly paints a picture of imminent growth, the fact that it has reduced its cash burn by 24% over the last year suggests some degree of prudence. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For Norsk Titanium To Raise More Cash For Growth?

Even though it has reduced its cash burn recently, shareholders should still consider how easy it would be for Norsk Titanium to raise more cash in the future. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Norsk Titanium's cash burn of US$21m is about 27% of its US$80m market capitalisation. That's fairly notable cash burn, so if the company had to sell shares to cover the cost of another year's operations, shareholders would suffer some costly dilution.

Is Norsk Titanium's Cash Burn A Worry?

Even though its cash burn relative to its market cap makes us a little nervous, we are compelled to mention that we thought Norsk Titanium's cash burn reduction was relatively promising. One real positive is that at least one analyst is forecasting that the company will reach breakeven. Even though we don't think it has a problem with its cash burn, the analysis we've done in this article does suggest that shareholders should give some careful thought to the potential cost of raising more money in the future. Taking an in-depth view of risks, we've identified 4 warning signs for Norsk Titanium that you should be aware of before investing.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

If you're looking to trade Norsk Titanium, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Norsk Titanium might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:NTI

Norsk Titanium

Engages in 3D printing of metal alloys for commercial aerospace, defense, and industrial sectors in Europe and the United States.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives