Even though Hexagon Composites (OB:HEX) has lost kr655m market cap in last 7 days, shareholders are still up 86% over 3 years

Low-cost index funds make it easy to achieve average market returns. But across the board there are plenty of stocks that underperform the market. That's what has happened with the Hexagon Composites ASA (OB:HEX) share price. It's up 69% over three years, but that is below the market return. Zooming in, the stock is up a respectable 9.4% in the last year.

Although Hexagon Composites has shed kr655m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

View our latest analysis for Hexagon Composites

Hexagon Composites isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

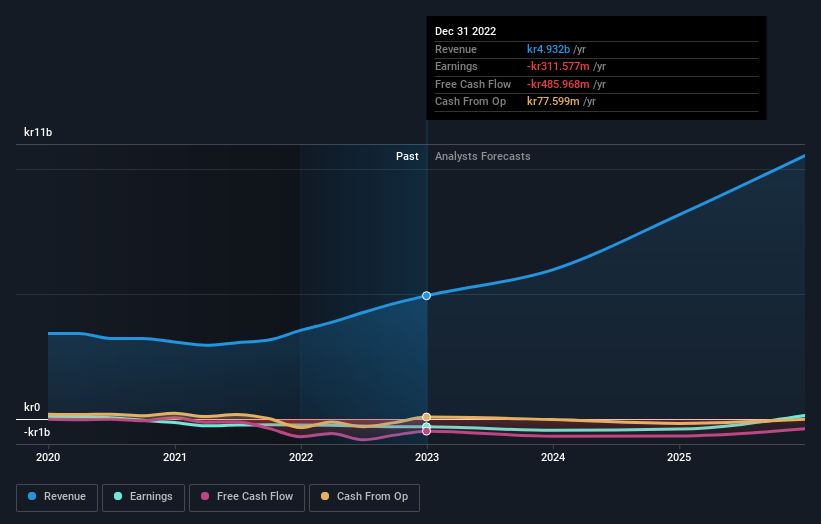

Over the last three years Hexagon Composites has grown its revenue at 14% annually. That's pretty nice growth. The annual gain of 19% over three years is better than nothing, but hardly impresses. So it's possible that expectations were elevated in the past, muting returns over three years. However, if you can reasonably expect profits in the next few years, this stock might belong on your watchlist.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Hexagon Composites stock, you should check out this FREE detailed report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We've already covered Hexagon Composites' share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Hexagon Composites' TSR of 86% over the last 3 years is better than the share price return.

A Different Perspective

It's good to see that Hexagon Composites has rewarded shareholders with a total shareholder return of 9.4% in the last twelve months. However, that falls short of the 11% TSR per annum it has made for shareholders, each year, over five years. Before spending more time on Hexagon Composites it might be wise to click here to see if insiders have been buying or selling shares.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.

If you're looking to trade Hexagon Composites, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hexagon Composites might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:HEX

Hexagon Composites

Engages in the manufacture and sale of composite pressure cylinders and fuel systems for alternative fuels in Europe, North America, South-East Asia, Africa, Oceania, and Norway.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives