- Norway

- /

- Construction

- /

- OB:CADLR

Cadeler (OB:CADLR) Is Up 8.2% After Early Wind Mover Delivery And New Green Loan Facility

Reviewed by Sasha Jovanovic

- Cadeler A/S recently enhanced its financial flexibility with a new EUR 60 million unsecured green corporate term loan facility and took delivery of Wind Mover, its tenth wind turbine installation vessel, ahead of schedule and within budget for immediate deployment in Europe.

- These developments, alongside sharply higher year-to-date earnings and reaffirmed 2025 revenue guidance, highlight Cadeler’s execution on complex offshore wind projects and its effort to support future growth with additional financial capacity.

- We’ll now explore how the ahead-of-schedule Wind Mover delivery could influence Cadeler’s investment narrative and long-term earnings profile.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Cadeler Investment Narrative Recap

Cadrler’s investment case centers on its ability to keep high utilization across a larger, more capable fleet while managing a heavy capex bill and a project pipeline that is still concentrated in Europe. The new EUR 60 million unsecured green loan and the ahead of schedule Wind Mover delivery modestly support near term flexibility, but do not fundamentally change the key short term catalyst of securing and executing multi year installation contracts or the main risk of potential utilization pressure in 2027–2028.

Against this backdrop, the early delivery and immediate deployment of Wind Mover stands out as the most relevant news, as it adds near term earning power to a fleet that has already doubled to ten vessels in twelve months. With 2025 revenue guidance reaffirmed at EUR 588 million to EUR 628 million and multiple next generation vessels now on the water, Cadeler’s ability to keep these assets working through future auction and policy recalibrations will be critical.

However, investors should also recognize that Cadeler’s heavy reliance on European projects leaves it exposed if auction timelines or policy support shift again...

Read the full narrative on Cadeler (it's free!)

Cadeler's narrative projects €1.0 billion revenue and €406.3 million earnings by 2028. This requires 30.6% yearly revenue growth and about a €173.7 million earnings increase from €232.6 million today.

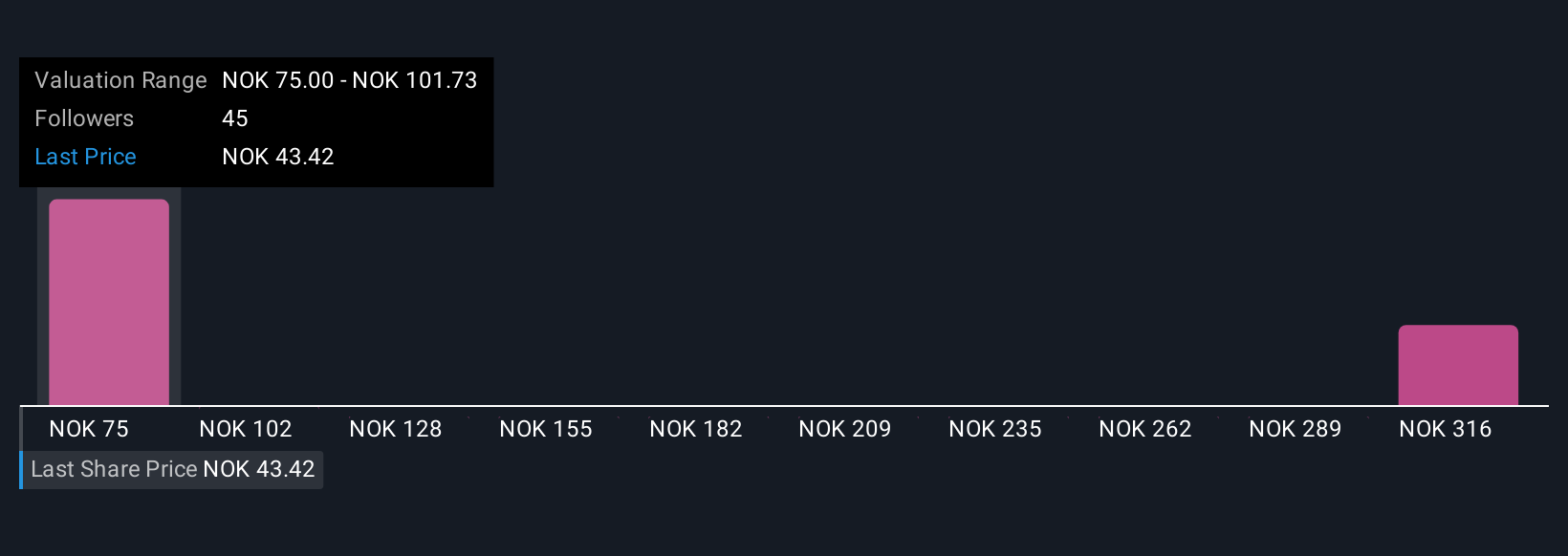

Uncover how Cadeler's forecasts yield a NOK75.16 fair value, a 65% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community currently see fair value for Cadeler anywhere between NOK66.74 and NOK195.79, underlining how far opinions can diverge. You should weigh those views against the risk that government auction resets and project delays in Europe could affect vessel utilization and earnings in the years ahead.

Explore 7 other fair value estimates on Cadeler - why the stock might be worth just NOK66.74!

Build Your Own Cadeler Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cadeler research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cadeler research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cadeler's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:CADLR

Cadeler

Engages in offshore wind farm installation, operations, and maintenance services in Denmark.

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026