Here's Why We Think Sparebanken Vest (OB:SVEG) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Sparebanken Vest (OB:SVEG), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Sparebanken Vest

Sparebanken Vest's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. Over the last three years, Sparebanken Vest has grown EPS by 14% per year. That's a good rate of growth, if it can be sustained.

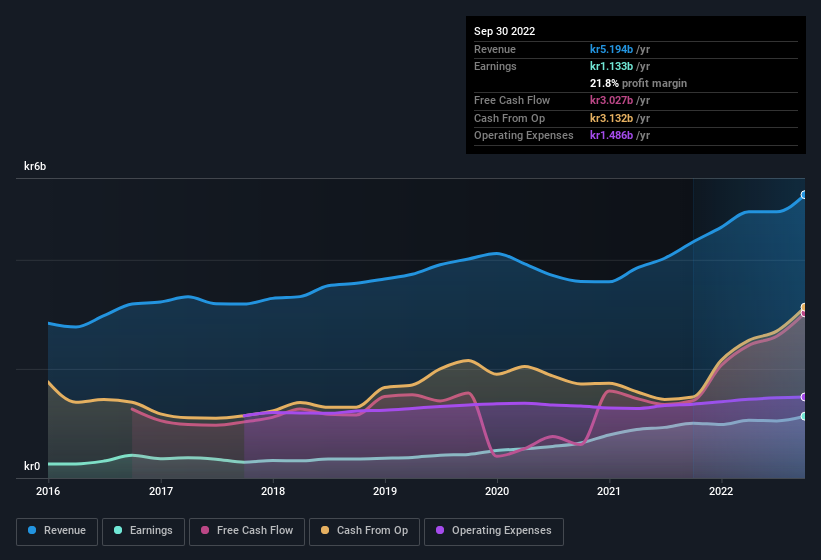

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Sparebanken Vest's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Sparebanken Vest maintained stable EBIT margins over the last year, all while growing revenue 20% to kr5.2b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Sparebanken Vest's future EPS 100% free.

Are Sparebanken Vest Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for Sparebanken Vest shareholders is that no insiders reported selling shares in the last year. Add in the fact that Magne Morken, the Independent Deputy Chairman of the company, paid kr63k for shares at around kr87.61 each. It seems that at least one insider is prepared to show the market there is potential within Sparebanken Vest.

The good news, alongside the insider buying, for Sparebanken Vest bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have kr207m worth of shares. That's a lot of money, and no small incentive to work hard. While their ownership only accounts for 2.1%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Should You Add Sparebanken Vest To Your Watchlist?

One positive for Sparebanken Vest is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. Still, you should learn about the 1 warning sign we've spotted with Sparebanken Vest.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Sparebanken Vest, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:SBNOR

Sparebanken Norge

Sparebanken Vest, a financial services company, provides banking and financing services in the counties of Vestland and Rogaland, Norway.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives