Here's Why We Think Sparebanken Vest (OB:SVEG) Is Well Worth Watching

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Sparebanken Vest (OB:SVEG). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Sparebanken Vest

How Quickly Is Sparebanken Vest Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. We can see that in the last three years Sparebanken Vest grew its EPS by 13% per year. That's a good rate of growth, if it can be sustained.

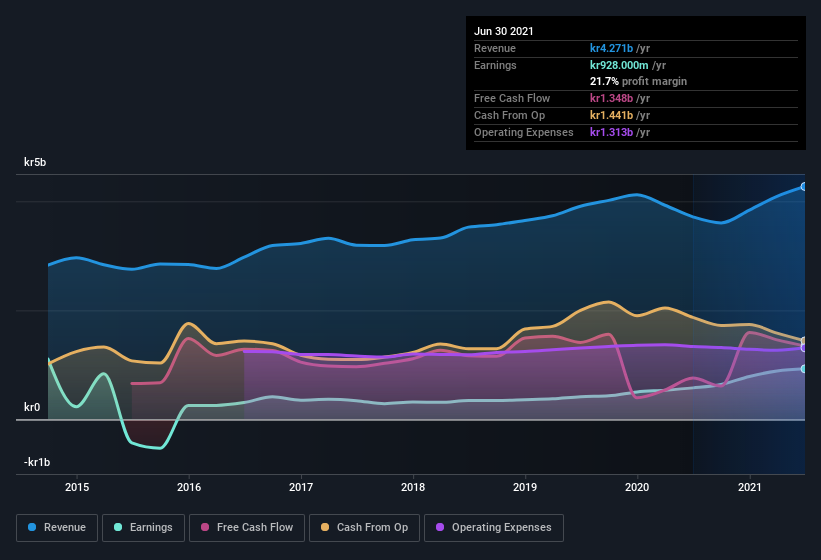

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of Sparebanken Vest's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Sparebanken Vest maintained stable EBIT margins over the last year, all while growing revenue 15% to kr4.3b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Sparebanken Vest's forecast profits?

Are Sparebanken Vest Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We haven't seen any insiders selling Sparebanken Vest shares, in the last year. So it's definitely nice that Independent Director Marianne Dorthea Jacobsen bought kr62k worth of shares at an average price of around kr89.20.

On top of the insider buying, it's good to see that Sparebanken Vest insiders have a valuable investment in the business. To be specific, they have kr412m worth of shares. That's a lot of money, and no small incentive to work hard. Even though that's only about 4.1% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Does Sparebanken Vest Deserve A Spot On Your Watchlist?

One positive for Sparebanken Vest is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. That makes the company a prime candidate for my watchlist - and arguably a research priority. Even so, be aware that Sparebanken Vest is showing 1 warning sign in our investment analysis , you should know about...

The good news is that Sparebanken Vest is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OB:SBNOR

Sparebanken Norge

Sparebanken Vest, a financial services company, provides banking and financing services in the counties of Vestland and Rogaland, Norway.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives