Here's Why I Think SpareBank 1 Østlandet (OB:SPOL) Might Deserve Your Attention Today

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like SpareBank 1 Østlandet (OB:SPOL), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for SpareBank 1 Østlandet

How Fast Is SpareBank 1 Østlandet Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. We can see that in the last three years SpareBank 1 Østlandet grew its EPS by 9.0% per year. That's a pretty good rate, if the company can sustain it.

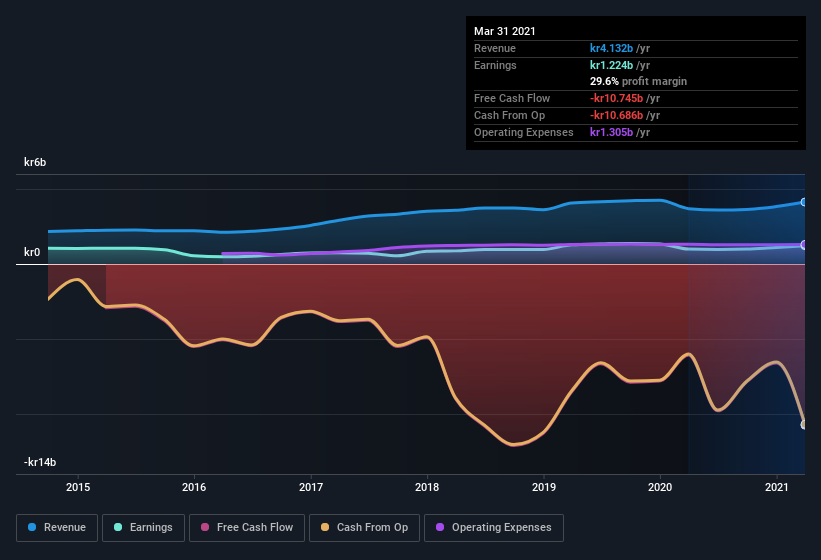

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that SpareBank 1 Østlandet's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. SpareBank 1 Østlandet maintained stable EBIT margins over the last year, all while growing revenue 12% to kr4.1b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for SpareBank 1 Østlandet?

Are SpareBank 1 Østlandet Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Over the last 12 months SpareBank 1 Østlandet insiders spent kr1.3m more buying shares than they received from selling them. Although I don't particularly like to see selling, the fact that they put more capital in, than they extracted, is a positive in my mind. It is also worth noting that it was Chief Financial Officer Geir-Egil Bolstad who made the biggest single purchase, worth kr920k, paying kr92.05 per share.

Should You Add SpareBank 1 Østlandet To Your Watchlist?

One important encouraging feature of SpareBank 1 Østlandet is that it is growing profits. Not every business can grow its EPS, but SpareBank 1 Østlandet certainly can. The cherry on top is the insider share purchases, which provide an extra impetus to keep and eye on this stock, at the very least. It is worth noting though that we have found 2 warning signs for SpareBank 1 Østlandet (1 doesn't sit too well with us!) that you need to take into consideration.

As a growth investor I do like to see insider buying. But SpareBank 1 Østlandet isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade SpareBank 1 Østlandet, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OB:SPOL

SpareBank 1 Østlandet

Provides various financial products and services to individuals, businesses, the public sector, clubs, and societies.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives