As global markets navigate a mixed economic landscape, with U.S. consumer confidence declining and European growth estimates revised lower, investors are seeking stability amid uncertainty. In this environment, high-yield dividend stocks can offer attractive income opportunities by providing regular payouts that may help cushion against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.31% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.61% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.68% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.08% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.82% | ★★★★★★ |

Click here to see the full list of 1943 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

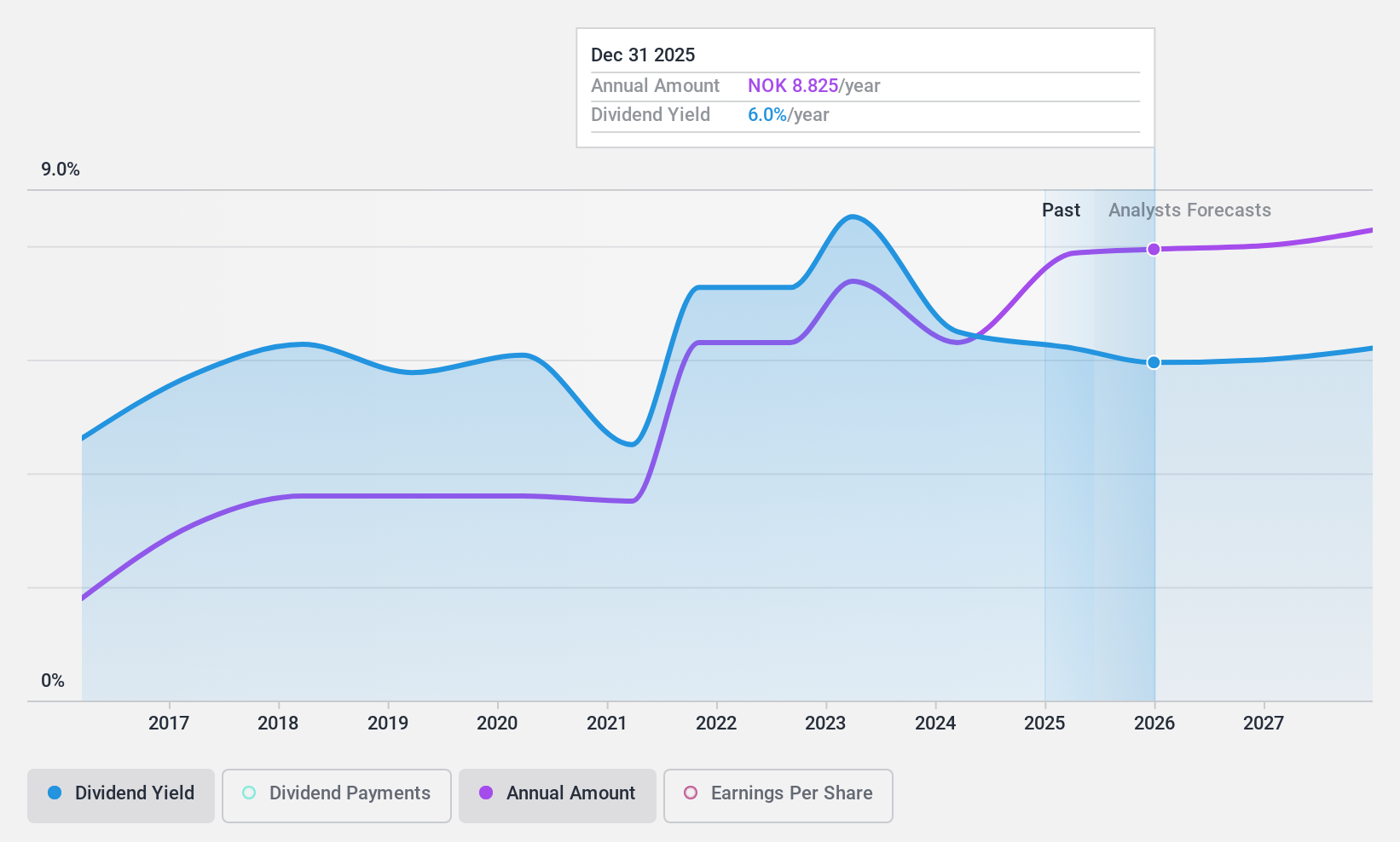

SpareBank 1 Nord-Norge (OB:NONG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SpareBank 1 Nord-Norge offers banking services in Northern Norway and has a market cap of NOK12.40 billion.

Operations: SpareBank 1 Nord-Norge's revenue segments include Retail Market (NOK2.41 billion), Segment Adjustment (NOK1.57 billion), Eiendoms-Megler 1 Nord-Norge (NOK222 million), Sparebank 1 Finans Nord-Norge (NOK327 million), Corporate Banking excluding SMBs (NOK1.53 billion), and Sparebank 1 Regnskaps-Huset Nord-Norge (NOK314 million).

Dividend Yield: 5.7%

SpareBank 1 Nord-Norge offers a stable dividend profile, with dividends well-covered by earnings at a payout ratio of 44%, expected to rise to 66.5% in three years. The bank's dividend payments have been reliable and stable over the past decade, though its current yield of 5.67% is lower than the top quartile in Norway. Recent business reorganizations aim to enhance efficiency and collaboration, potentially supporting future financial stability and dividend sustainability.

- Take a closer look at SpareBank 1 Nord-Norge's potential here in our dividend report.

- Our expertly prepared valuation report SpareBank 1 Nord-Norge implies its share price may be lower than expected.

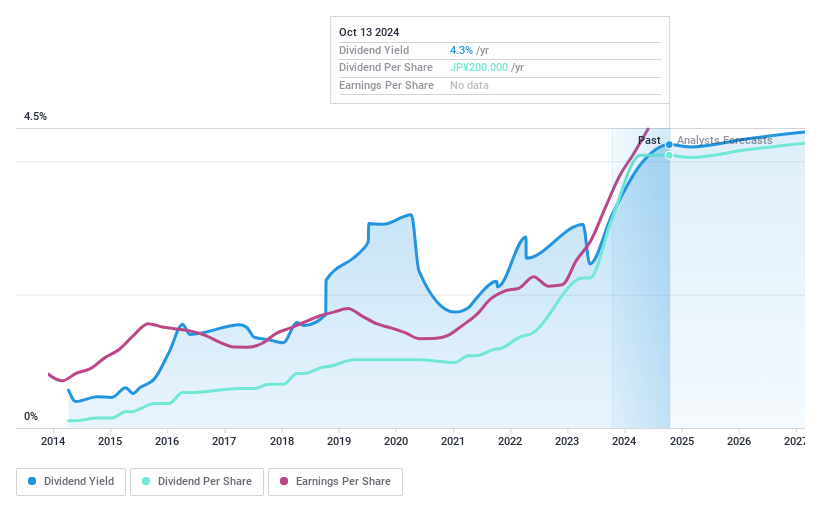

Takeuchi Mfg (TSE:6432)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Takeuchi Mfg. Co., Ltd. manufactures and sells construction machinery both in Japan and internationally, with a market cap of ¥237.38 billion.

Operations: Takeuchi Mfg. Co., Ltd. generates revenue through the manufacturing and sale of construction machinery across domestic and international markets.

Dividend Yield: 4%

Takeuchi Mfg. offers a mixed dividend profile. Despite its dividends being well-covered by earnings with a 24% payout ratio, the high cash payout ratio of 363.2% raises concerns about sustainability from cash flows. The company's dividends have been stable and growing over the past decade, positioning it in the top 25% of JP market payers with a yield of 4.02%. However, recent share buybacks suggest efforts to enhance shareholder returns amidst forecasted earnings declines.

- Click here to discover the nuances of Takeuchi Mfg with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Takeuchi Mfg's share price might be too pessimistic.

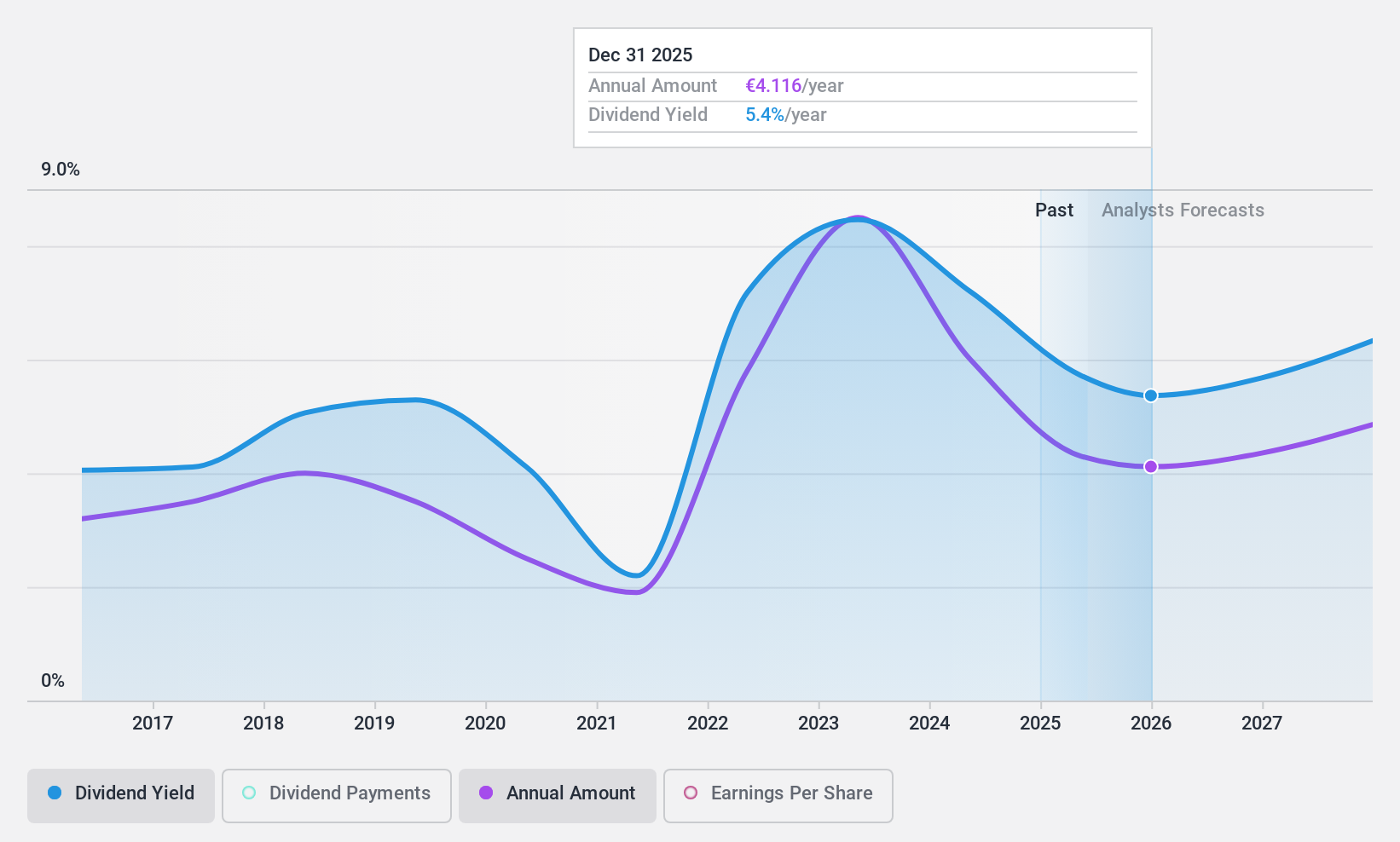

Bayerische Motoren Werke (XTRA:BMW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bayerische Motoren Werke Aktiengesellschaft develops, manufactures, and sells automobiles, motorcycles, and related spare parts and accessories globally with a market cap of €49.20 billion.

Operations: Bayerische Motoren Werke's revenue is primarily derived from its Automotive segment at €128.15 billion, complemented by its Financial Services generating €38.10 billion, and the Motorcycles segment contributing €3.21 billion.

Dividend Yield: 7.6%

Bayerische Motoren Werke's dividend yield of 7.6% ranks it among the top 25% in Germany, yet its sustainability is questionable as dividends are not covered by free cash flows or earnings. Despite a low payout ratio of 36%, dividend reliability has been compromised due to volatility over the past decade. The stock trades below estimated fair value, yet recent earnings declines may impact future payouts, underscoring potential risks for income-focused investors.

- Delve into the full analysis dividend report here for a deeper understanding of Bayerische Motoren Werke.

- The valuation report we've compiled suggests that Bayerische Motoren Werke's current price could be quite moderate.

Summing It All Up

- Take a closer look at our Top Dividend Stocks list of 1943 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NONG

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives