Shareholders Will Probably Not Have Any Issues With Sparebanken Møre's (OB:MORG) CEO Compensation

Key Insights

- Sparebanken Møre to hold its Annual General Meeting on 21st of November

- Total pay for CEO Trond Nydal includes kr3.05m salary

- Total compensation is similar to the industry average

- Sparebanken Møre's EPS grew by 22% over the past three years while total shareholder return over the past three years was 25%

CEO Trond Nydal has done a decent job of delivering relatively good performance at Sparebanken Møre (OB:MORG) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 21st of November. Here is our take on why we think the CEO compensation looks appropriate.

View our latest analysis for Sparebanken Møre

How Does Total Compensation For Trond Nydal Compare With Other Companies In The Industry?

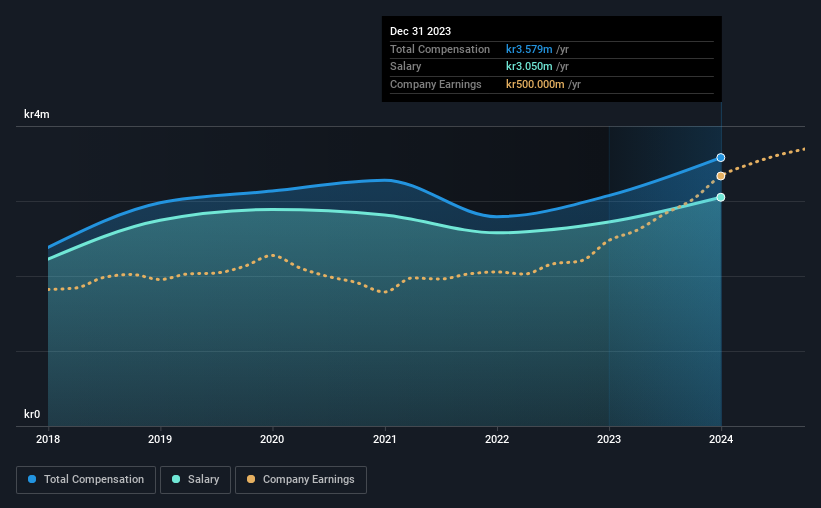

According to our data, Sparebanken Møre has a market capitalization of kr4.5b, and paid its CEO total annual compensation worth kr3.6m over the year to December 2023. That's a notable increase of 17% on last year. We note that the salary portion, which stands at kr3.05m constitutes the majority of total compensation received by the CEO.

On examining similar-sized companies in the Norwegian Banks industry with market capitalizations between kr2.2b and kr8.9b, we discovered that the median CEO total compensation of that group was kr3.6m. From this we gather that Trond Nydal is paid around the median for CEOs in the industry.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | kr3.1m | kr2.7m | 85% |

| Other | kr529k | kr352k | 15% |

| Total Compensation | kr3.6m | kr3.1m | 100% |

On an industry level, around 80% of total compensation represents salary and 20% is other remuneration. Our data reveals that Sparebanken Møre allocates salary more or less in line with the wider market. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Sparebanken Møre's Growth

Over the past three years, Sparebanken Møre has seen its earnings per share (EPS) grow by 22% per year. In the last year, its revenue is up 20%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Sparebanken Møre Been A Good Investment?

With a total shareholder return of 25% over three years, Sparebanken Møre shareholders would, in general, be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We did our research and spotted 1 warning sign for Sparebanken Møre that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:MORG

Sparebanken Møre

Provides banking services for retail and corporate customers in Norway.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026