- Spain

- /

- Infrastructure

- /

- BME:AENA

Top European Dividend Stocks For October 2025

Reviewed by Simply Wall St

As European markets navigate a period of profit-taking and political uncertainty, with the STOXX Europe 600 Index recently dipping after reaching record highs, investors are keenly observing how these dynamics might influence dividend-paying stocks. In such an environment, stocks that offer consistent dividends can be particularly attractive as they may provide a measure of stability and income amid broader market volatility.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.29% | ★★★★★★ |

| Sulzer (SWX:SUN) | 3.36% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.79% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.63% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.17% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.26% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.75% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.68% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.31% | ★★★★★☆ |

| Bravida Holding (OM:BRAV) | 4.02% | ★★★★★★ |

Click here to see the full list of 228 stocks from our Top European Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Aena S.M.E (BME:AENA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aena S.M.E., S.A. operates and manages airports across Spain, Brazil, the United Kingdom, Mexico, and Colombia with a market capitalization of €34.62 billion.

Operations: Aena S.M.E., S.A. generates revenue through various segments including €3.24 billion from Airports - Aeronautical, €1.84 billion from Airports - Commercial (including Car Park Network), €416.13 million from International - LUTON, €262.34 million from International - BOAB, €115.69 million from International - ANB, and €120.94 million from Real Estate Services, along with contributions of €14.98 million from the Airport of The Region of Murcia (AIRM).

Dividend Yield: 4.2%

Aena S.M.E.'s dividend payments have increased over the past decade, though they remain volatile and unreliable. Despite a low dividend yield of 4.23% compared to top Spanish payers, dividends are covered by earnings and cash flows with payout ratios of 72.5% and 74.2%, respectively. Recent earnings growth is evident with net income rising to €893.75 million for H1 2025 from €808.64 million a year prior, indicating potential for future stability in payouts despite high debt levels.

- Click here to discover the nuances of Aena S.M.E with our detailed analytical dividend report.

- Our valuation report unveils the possibility Aena S.M.E's shares may be trading at a premium.

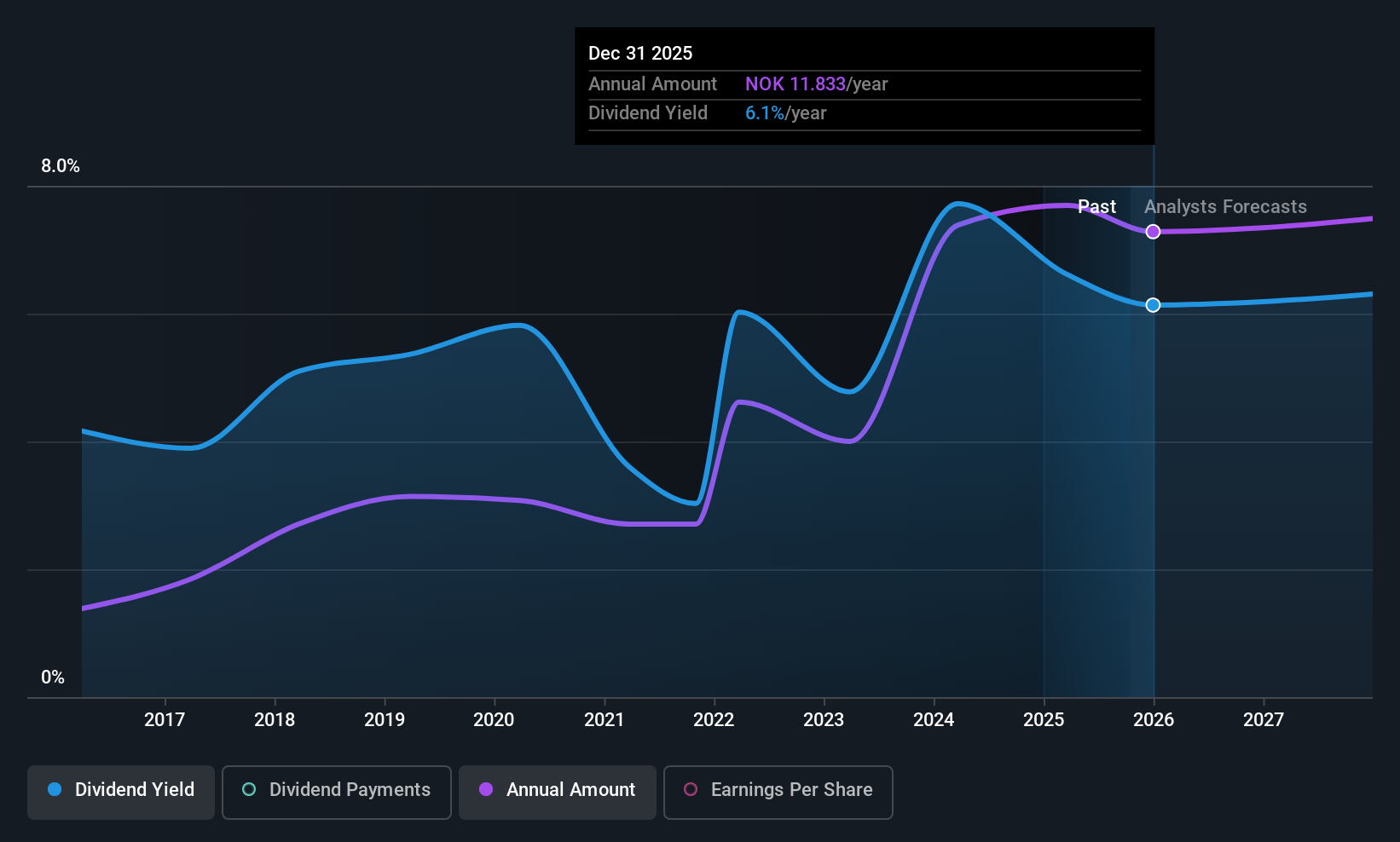

SpareBank 1 SMN (OB:MING)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SpareBank 1 SMN, along with its subsidiaries, offers a range of banking, accounting, and real estate products and services to individuals and businesses in Norway and internationally, with a market capitalization of NOK28.18 billion.

Operations: SpareBank 1 SMN generates revenue through several segments, including Retail Market (NOK3.18 billion), Corporate Market (NOK1.97 billion), Eiendoms Megler 1 (NOK539 million), Sparebank 1 Finans Midt-Norge (NOK432 million), and Sparebank 1 Regnskapshuset SMN (NOK837 million).

Dividend Yield: 6.4%

SpareBank 1 SMN offers a stable and reliable dividend yield of 6.4%, though it falls short of the top dividend payers in Norway. Recent earnings growth, with net income reaching NOK 1,108 million in Q2 2025, supports its sustainable payout ratio of 61.7%. Dividends have been consistently growing over the past decade without volatility. The stock trades significantly below its estimated fair value, presenting potential for capital appreciation alongside steady income returns.

- Delve into the full analysis dividend report here for a deeper understanding of SpareBank 1 SMN.

- The analysis detailed in our SpareBank 1 SMN valuation report hints at an deflated share price compared to its estimated value.

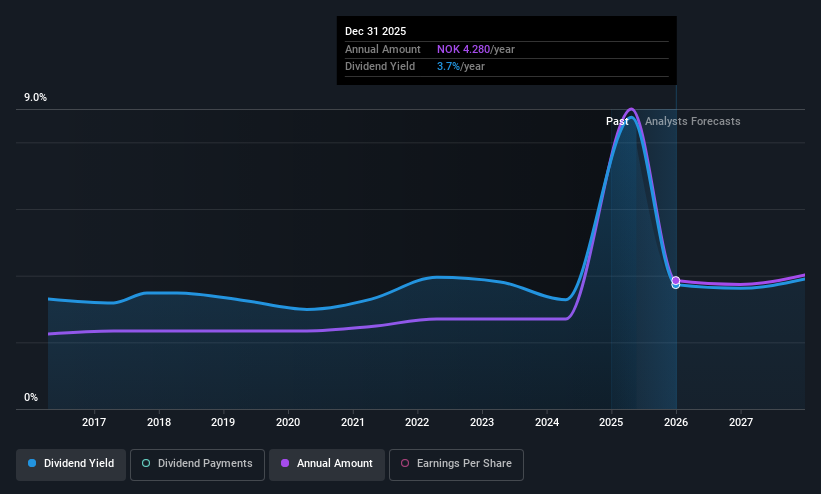

Orkla (OB:ORK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orkla ASA is an industrial investment company focused on brands and consumer-oriented businesses across Norway, Sweden, Denmark, Finland, Iceland, the Baltics, Europe, and internationally with a market cap of NOK104.83 billion.

Operations: Orkla ASA's revenue segments include Portfolio Companies such as Orkla Foods (NOK20.63 billion), Orkla India (NOK3.07 billion), Orkla Health (NOK7.51 billion), Orkla Snacks (NOK10.01 billion), Orkla House Care (NOK1.66 billion), and Orkla Food Ingredients (NOK20.36 billion); Financial Investments like Orkla Real Estate contribute NOK764 million; and others including Home & Personal Care, The European Pizza Company, and Health and Sports Nutrition Group add NOK2.81 billion, NOK3.06 billion, and NOK1.26 billion respectively to the company's diverse revenue streams.

Dividend Yield: 9.5%

Orkla's dividend payments have been stable and growing over the past decade, but the high cash payout ratio of 140.5% indicates they are not well covered by free cash flows. Despite a reasonable earnings payout ratio of 67%, sustainability concerns arise due to limited coverage by earnings or cash flows. The dividend yield of 9.51% is slightly below top-tier Norwegian payers and recent earnings growth was modest at 2%. Orkla trades at a significant discount to its estimated fair value, suggesting potential for capital appreciation.

- Get an in-depth perspective on Orkla's performance by reading our dividend report here.

- Our valuation report here indicates Orkla may be undervalued.

Summing It All Up

- Dive into all 228 of the Top European Dividend Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:AENA

Aena S.M.E

Engages in the management of airports in Spain, Brazil, the United Kingdom, Mexico, and Colombia.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives