- Poland

- /

- Capital Markets

- /

- WSE:PRA

European Penny Stocks To Watch In April 2025

Reviewed by Simply Wall St

As European markets experience a lift amid easing trade tensions and positive economic signals, investors are keenly watching for opportunities that align with the current landscape. Penny stocks, though often seen as a throwback to earlier market times, continue to capture interest due to their potential for growth and affordability. In this context, we will explore several European penny stocks that stand out for their financial strength and potential long-term value.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.14 | SEK2.05B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.70 | SEK243.41M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.78 | SEK283.44M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.70 | SEK225.1M | ✅ 2 ⚠️ 2 View Analysis > |

| Tesgas (WSE:TSG) | PLN2.54 | PLN28.83M | ✅ 2 ⚠️ 3 View Analysis > |

| IMS (WSE:IMS) | PLN3.64 | PLN123.37M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.60 | €54.84M | ✅ 3 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.975 | €32.65M | ✅ 3 ⚠️ 3 View Analysis > |

| Arcure (ENXTPA:ALCUR) | €3.96 | €22.93M | ✅ 3 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.185 | €301.67M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 429 stocks from our European Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Instabank (OB:INSTA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Instabank ASA offers a range of banking products and services in Norway, with a market cap of NOK854.87 million.

Operations: The company generates NOK334.87 million from its banking segment in Norway.

Market Cap: NOK854.87M

Instabank ASA, with a market cap of NOK854.87 million, has shown consistent earnings growth over the past five years but faced a slight decline in earnings last year. The bank's financial stability is supported by an appropriate Loans to Assets ratio and primarily low-risk funding sources. However, it struggles with a high level of bad loans at 6.9%. Recent strategic cooperation with smartmiete.de marks its expansion into Germany, enhancing its presence beyond the Nordics. Instabank offers dividends and maintains stable profit margins despite recent declines compared to previous years.

- Click here and access our complete financial health analysis report to understand the dynamics of Instabank.

- Review our growth performance report to gain insights into Instabank's future.

Scana (OB:SCANA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Scana ASA is a technology and services provider for the offshore and energy industries across Norway, other European countries, the United States, Asia, and Africa with a market cap of NOK 907.51 million.

Operations: The company's revenue is primarily derived from its Offshore (Incl. Maritime) segment at NOK 1.20 billion and its Energy segment at NOK 824.6 million.

Market Cap: NOK907.51M

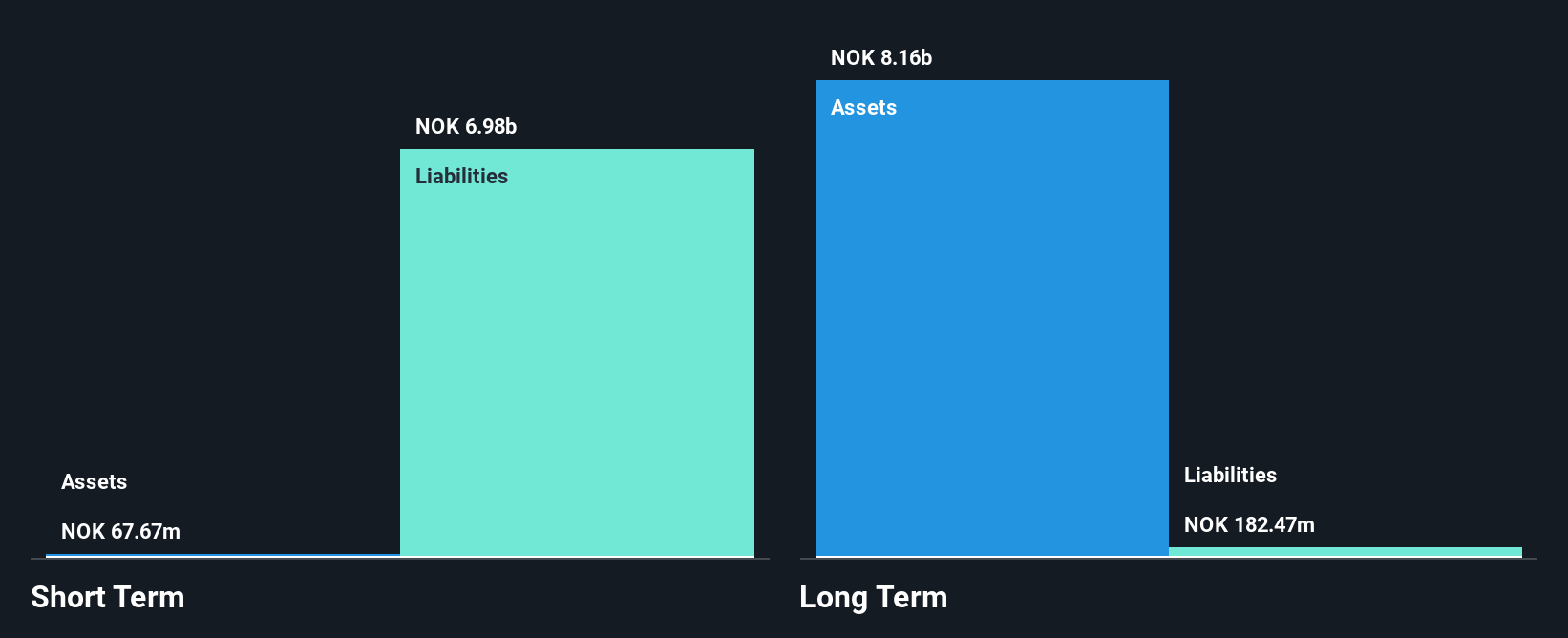

Scana ASA, with a market cap of NOK 907.51 million, has demonstrated strong revenue growth, reaching NOK 1.97 billion last year despite a net loss in the fourth quarter. The company's financial position is robust, with short-term assets exceeding both short and long-term liabilities and satisfactory net debt to equity ratio at 9.1%. Scana's interest payments are well covered by EBIT and operating cash flow covers its debt effectively. However, management's average tenure is relatively short at 1.6 years, indicating potential instability in leadership despite recent executive changes including a new CFO appointment.

- Jump into the full analysis health report here for a deeper understanding of Scana.

- Examine Scana's earnings growth report to understand how analysts expect it to perform.

Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna (WSE:PRA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna, operating as SPARK VC S.A., is a publicly owned investment manager with a market cap of PLN146.67 million.

Operations: No specific revenue segments have been reported for SPARK VC S.A.

Market Cap: PLN146.67M

Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna, operating as SPARK VC S.A., has a market cap of PLN146.67 million and is currently pre-revenue with no significant revenue streams reported. The company remains debt-free, which could be advantageous in managing its financial stability despite a net loss of PLN0.89 million in the recent quarter. However, it faces challenges with less than a year of cash runway and high share price volatility over the past three months. Short-term assets comfortably cover liabilities, but the board's average tenure is short at 1.6 years, suggesting limited experience in leadership roles.

- Unlock comprehensive insights into our analysis of Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna stock in this financial health report.

- Examine Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna's past performance report to understand how it has performed in prior years.

Turning Ideas Into Actions

- Get an in-depth perspective on all 429 European Penny Stocks by using our screener here.

- Want To Explore Some Alternatives? These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:PRA

Prime Alternatywna Spolka Inwestycyjna Spolka Akcyjna

SPARK VC S.A. is a publicly owned investment manager.

Flawless balance sheet low.

Market Insights

Community Narratives