- Saudi Arabia

- /

- Telecom Services and Carriers

- /

- SASE:7010

Three Top Dividend Stocks To Consider

Reviewed by Simply Wall St

In the midst of a choppy start to the year for global markets, marked by inflation concerns and political uncertainties, investors are seeking stability amidst fluctuating indices. As U.S. equities face pressure and small-cap stocks underperform, dividend stocks emerge as an appealing option for those looking to balance potential risks with steady income streams in these uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.36% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.00% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.66% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.64% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.89% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.21% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.17% | ★★★★★★ |

Click here to see the full list of 2007 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

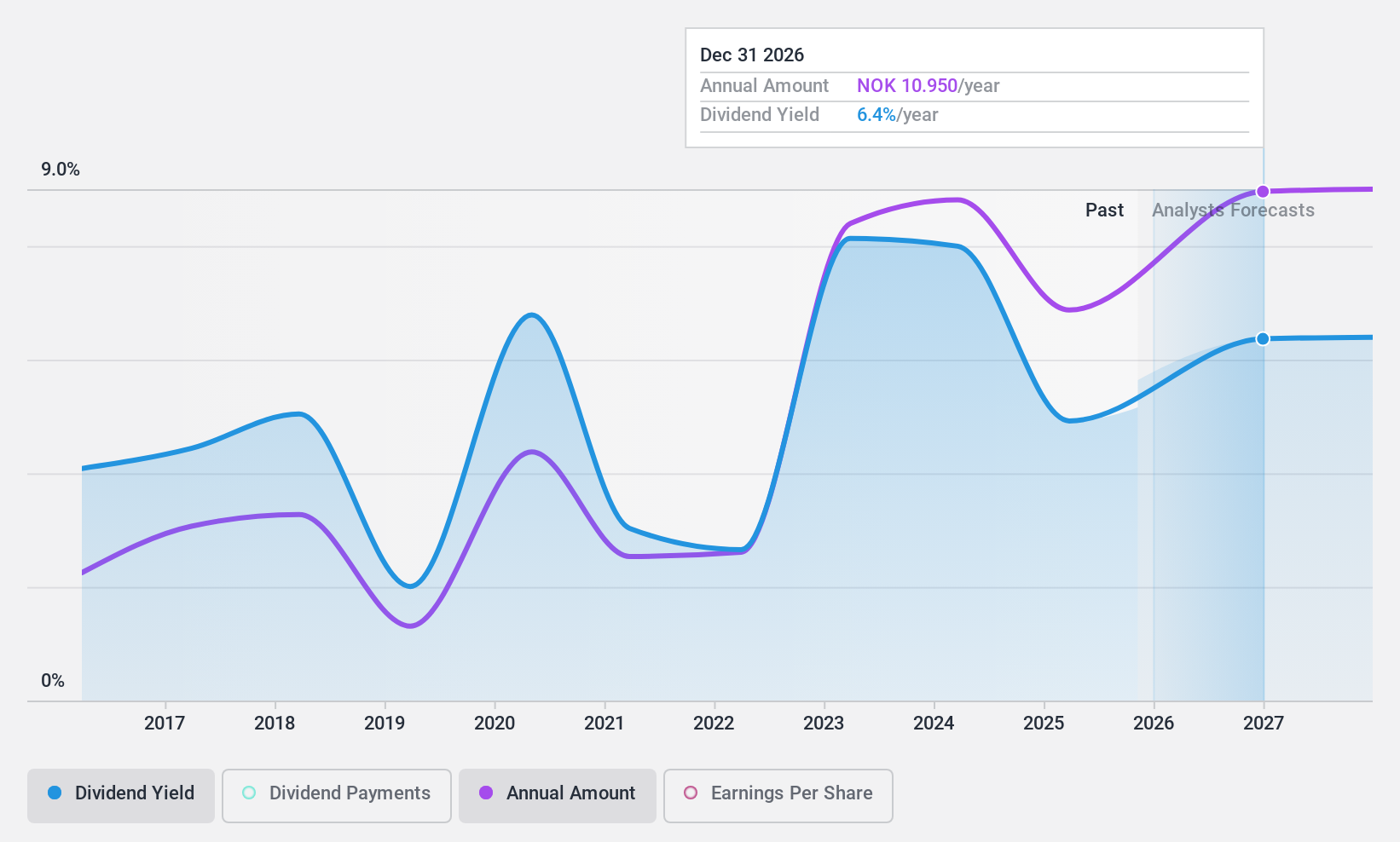

SpareBank 1 Helgeland (OB:HELG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SpareBank 1 Helgeland offers a range of financial products and services to retail customers, small and medium enterprises, municipal authorities, and institutions in Norway with a market cap of NOK3.93 billion.

Operations: SpareBank 1 Helgeland generates revenue from its Retail segment with NOK462 million and Corporate Market segment with NOK271 million.

Dividend Yield: 7.4%

SpareBank 1 Helgeland's dividend payments have been volatile and unreliable over the past decade, with a history of annual drops exceeding 20%. Despite this, dividends are currently covered by earnings with a payout ratio of 70.4% and are forecast to remain covered in three years at 89.4%. Recent earnings reports show improvement, with net income for the third quarter rising to NOK 155 million from NOK 134 million a year prior.

- Dive into the specifics of SpareBank 1 Helgeland here with our thorough dividend report.

- According our valuation report, there's an indication that SpareBank 1 Helgeland's share price might be on the cheaper side.

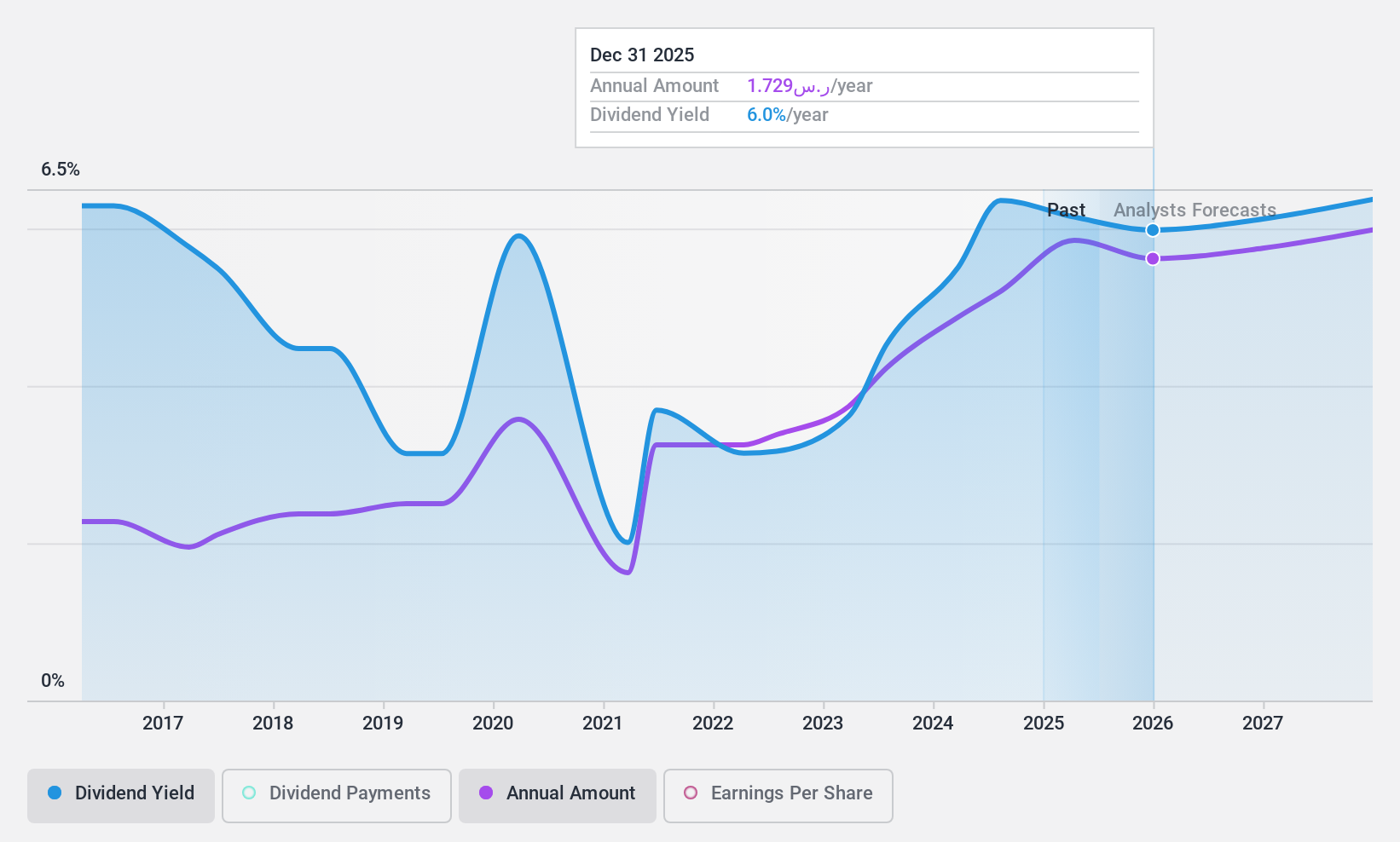

Riyad Bank (SASE:1010)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Riyad Bank offers banking and investment services in the Kingdom of Saudi Arabia, with a market cap of SAR83.71 billion.

Operations: Riyad Bank's revenue segments include Riyad Capital at SAR968.64 million, Retail Banking at SAR4.23 billion, Corporate Banking at SAR7.77 billion, and Treasury and Investment at SAR2.21 billion.

Dividend Yield: 5.7%

Riyad Bank's dividend yield is among the top 25% in Saudi Arabia, supported by a payout ratio of 53.3%, indicating dividends are well-covered by earnings. Recent earnings growth, with net income rising to SAR 2.65 billion in Q3 2024 from SAR 2.09 billion a year ago, strengthens its position as a dividend payer. However, its dividend track record has been volatile over the past decade despite increasing payments during this period.

- Get an in-depth perspective on Riyad Bank's performance by reading our dividend report here.

- Our valuation report unveils the possibility Riyad Bank's shares may be trading at a discount.

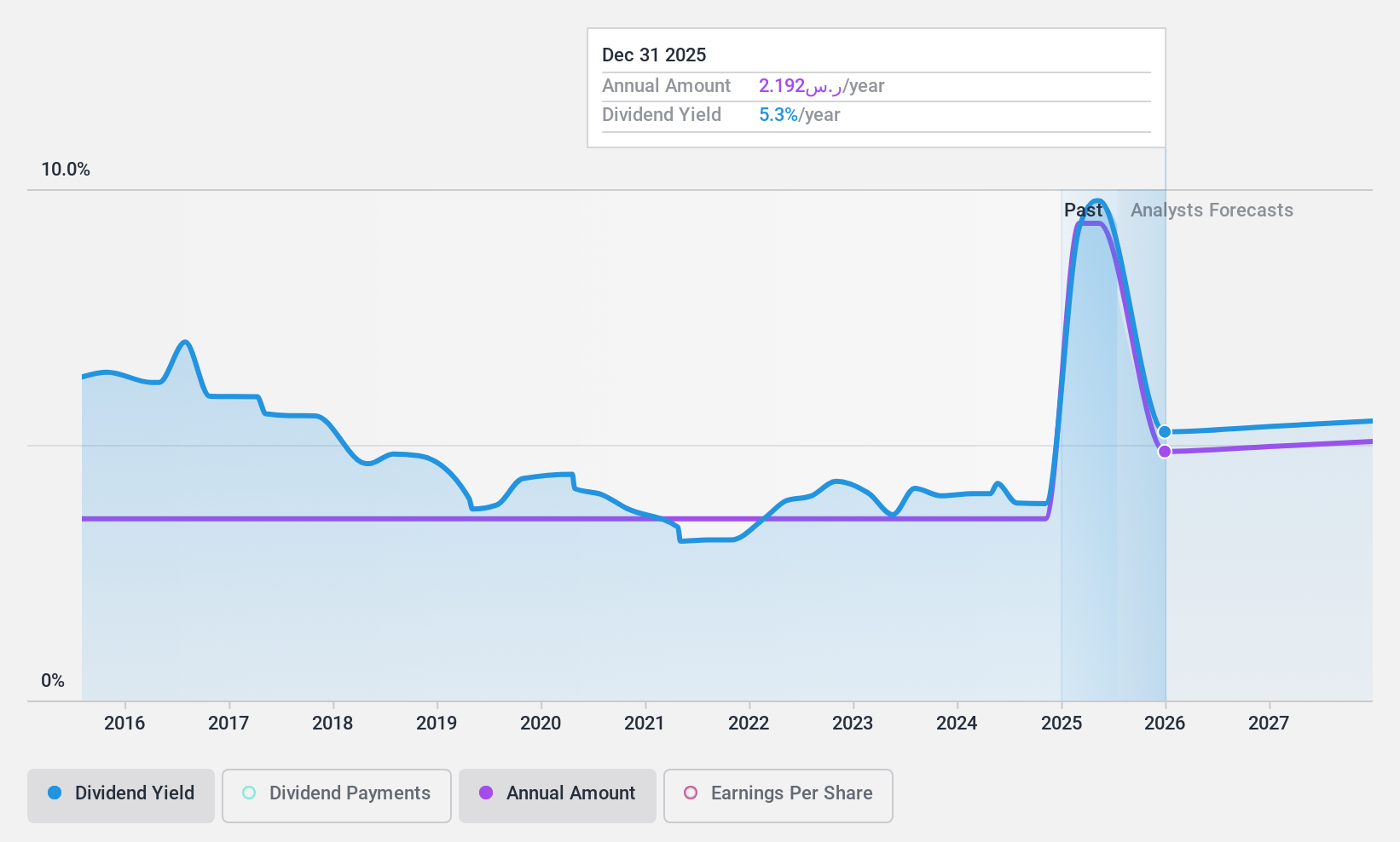

Saudi Telecom (SASE:7010)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Saudi Telecom Company, along with its subsidiaries, offers telecommunications, information, media, and digital payment services both in the Kingdom of Saudi Arabia and internationally, with a market cap of SAR204.46 billion.

Operations: Saudi Telecom's revenue segments include Saudi Telecom Company at SAR49.43 billion, Saudi Telecom Channels Company at SAR15.03 billion, Arabian Internet and Communications Services Company (Solutions) at SAR11.20 billion, Kuwait Telecommunications Company (Stc Kuwait) at SAR4.33 billion, STC Bahrain BSC (C) (Stc Bahrain) at SAR1.92 billion, Gulf Digital Media Model Company LTD (Intigral) at SAR670.56 million, Advanced Technology and Cybersecurity Company (Sirar) at SAR579.31 million, Public Telecommunications Company (Specialized) at SAR422.79 million, and STC Bank contributing SAR1.22 billion to the total revenue mix in millions of Saudi Riyals.

Dividend Yield: 3.9%

Saudi Telecom's dividends have been stable and growing over the past decade, supported by a payout ratio of 60% and a cash payout ratio of 58.4%, indicating coverage by both earnings and cash flows. Despite a dividend yield of 3.9%, which is lower than the top quartile in Saudi Arabia, its dividends are reliable with little volatility. Recent Q3 earnings showed sales growth to SAR 18.64 billion but a slight decline in net income to SAR 4.64 billion year-over-year.

- Unlock comprehensive insights into our analysis of Saudi Telecom stock in this dividend report.

- In light of our recent valuation report, it seems possible that Saudi Telecom is trading behind its estimated value.

Seize The Opportunity

- Investigate our full lineup of 2007 Top Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:7010

Saudi Telecom

Provides telecommunications, information, media, and digital payment services in the Kingdom of Saudi Arabia and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives