Is There Still Opportunity in DNB Bank After 32.5% Gain This Year?

Reviewed by Bailey Pemberton

If you’ve been eyeing DNB Bank’s stock, you’re definitely not alone. The past year has been a rollercoaster for many banks, but DNB is sitting up and getting noticed. Maybe you’re wondering if it’s time to buy, hold, or cash in your gains. The buzz isn’t without reason; after all, the stock has climbed an impressive 32.5% in the past year, and it’s up another 17.6% since January. Even a quick glance at the three-year return, boasting a 90.7% gain, shows DNB’s trend isn’t just a flash in the pan.

Of course, markets move for a reason. Recent shifts in the financial sector, especially as investors rethink economic risks and interest rate paths, have helped nudge Norwegian banks like DNB higher. That being said, not everything has been a straight upward line: we saw a small 1.2% dip in the last week, though the stock is still up 2.5% over the past month. All this makes it a classic moment where investors start to weigh upside potential against valuation risk.

Speaking of valuation, here’s where things get interesting. By the numbers, DNB earns a value score of 5 out of 6, meaning it’s undervalued on nearly every metric that matters. In the next section, we’ll break down each of those valuation checks and see how DNB stacks up in detail. But there’s also an even more insightful way to look at valuation, one we’ll dive into at the end of the article, so stay tuned for that key perspective.

Why DNB Bank is lagging behind its peers

Approach 1: DNB Bank Excess Returns Analysis

The Excess Returns valuation model examines how efficiently DNB Bank puts its equity capital to work by comparing the profit it generates above and beyond its cost of equity. This model is especially relevant for banks, as it measures true value creation for shareholders, not just headline earnings.

For DNB Bank, the numbers paint an impressive picture. The current Book Value stands at NOK171.56 per share. The projected Stable Book Value rises to NOK192.85 per share, based on the weighted future estimates from 11 analysts. The bank is expected to produce a Stable EPS of NOK27.53 per share, sourced from 14 analyst forecasts on Return on Equity, which averages 14.28%. Importantly, the cost of equity is NOK14.39 per share, meaning the bank is generating a substantial excess return of NOK13.15 per share. This suggests a strong and sustainable value-creation engine.

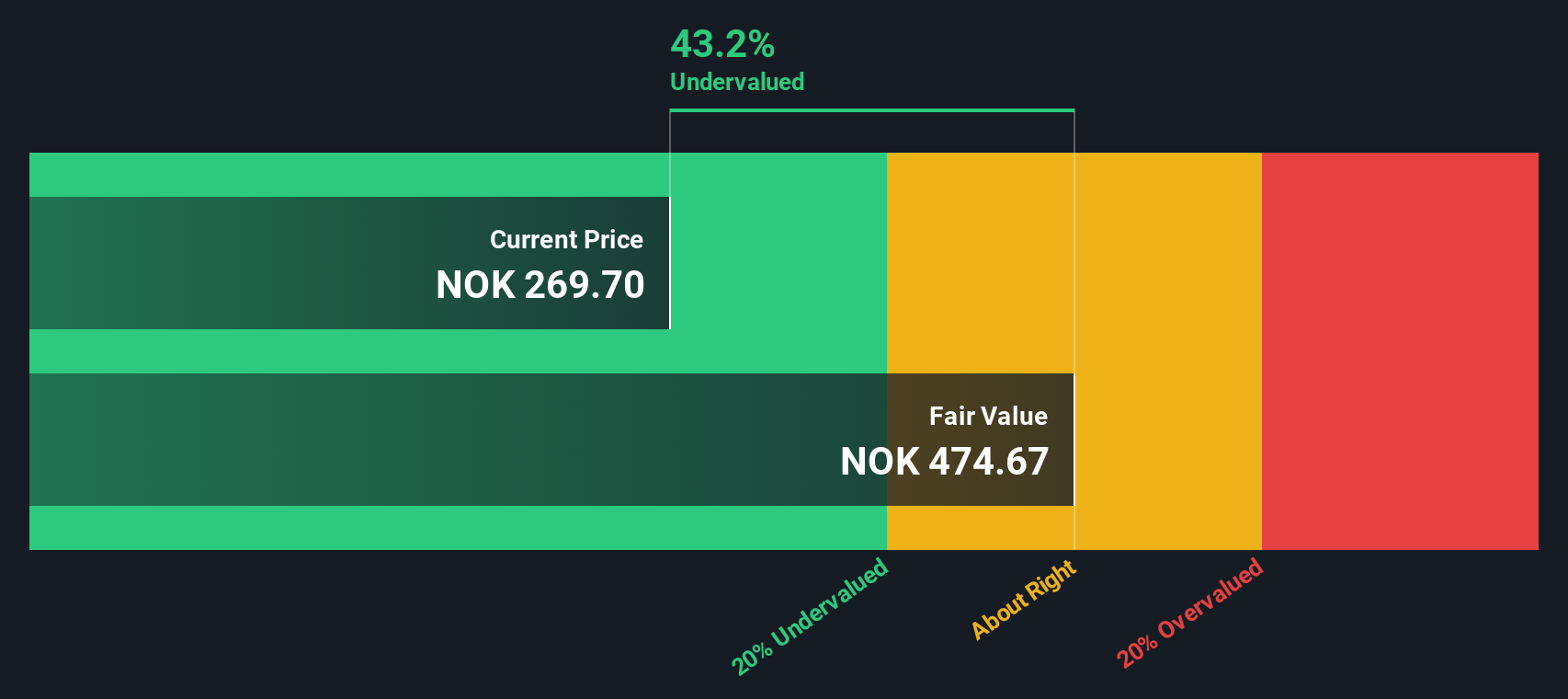

Based on these robust return metrics, the Excess Returns model estimates DNB's intrinsic value to be significantly higher than its current trading price. This results in a calculated discount of 43.1%. In short, DNB Bank appears consistently undervalued relative to its true earning power.

Result: UNDERVALUED

Our Excess Returns analysis suggests DNB Bank is undervalued by 43.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: DNB Bank Price vs Earnings

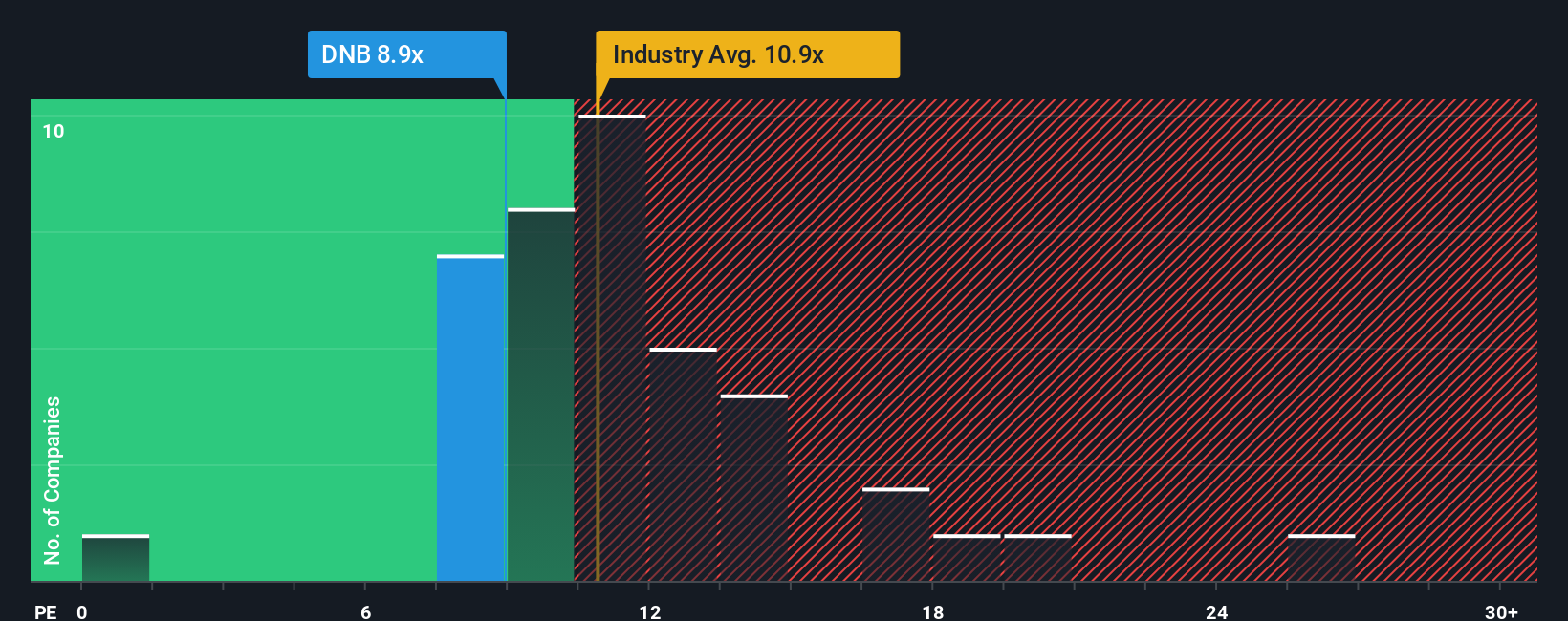

The Price-to-Earnings (PE) ratio is a widely accepted valuation metric for profitable companies like DNB Bank, as it connects the company’s share price directly to its underlying earnings. For banks and mature financial institutions, PE is especially relevant because profit stability and transparency allow for reliable comparisons across the industry.

What counts as a "normal" or "fair" PE ratio is shaped by several factors. For instance, a higher growth outlook can warrant a higher PE, while elevated risks or weaker prospects demand a discount. Industry averages and competitor numbers provide context as well, but do not always capture these subtleties.

DNB Bank currently trades on a PE ratio of 8.94x. This is a discount when compared to the average for Nordic peers at 9.43x and the broader banking industry at 10.66x. Simply Wall St’s Fair Ratio model, which rigorously weighs DNB’s growth, profit margins, scale, and risk profile, indicates a fair PE of 10.78x. Unlike traditional peer or industry benchmarks, the Fair Ratio accounts for DNB’s unique fundamentals, so it provides a much clearer picture of what investors should pay. Since there is a meaningful gap between DNB’s current PE and its calculated Fair Ratio, the stock is looking undervalued based on its earnings power and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your DNB Bank Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is an approachable tool that helps you tie a company’s story, the real-world factors and your perspective on its industry strength, risks, and catalysts, directly to your own forecast of its future revenue, margins, and ultimately, what you believe is a fair value for the stock.

Unlike static numbers, Narratives connect your outlook for DNB Bank with a financial forecast and translate that into a fair value estimate. This makes it much easier to decide when to buy, hold, or sell by comparing your calculated value with the current share price. Best of all, Narratives are interactive and available for free within the Simply Wall St Community, where millions of investors share their views and continually update stories as new news or earnings data comes in, so they always reflect fresh information.

For example, with DNB Bank, some investors take a bullish view, expecting profits to remain resilient with a fair value as high as NOK309.0 per share, while others are more cautious, setting their fair value closer to NOK230.0. This allows you to see in real time how different stories and assumptions lead to very different estimates and decisions.

Do you think there's more to the story for DNB Bank? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:DNB

DNB Bank

Provides financial services to individuals and businesses in Norway and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives