Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Fastned B.V. (AMS:FAST) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Fastned B.V

What Is Fastned B.V's Net Debt?

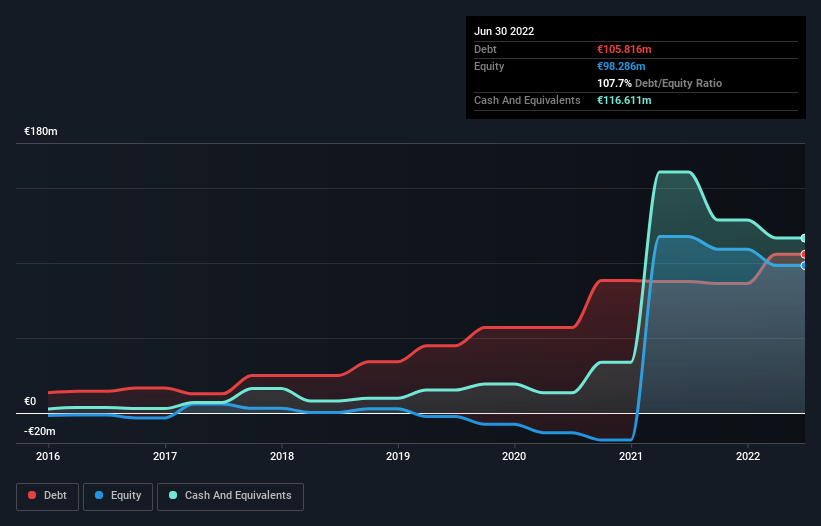

As you can see below, at the end of June 2022, Fastned B.V had €105.8m of debt, up from €87.7m a year ago. Click the image for more detail. However, its balance sheet shows it holds €116.6m in cash, so it actually has €10.8m net cash.

How Strong Is Fastned B.V's Balance Sheet?

According to the last reported balance sheet, Fastned B.V had liabilities of €20.0m due within 12 months, and liabilities of €111.5m due beyond 12 months. On the other hand, it had cash of €116.6m and €5.04m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by €9.84m.

Having regard to Fastned B.V's size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the €656.1m company is struggling for cash, we still think it's worth monitoring its balance sheet. Despite its noteworthy liabilities, Fastned B.V boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Fastned B.V can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Fastned B.V wasn't profitable at an EBIT level, but managed to grow its revenue by 147%, to €21m. So there's no doubt that shareholders are cheering for growth

So How Risky Is Fastned B.V?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And we do note that Fastned B.V had an earnings before interest and tax (EBIT) loss, over the last year. And over the same period it saw negative free cash outflow of €63m and booked a €20m accounting loss. But at least it has €10.8m on the balance sheet to spend on growth, near-term. Importantly, Fastned B.V's revenue growth is hot to trot. High growth pre-profit companies may well be risky, but they can also offer great rewards. For riskier companies like Fastned B.V I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:FAST

Fastned B.V

Engages in the construction and operation of charging stations for fully electric and hybrid cars.

Mediocre balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026