- Netherlands

- /

- Construction

- /

- ENXTAM:HEIJM

Euronext Amsterdam Dividend Stocks To Watch In July 2024

Reviewed by Simply Wall St

As global markets navigate through varying economic signals, the Netherlands stock market remains a focal point for investors looking for stable dividend yields. Amidst this backdrop, certain stocks on the Euronext Amsterdam stand out for their potential to offer consistent dividends, making them particularly appealing in the current economic climate characterized by cautious optimism and shifting monetary policies.

Top 5 Dividend Stocks In The Netherlands

| Name | Dividend Yield | Dividend Rating |

| Acomo (ENXTAM:ACOMO) | 6.48% | ★★★★★☆ |

| ABN AMRO Bank (ENXTAM:ABN) | 9.38% | ★★★★☆☆ |

| Signify (ENXTAM:LIGHT) | 6.38% | ★★★★☆☆ |

| Randstad (ENXTAM:RAND) | 5.30% | ★★★★☆☆ |

| Koninklijke Heijmans (ENXTAM:HEIJM) | 4.22% | ★★★★☆☆ |

| Koninklijke KPN (ENXTAM:KPN) | 4.08% | ★★★★☆☆ |

We'll examine a selection from our screener results.

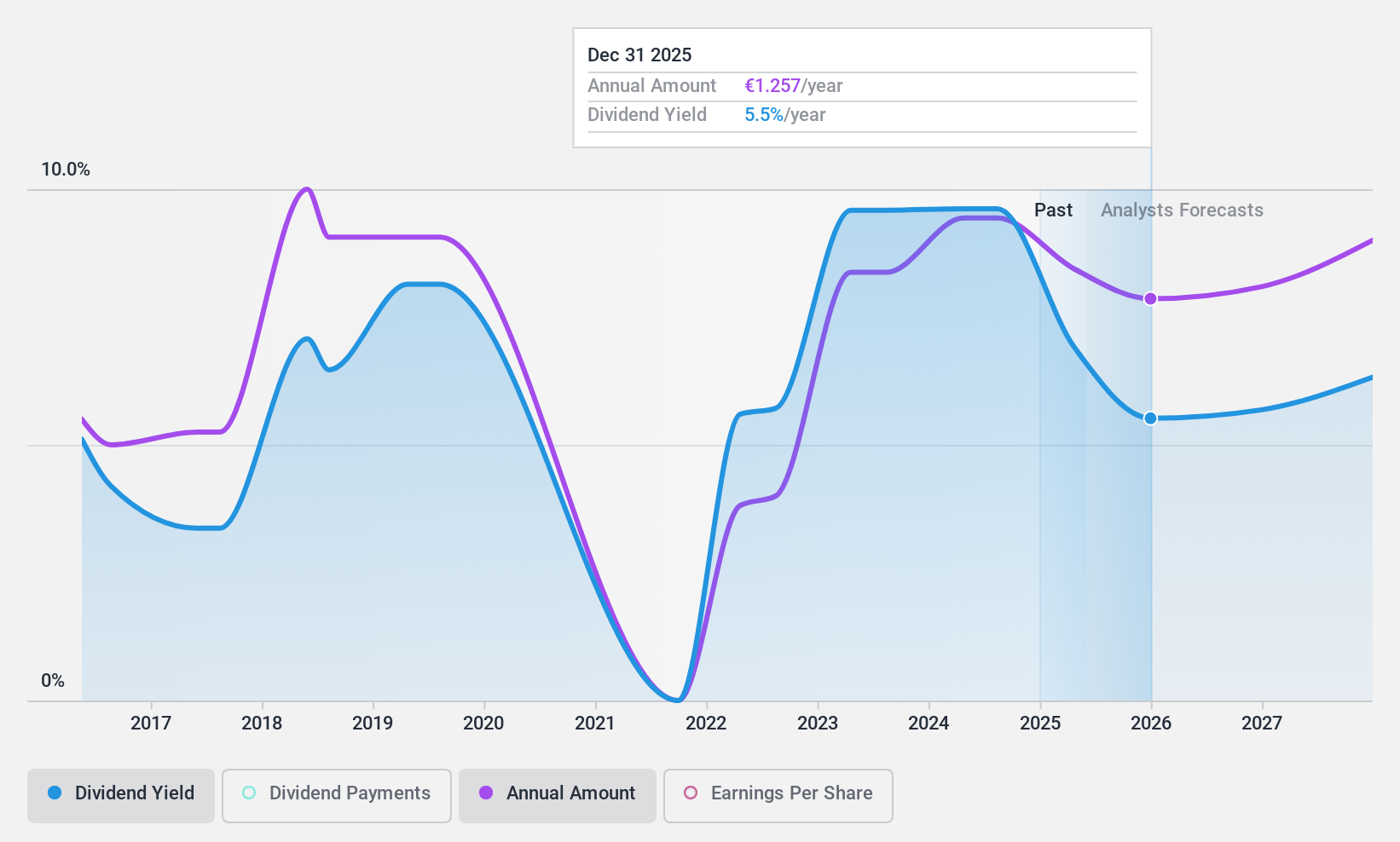

ABN AMRO Bank (ENXTAM:ABN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ABN AMRO Bank N.V. offers a wide range of banking products and financial services to retail, private, and business clients both in the Netherlands and globally, with a market capitalization of approximately €13.42 billion.

Operations: ABN AMRO Bank N.V. generates its revenue primarily through Personal & Business Banking (€4.07 billion), Corporate Banking (€3.50 billion), and Wealth Management (€1.59 billion).

Dividend Yield: 9.4%

ABN AMRO Bank's dividend track record has been unstable with volatile payments over the past 8 years, making it a less reliable choice for consistent income. However, the dividends are currently well-covered by earnings with a payout ratio of 47.9%, and this trend is expected to continue over the next three years. Despite recent growth in earnings, forecasts predict an average annual decline of 11.4% in earnings over the next three years. The bank is trading at a significant discount to its estimated fair value and offers one of the higher yields in its market at 9.38%. Recent strategic acquisitions aim to expand its presence in European wealth management, potentially influencing future financial stability and dividend sustainability.

- Get an in-depth perspective on ABN AMRO Bank's performance by reading our dividend report here.

- Our valuation report here indicates ABN AMRO Bank may be undervalued.

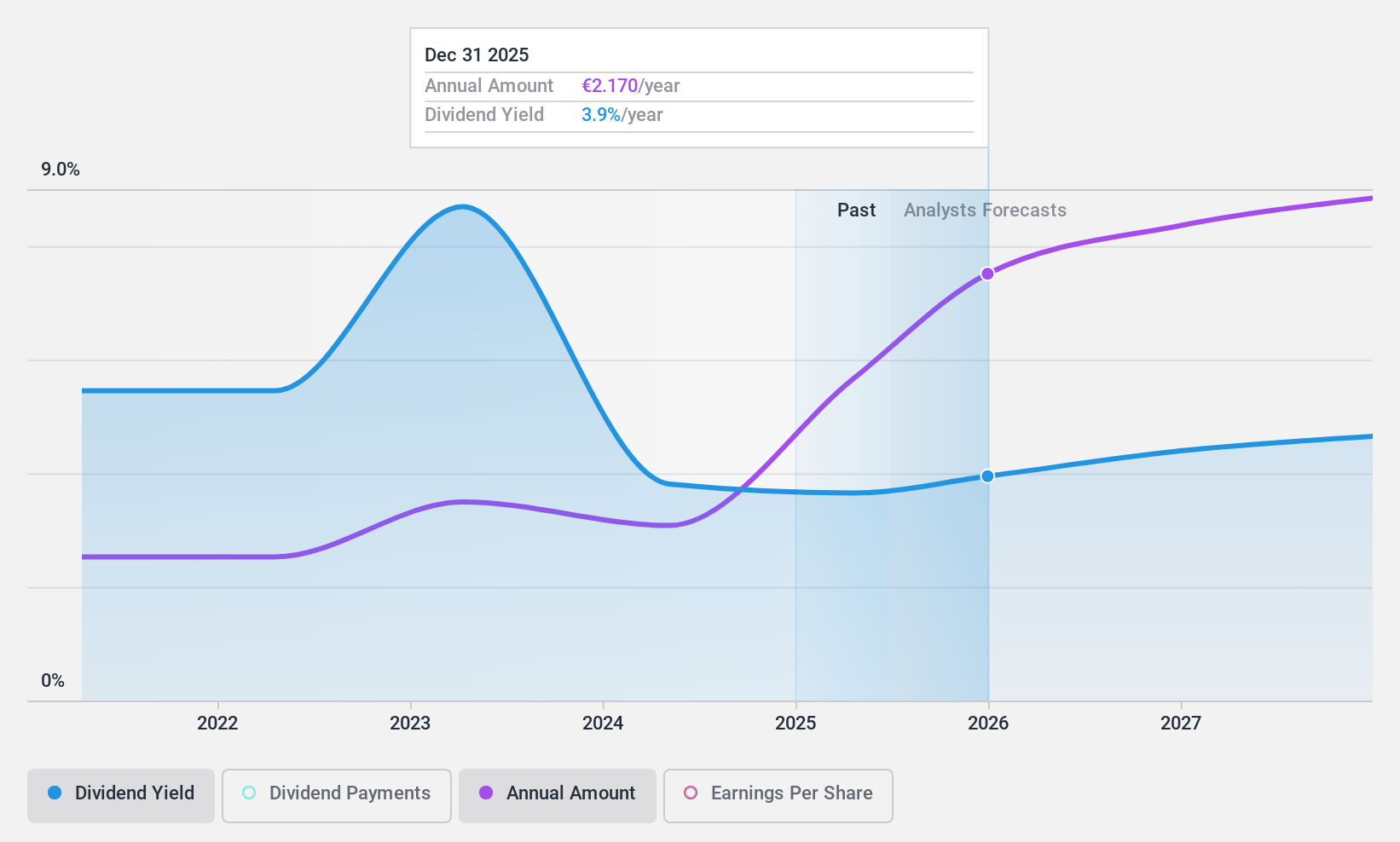

Koninklijke Heijmans (ENXTAM:HEIJM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. is a Dutch company involved in property development, construction, and infrastructure projects both domestically and internationally, with a market capitalization of approximately €566.03 million.

Operations: Koninklijke Heijmans N.V. generates revenue through its Real Estate, Van Wanrooij, Infrastructure Works, and Construction & Technology segments, with respective earnings of €411.79 million, €124.76 million, €800.03 million, and €1.08 billion.

Dividend Yield: 4.2%

Koninklijke Heijmans has shown a 19.4% annual earnings growth over the past five years, supporting its dividend payments with a modest payout ratio of 37.1%. However, its dividend history has been inconsistent with volatile payments and an unstable track record over the last decade. Despite this, dividends are reasonably covered by both earnings and cash flows (cash payout ratio at 59%). Currently, HEIJM's dividend yield stands at 4.22%, which is lower than the top quartile of Dutch dividend payers at 5.51%.

- Navigate through the intricacies of Koninklijke Heijmans with our comprehensive dividend report here.

- The analysis detailed in our Koninklijke Heijmans valuation report hints at an deflated share price compared to its estimated value.

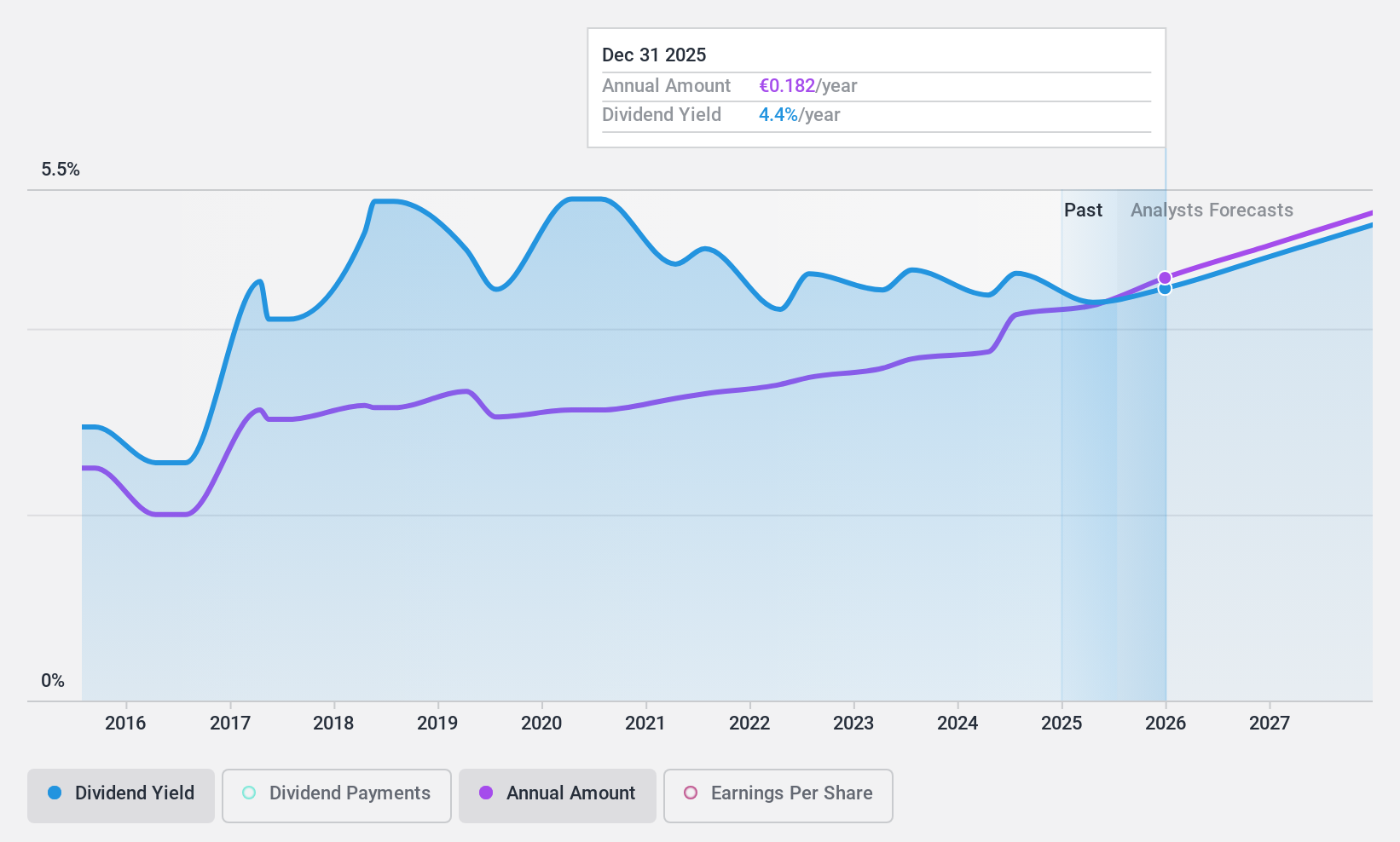

Koninklijke KPN (ENXTAM:KPN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke KPN N.V. is a telecommunications and IT service provider operating primarily in the Netherlands, with a market capitalization of approximately €14.44 billion.

Operations: Koninklijke KPN N.V. generates its revenues primarily from three segments: Consumer (€2.93 billion), Business (€1.84 billion), and Wholesale (€0.70 billion).

Dividend Yield: 4.1%

Koninklijke KPN has experienced a 13.6% annual earnings growth over the past five years, underpinning its dividend sustainability with a payout ratio of 78.4% and cash payout ratio of 59.6%. Recent strategic moves include acquiring significant spectrum for €58.4 million to enhance its 5G capabilities and forming TowerCo with ABP, improving infrastructure management. Despite these positives, KPN's dividends have shown volatility over the past decade and its current yield of 4.08% is below the top quartile in the Dutch market at 5.51%.

- Click here to discover the nuances of Koninklijke KPN with our detailed analytical dividend report.

- Our valuation report here indicates Koninklijke KPN may be overvalued.

Turning Ideas Into Actions

- Discover the full array of 6 Top Euronext Amsterdam Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke Heijmans might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:HEIJM

Koninklijke Heijmans

Engages in the property development, construction, and infrastructure businesses in the Netherlands and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives