Amidst concerns over the independence of the U.S. Federal Reserve and renewed geopolitical tensions, European markets have faced a challenging period, with major indices like the STOXX Europe 600 Index experiencing declines. Despite these headwinds, opportunities remain for investors willing to explore beyond traditional blue-chip stocks. Penny stocks, though an older term, continue to represent a compelling investment area by offering potential growth in smaller or less-established companies when supported by strong financials.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.172 | €1.44B | ✅ 5 ⚠️ 2 View Analysis > |

| Maps (BIT:MAPS) | €3.34 | €44.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €259.45M | ✅ 2 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €3.12 | €65.81M | ✅ 4 ⚠️ 2 View Analysis > |

| Euroland Société anonyme (ENXTPA:ALERO) | €3.02 | €9.58M | ✅ 2 ⚠️ 5 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.435 | €391.99M | ✅ 4 ⚠️ 1 View Analysis > |

| High (ENXTPA:HCO) | €3.66 | €71.95M | ✅ 1 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.075 | €286.81M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.93 | €31.36M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 327 stocks from our European Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

MKB Nedsense (ENXTAM:NEDSE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MKB Nedsense N.V. is involved in financing and lending funds to individuals and legal entities, with a market cap of €29 million.

Operations: The company's revenue segment is primarily focused on CAD/CAM Software, generating -€0.55 million.

Market Cap: €29M

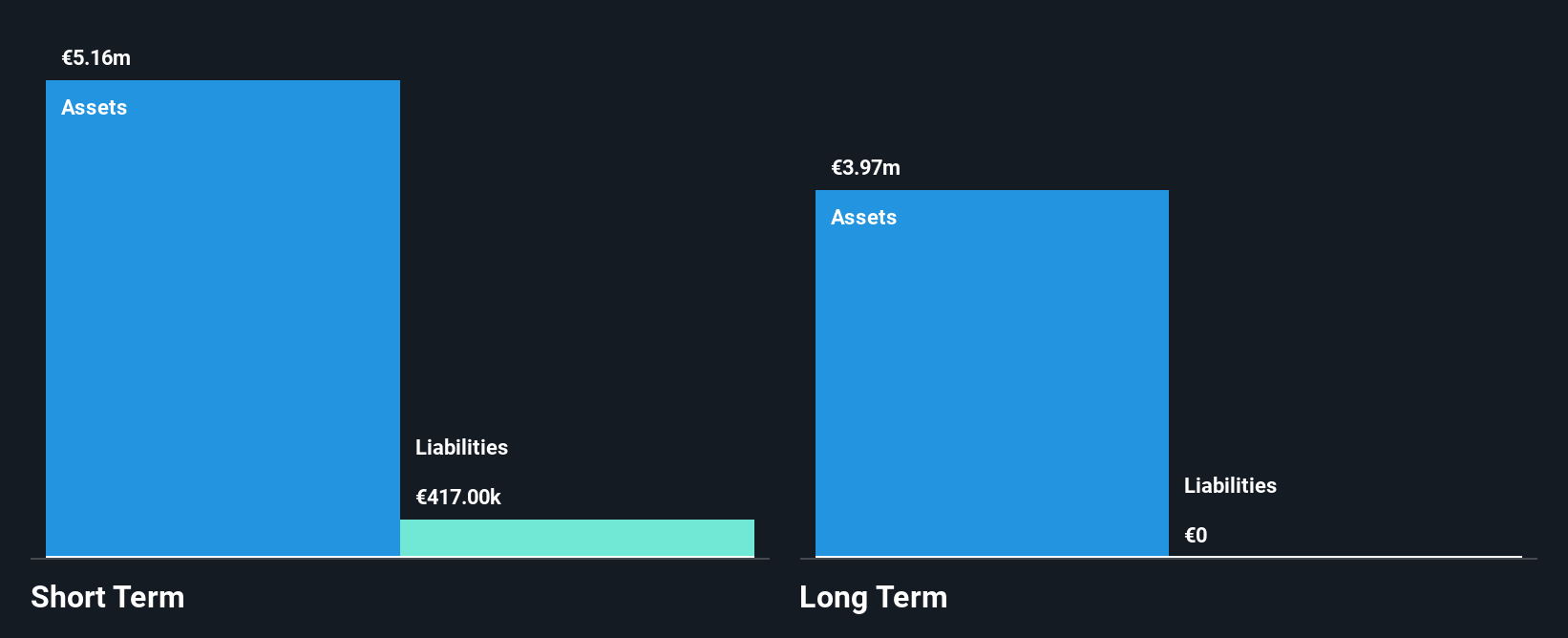

MKB Nedsense N.V., with a market cap of €29 million, is pre-revenue, generating negative revenue of €-0.55 million primarily from its CAD/CAM Software segment. Despite being debt-free and having short-term assets (€5.2M) that exceed liabilities (€417K), the company remains unprofitable with a negative return on equity (-6.36%). Recent earnings results for the half-year ended June 30, 2025, showed a net loss of €0.553 million and increased volatility in share price suggests caution for investors seeking stability in penny stocks. However, no significant shareholder dilution has occurred recently.

- Unlock comprehensive insights into our analysis of MKB Nedsense stock in this financial health report.

- Review our historical performance report to gain insights into MKB Nedsense's track record.

Raisio (HLSE:RAIVV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Raisio plc, with a market cap of €402.33 million, produces and sells food and food ingredients in Finland, the United Kingdom, Ireland, Belgium, and the Netherlands.

Operations: Raisio generates revenue through its food and food ingredients business across Finland, the United Kingdom, Ireland, Belgium, and the Netherlands.

Market Cap: €402.33M

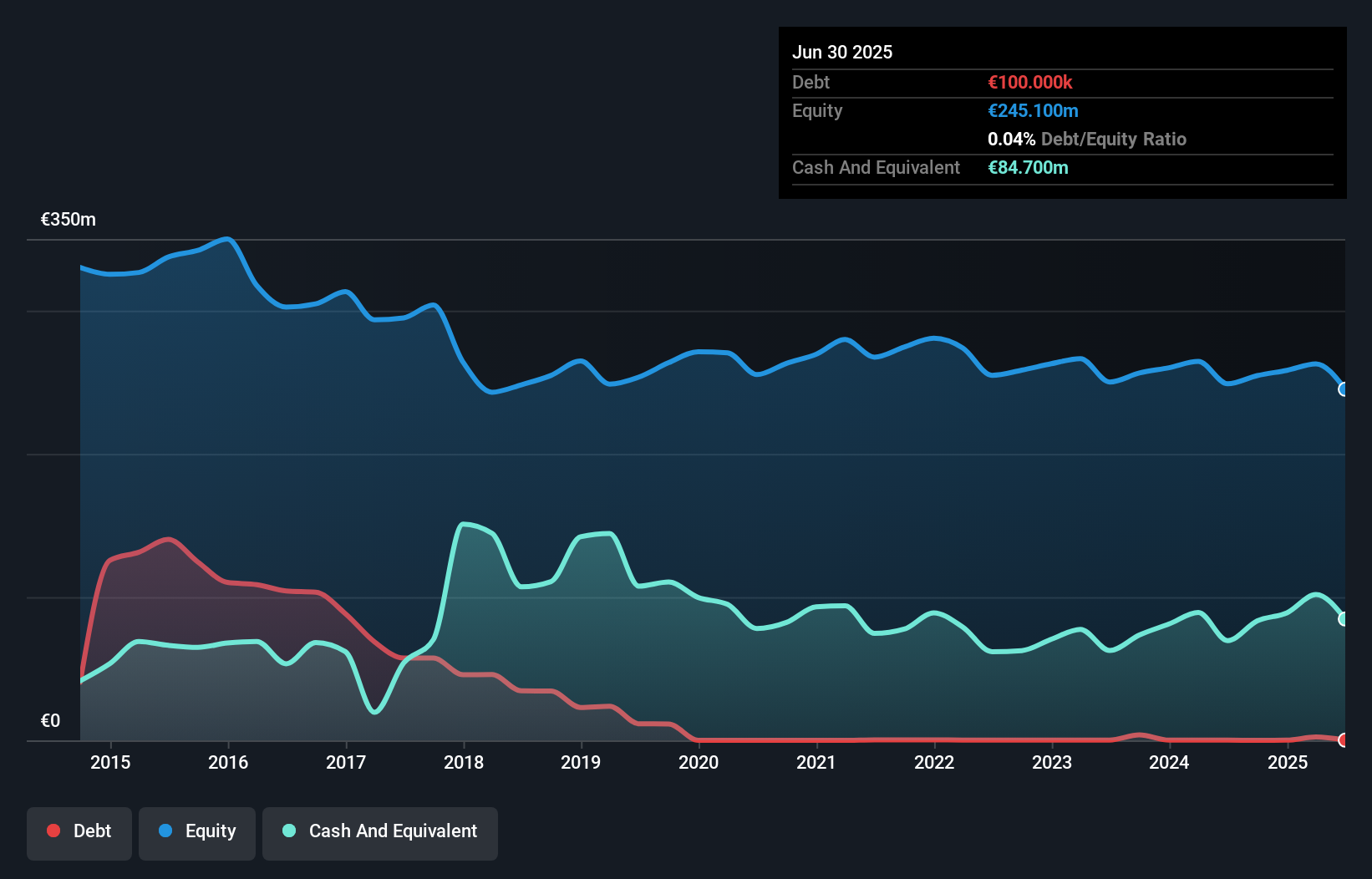

Raisio plc, with a market cap of €402.33 million, operates in the food and ingredients sector across several European countries. The company has shown stable earnings growth recently, reporting a net income increase to €11.2 million for the first half of 2025 from €9.1 million the previous year. While its dividend yield of 5.48% is not well covered by earnings, Raisio's debt is well-managed with operating cash flow significantly surpassing debt levels. Recent strategic changes include appointing Anni Palmio as M&A Director and forming an M&A Committee to bolster acquisition efforts, potentially enhancing future growth prospects despite past profit volatility challenges.

- Take a closer look at Raisio's potential here in our financial health report.

- Review our growth performance report to gain insights into Raisio's future.

H&R GmbH KGaA (XTRA:2HRA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: H&R GmbH & Co. KGaA is involved in the production and distribution of chemical-pharmaceutical raw materials and precision plastic parts globally, with a market cap of €185.36 million.

Operations: The company generates revenue from its Chemical-Pharmaceutical Raw Materials Sales (€486.15 million), ChemPharm Refining (€805.95 million), and Plastics (€42.62 million) segments.

Market Cap: €185.36M

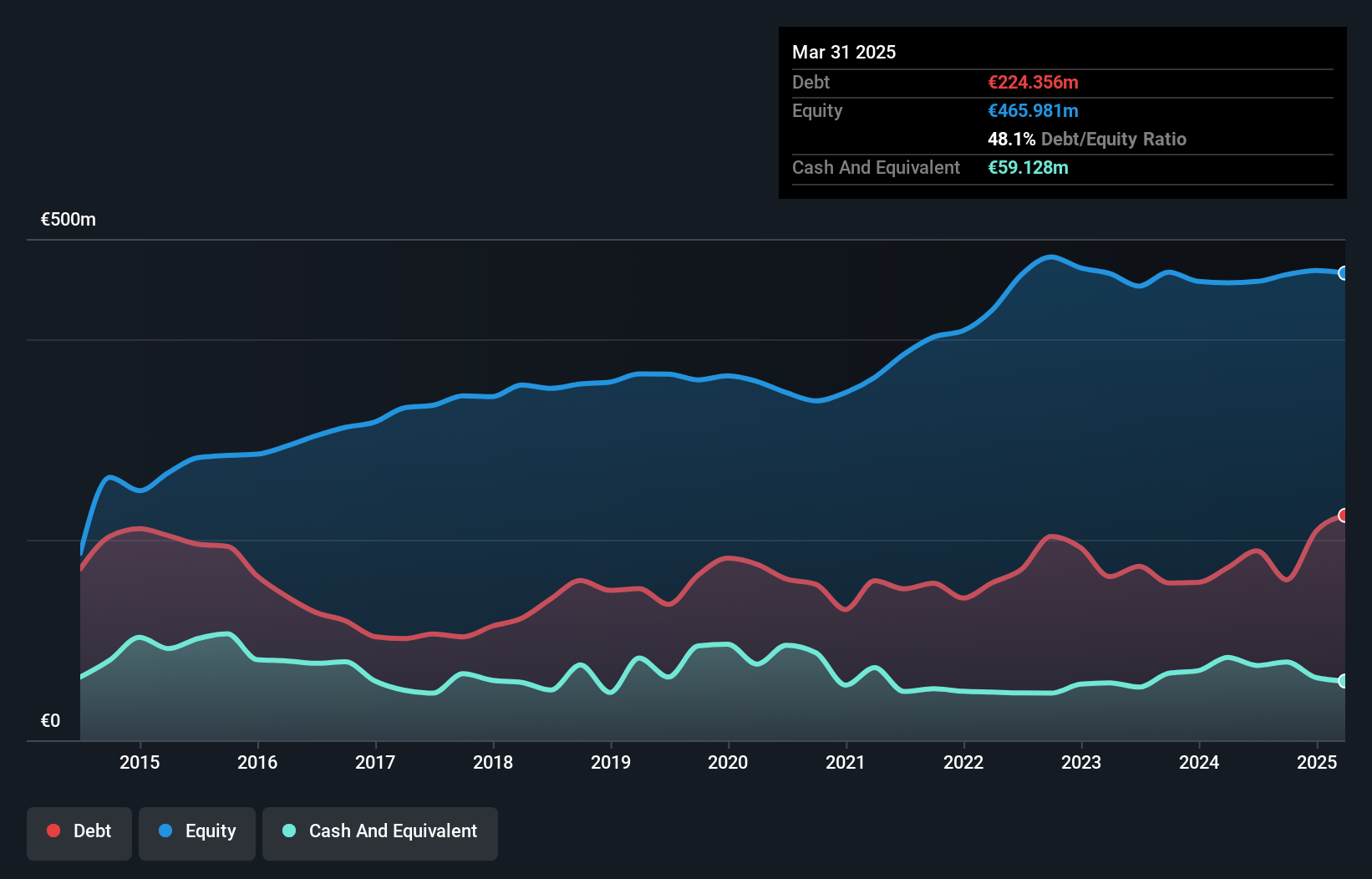

H&R GmbH & Co. KGaA, with a market cap of €185.36 million, has recently experienced financial challenges, reporting a net loss of €1.63 million in Q2 2025 compared to a profit the previous year. Despite this setback, the company's debt is well-covered by operating cash flow and its short-term assets exceed both short and long-term liabilities, indicating sound liquidity management. However, its dividend track record remains unstable and earnings growth has been negative over the past year. The recent acquisition by Nils Hansen could lead to strategic changes such as delisting or restructuring efforts to streamline operations further.

- Click to explore a detailed breakdown of our findings in H&R GmbH KGaA's financial health report.

- Evaluate H&R GmbH KGaA's prospects by accessing our earnings growth report.

Taking Advantage

- Click through to start exploring the rest of the 324 European Penny Stocks now.

- Curious About Other Options? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:RAIVV

Raisio

Produces and sells food and food ingredients in Finland, the United Kingdom, Ireland, Belgium, and the Netherlands.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives