- Netherlands

- /

- Retail REITs

- /

- ENXTAM:URW

Shareholders in Unibail-Rodamco-Westfield (AMS:URW) are in the red if they invested three years ago

If you love investing in stocks you're bound to buy some losers. But long term Unibail-Rodamco-Westfield (AMS:URW) shareholders have had a particularly rough ride in the last three year. Regrettably, they have had to cope with a 57% drop in the share price over that period. And the ride hasn't got any smoother in recent times over the last year, with the price 30% lower in that time. Shareholders have had an even rougher run lately, with the share price down 19% in the last 90 days.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

See our latest analysis for Unibail-Rodamco-Westfield

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unibail-Rodamco-Westfield became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

We think that the revenue decline over three years, at a rate of 26% per year, probably had some shareholders looking to sell. And that's not surprising, since it seems unlikely that EPS growth can continue for long in the absence of revenue growth.

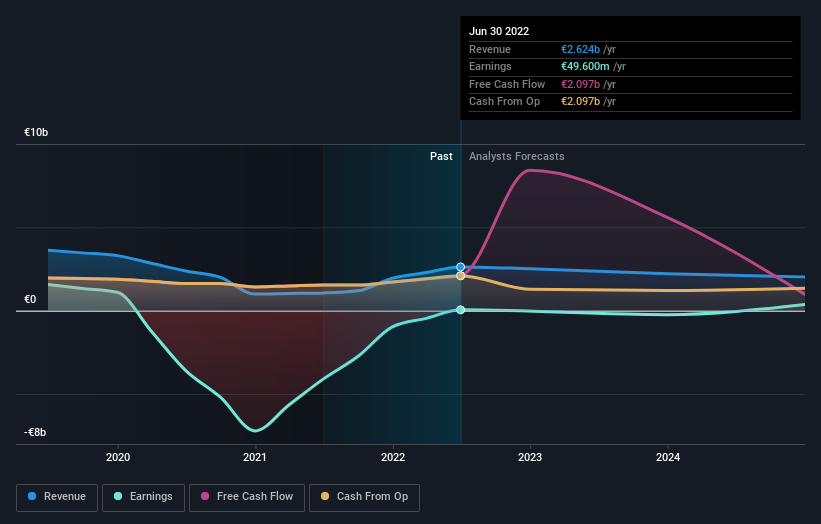

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Unibail-Rodamco-Westfield is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Unibail-Rodamco-Westfield in this interactive graph of future profit estimates.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Unibail-Rodamco-Westfield's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Unibail-Rodamco-Westfield shareholders, and that cash payout explains why its total shareholder loss of 53%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

The last twelve months weren't great for Unibail-Rodamco-Westfield shares, which performed worse than the market, costing holders 30%. The market shed around 23%, no doubt weighing on the stock price. The three-year loss of 15% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Unibail-Rodamco-Westfield has 2 warning signs (and 1 which is significant) we think you should know about.

We will like Unibail-Rodamco-Westfield better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NL exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:URW

Unibail-Rodamco-Westfield

Unibail-Rodamco-Westfield is an owner, developer and operator of sustainable, high-quality real estate assets in the most dynamic cities in Europe and the United States.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives