- Netherlands

- /

- Entertainment

- /

- ENXTAM:UMG

Universal Music Group (ENXTAM:UMG): Evaluating Valuation Following AI Platform Deal and Copyright Settlement

Reviewed by Simply Wall St

Universal Music Group (ENXTAM:UMG) and AI music startup Udio have settled a copyright dispute and are teaming up to create a new AI-powered music platform in 2026. This collaboration signals a shift for UMG toward integrating advanced technology solutions in music creation.

See our latest analysis for Universal Music Group.

Following the news of Universal Music Group’s AI partnership, shares have seen some volatility, with a 6.8% slide over the past month but a modest 1.2% gain in total shareholder return over the past year. While short-term price momentum has cooled, UMG’s move to embrace innovative business models keeps it in the spotlight for investors thinking long term.

If stories of industry transformation interest you, it’s worth taking a look at other fast movers. Now may be a smart time to discover fast growing stocks with high insider ownership

With the stock trading at a 26% discount to analyst price targets, investors now face a key question: Is UMG undervalued at current levels, or has the market already anticipated the potential from its AI partnership?

Most Popular Narrative: 20.6% Undervalued

Universal Music Group’s most-followed narrative values shares notably higher than the last close, suggesting potential upside for those who are convinced by its key assumptions.

Expansion of premium and superfan streaming tiers (for example, "SVIP" in China, with public targets of 20% penetration at 2x or greater ARPU) combined with upcoming Streaming 2.0 deals across major platforms (with UMG's revenue generally benefiting from per-subscriber minimums and revenue share) positions the company for further ARPU upside and recurring revenue growth, which should flow through to both operating margins and EBITDA.

Curious about the ambitious blueprint that could re-rate UMG? The potential for next-level recurring revenue and margin growth may surprise you. Significant assumptions are embedded in the details. Explore how bold projections for streaming tiers and future earnings support this valuation and see which numbers underpin the most optimistic outlook for Universal Music Group’s fair value.

Result: Fair Value of $29.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts toward short-form content and dependence on superstar artists could pose challenges for Universal Music Group’s revenue growth and margin assumptions in the coming years.

Find out about the key risks to this Universal Music Group narrative.

Another View: Multiples Tell a Different Story

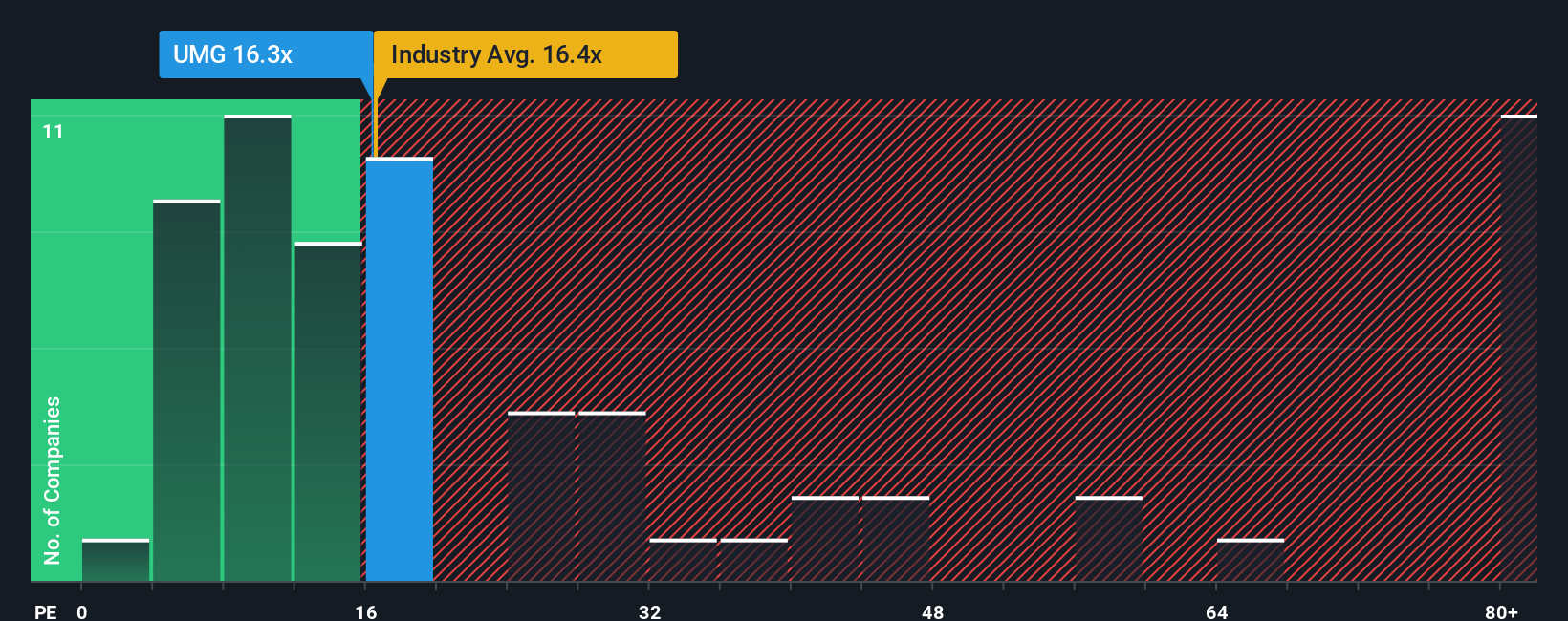

Looking at Universal Music Group’s price-to-earnings ratio of 16.4x, the shares are pricier than both the European Entertainment industry average (15.8x) and their estimated fair ratio (13.5x). However, they are still cheaper than their peer average (46.8x). This suggests the market sees premium potential, but also flags valuation risk if future growth slows. Are the premium expectations baked into today’s share price justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Universal Music Group Narrative

If you’re the type who prefers independent analysis or wants to test your own ideas, building your perspective takes just minutes. Do it your way

A great starting point for your Universal Music Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let a great opportunity slip past you. Open your eyes to a wider market by checking stocks handpicked for growth, value, and innovation using the Simply Wall Street Screener.

- Tap into the explosive potential of artificial intelligence by researching these 26 AI penny stocks, which are reshaping industries with groundbreaking tech.

- Uncover stocks that the market may be underestimating by assessing these 834 undervalued stocks based on cash flows, a source packed with hidden value ready for the spotlight.

- Catch innovative healthcare leaders making waves by browsing these 34 healthcare AI stocks, where science meets smart investing for future returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:UMG

Outstanding track record with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion