- Netherlands

- /

- Insurance

- /

- ENXTAM:NN

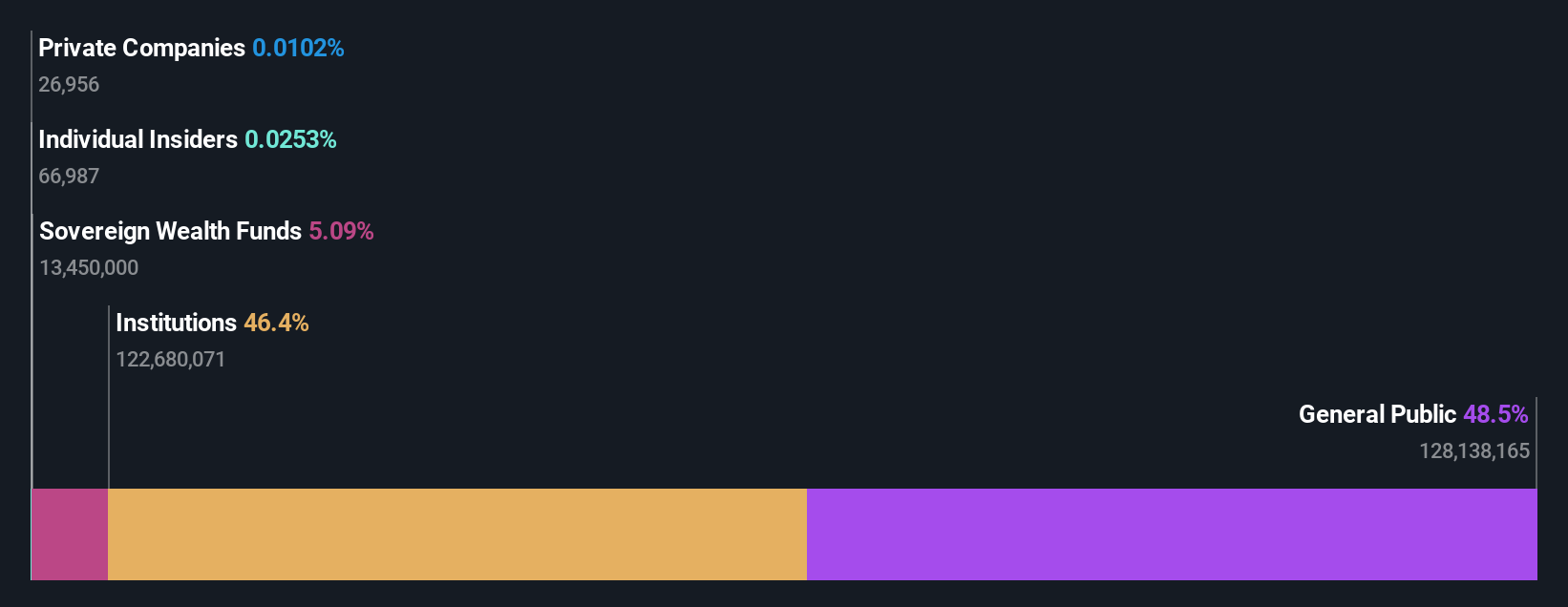

While institutions own 46% of NN Group N.V. (AMS:NN), individual investors are its largest shareholders with 48% ownership

Key Insights

- The considerable ownership by individual investors in NN Group indicates that they collectively have a greater say in management and business strategy

- The top 25 shareholders own 42% of the company

- Institutional ownership in NN Group is 46%

To get a sense of who is truly in control of NN Group N.V. (AMS:NN), it is important to understand the ownership structure of the business. With 48% stake, individual investors possess the maximum shares in the company. Put another way, the group faces the maximum upside potential (or downside risk).

Institutions, on the other hand, account for 46% of the company's stockholders. Generally speaking, as a company grows, institutions will increase their ownership. Conversely, insiders often decrease their ownership over time.

In the chart below, we zoom in on the different ownership groups of NN Group.

See our latest analysis for NN Group

What Does The Institutional Ownership Tell Us About NN Group?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

NN Group already has institutions on the share registry. Indeed, they own a respectable stake in the company. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of NN Group, (below). Of course, keep in mind that there are other factors to consider, too.

NN Group is not owned by hedge funds. Looking at our data, we can see that the largest shareholder is BlackRock, Inc. with 6.7% of shares outstanding. Norges Bank Investment Management is the second largest shareholder owning 5.1% of common stock, and The Vanguard Group, Inc. holds about 4.4% of the company stock.

On studying our ownership data, we found that 25 of the top shareholders collectively own less than 50% of the share register, implying that no single individual has a majority interest.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of NN Group

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our data suggests that insiders own under 1% of NN Group N.V. in their own names. As it is a large company, we'd only expect insiders to own a small percentage of it. But it's worth noting that they own €4.0m worth of shares. It is always good to see at least some insider ownership, but it might be worth checking if those insiders have been selling.

General Public Ownership

With a 48% ownership, the general public, mostly comprising of individual investors, have some degree of sway over NN Group. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 1 warning sign we've spotted with NN Group .

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NN Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:NN

NN Group

A financial services company, provides life and non-life insurance products in Netherlands and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion